Initiatives and results

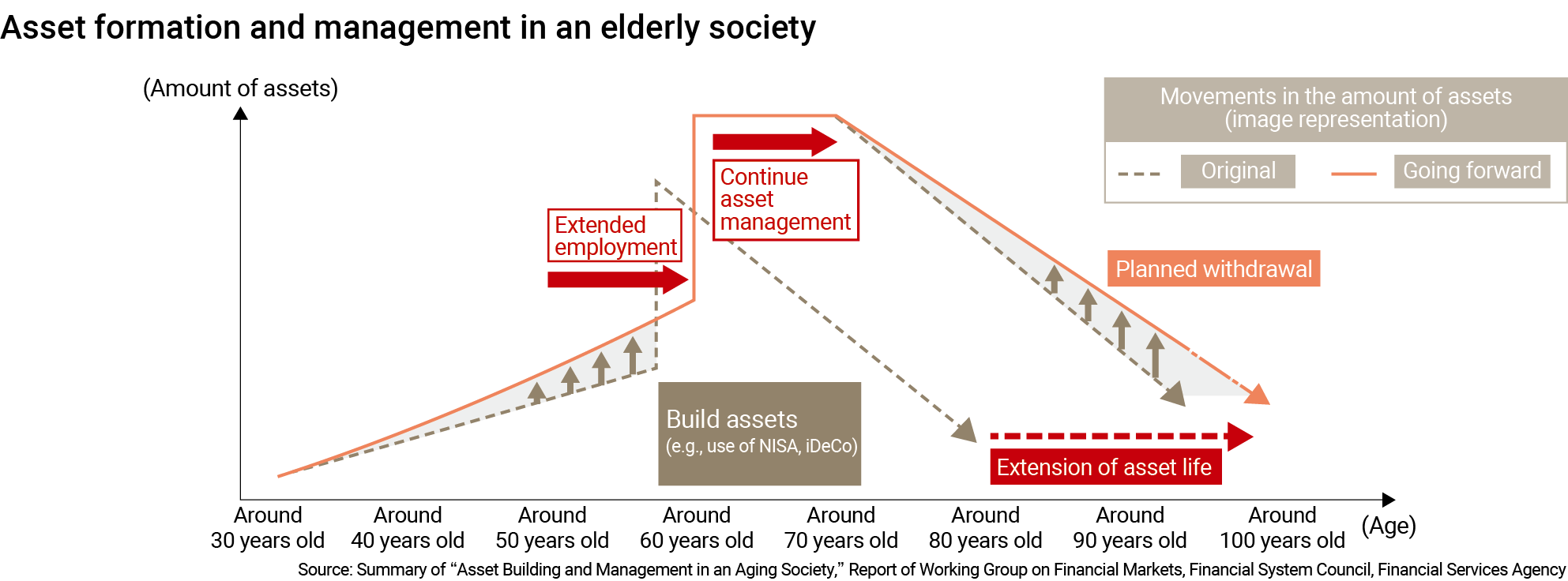

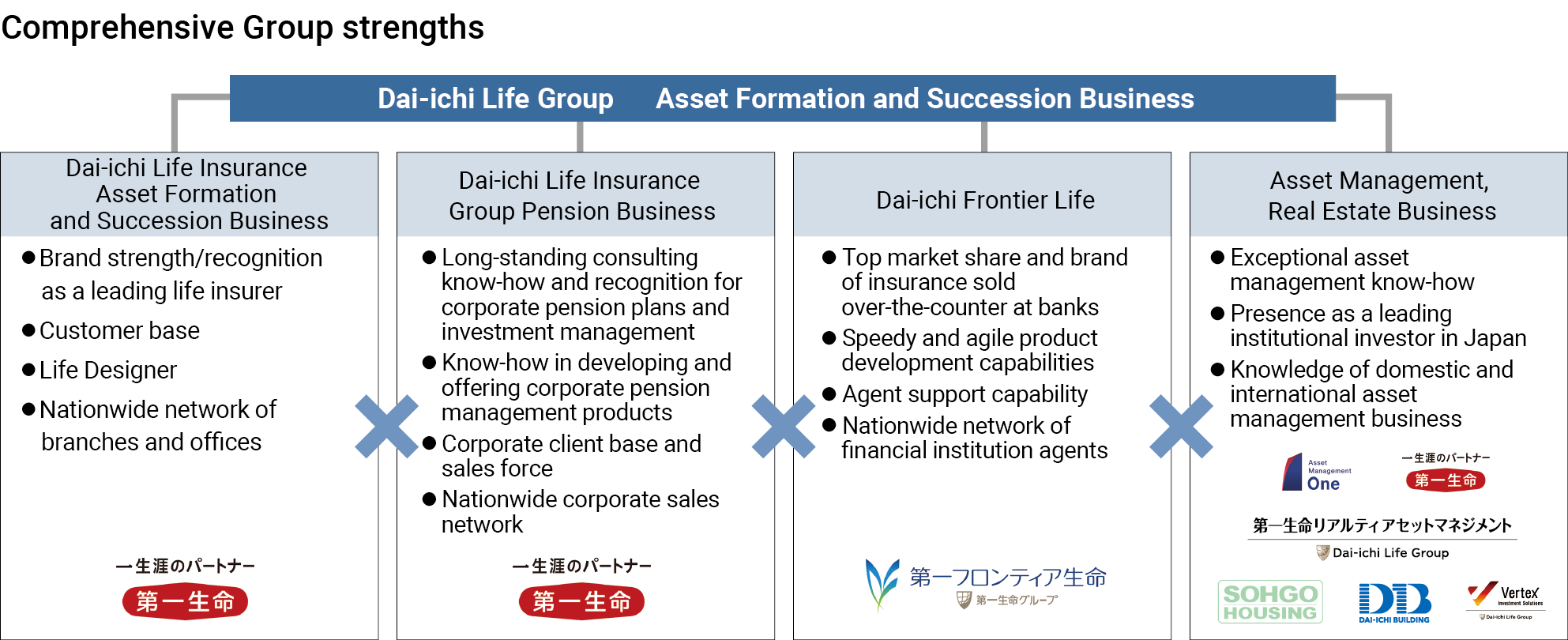

The Group aims to bring together and leverage the strengths of each of its businesses in the area of asset formation and succession, including the savings and mutual fund business for individuals, the group annuities business, and the over-the-counter sales business, as a means to enhance the products and services that support the needs of our customers at each stage of their lives, including asset formation for younger generations, extending the asset life expectancy of middle-aged and older generations, and passing assets down to the next generation.

In one specific initiative, Dai-ichi Life began offering a new plan for iDeCo, "Dai-ichi Life's iDeCo Mirai-Deco," in October 2022. Moreover, Dai-ichi Life launched "Asset Formation Plus," a digital platform service that uses digital functions to provide advice and information to individual customers on how to extend their asset life expectancy, and to prompt people to think about asset formation and succession from a more familiar, everyday perspective. "Asset Formation Plus" also provides net banking services using Banking as a Service (BaaS) provided by SBI Sumishin Net Bank, Ltd., and Rakuten Bank, Ltd.

Dai-ichi Frontier Life, which provides savings products for individuals, introduced new products to meet a broad range of customers' needs in the areas of asset formation and succession, including the August 2022 launch of "Premier Present 3," which, in addition to functioning as a savings product, provides protection against costs arising from dementia and nursing care. Dai-ichi Life's sales representatives also handle some of Dai-ichi Frontier Life's products, thereby delivering the experiential value of asset formation and succession to an even greater number of customers as part of the Group as a whole.

In addition, Vertex Investment Solutions has been established as a new asset management subsidiary of the Company. This company provides asset management functions and solutions using the latest asset management technology.

Medium-term initiatives

