Basic approach

It is estimated that more than half of the world's GDP is derived from nature and ecosystems, and natural capital is an important foundation for the Group's business activities. The two are also said to be closely related, as heavy rains, floods, and droughts caused by climate change can lead to the degradation of natural capital.

Based on this recognition, the Group, as a member of society, considers that the conservation of the local environment, climate change countermeasures, global environmental protection, the preservation of natural capital and biodiversity, and the creation of a recycling-oriented society are among its corporate social responsibilities. The Group will always act in consideration of its impact on the environment, in compliance with the Group's "Vision and Group Action Principles for Environmental Initiatives*1," and in keeping with the "Basic Policy on Responsible Investment*1" of our domestic core subsidiary, Dai-ichi Life.

In the new mid-term management plan, we have defined "Core Materiality" as important issues that we must prioritize in order to realize our Group's vision for FY2030. We have also defined "Environmental Leadership" as an issue that we must address to ensure the sustainability of the global environment, which is the foundation of people's lives. Under this Core Materiality, the Group, as an operational company and as an institutional investor, is committed to strategic responses to environmental challenges, particularly climate change and natural capital, with the goal of contributing to the realization of a decarbonized society. We will also actively communicate our views and become more involved in and contribute to global rulemaking through active participation in domestic and international initiatives such as GFANZ*2, the world's largest coalition of financial institutions with a net-zero commitment.

To realize the aspirations*3 embedded in the Group Purpose, we will demonstrate leadership both as an institutional investor and a operational company to an even greater degree. This includes enhancing measures that could become examples to others, such as improving sustainability disclosures. