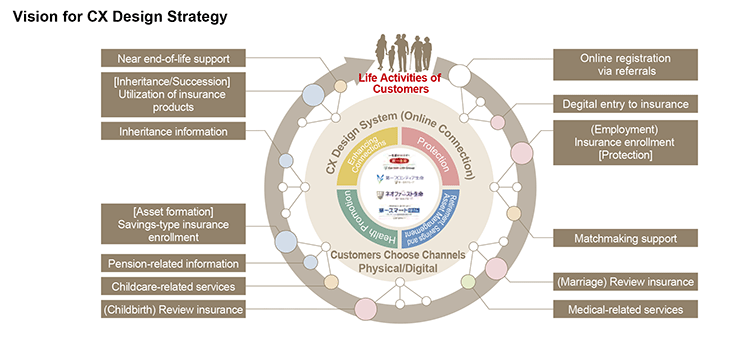

With the aim of solving issues related to Financial Well-being for All, the Group has been strengthening its initiatives to improve CX (customer experience) which represents the psychological and emotional value that customers experience at all touchpoints with the Group. In FY2024, we will create value that exceeds of the original product or service, by working to improve the customer experiential value.

The Customer First Group Business Operation Policy

In accordance with The Customer First Group Business Operation Policy established by the Dai-ichi Life Group, we disclose the status of initiatives at each Group company.

Initiatives to Improve Customer Experience in Japan

In our domestic business, we will contribute to the well-being of our customers by providing our four experiential values of "Protection," "Asset Formation/Succession," "Health and Medical Care," and "Enhancing Connections" to our customers. The Group has expanded its business domains with the addition of ipet Insurance, a pet insurance company, and Benefit One, a platform for employee benefit services. Through the provision of optimum products and services, including in non-insurance areas, we will work to create values unique to the Group. Moreover, various digital tools utilizing the latest technologies have become an indispensable part of our lives. In addition to real contact with customers through sales reps and insurance agencies, the Group regards digital contact with customers as an important connection with them. By integrating real and digital connections, we will build a system that provides optimal consulting and customer follow-up services at the optimal time by deepening our understanding of each individual customer. We will continue to pursue value that resonates with our customers and meet their diversifying values and needs by making repeated improvements through the STPD cycle*, not only in the traditional areas of protection and asset formation/ succession, but also in all customer experiences, including new products and services, with the aim of being consistently chosen by customers.

- *

A management approach based on "See," "Think," "Plan," and "Do."

What does "CX" refer to?

We define customer experience (CX) as the psychological and emotional value that customers experience through all points of contact with the Group. By focusing on CX and working to improve the customer experiential value, we will create value that exceeds that of the original product or service.

Management based on the "voices of customers"

As customers continue to diversify their values and change their behavior, we believe it is more important than ever to enhance CX by closely aligning ourselves with the values of each customer. We intend to improve CX by collecting a wide range of "voices of customers" including opinions, requests, complaints, and thanks and implementing improvement initiatives based on the "voices of customers." For example, Dai-ichi Life has established a system to collect and analyze "voices of customers" from across Japan and reflect them in management and is gradually improving the system. Specifically, at "Voice of Customer" (VOC) meetings, in addition to the "voices of customers," we utilize and analyze the NPS®* from customer satisfaction surveys to identify issues by checking what is supported by customers and what needs improvement.

Expand and raise the level of digital contacts

To improve CX, we are working to expand digital contacts and raise the level of the customer experience through digital technologies. Dai-ichi Life operates a website called "Mirashiru" to provide information related to people and their lives, health, money, and insurance. The site focuses on the four experiential values and daily communication with customers. The function was expanded to meet various customer needs including insurance counseling through the connection of customers and sales reps in Dai-ichi Life. In addition, we provide dedicated My Page functions that serve as a direct point of contact with customers of Dai-ichi Frontier Life, Neo First Life, ipet Insurance, and other companies. Expanding that support by enabling various procedures to be completed digitally helps improve customer convenience. We also provide various services and applications related to health promotion and asset formation to help customers achieve well-being.

While working to expand and upgrade the level of digital contacts, we will work to improve CX for customers by promoting the integration of real and digital contacts.

Information site "Mirashiru"