To address the diversifying needs and values of customers in the asset formation and succession area, we believe it is important to develop highly convenient services from the customer's perspective. To this end, we will further accelerate efforts to expand our service lineup, strengthen our digital links with customers, and upgrade our consulting capabilities.

In addition to the medium- to long-term investment knowledge and savings product development capabilities of Dai-ichi Life, Asset Management One, and other companies, we will leverage the expertise and mobility of Vertex Investment Solutions, which was established in fiscal 2022, to expand our product lineup and thereby contribute our customers' asset formation and succession. We will also work to develop and strengthen a structure that allows us to offer the best possible product proposals, including the use of iDeCo and NISA, among others.

To evolve into a more convenient and attractive service that customers can use on a daily basis, Dai-ichi Life's digital platform service, "Asset Formation Plus," will strive to offer further support for customers' asset formation and succession, while using external services and functions that have a proven track record in the digital field.

Furthermore, to provide optimal solutions to each customer, we believe it is important to provide consulting services that are tailored to the customer's lifetime with regard to both protection and asset formation/succession. In particular, it will be critical for us to refine our consulting services for customers in the pre- and post-retirement periods, when the need for asset management and asset succession is growing. We are promoting the development and education for human capital capable of providing valueadded consulting services that precisely meet the needs of our customers with the highest priority on their benefits.

By combining the strengths of the Group, actively considering alliances and M&A with companies outside the Group, and embarking on new initiatives while strengthening the value chain, we will remarkably enhance our CX in the area of asset formation and succession, seeking to realize our customers' everyday well-being and address social issues.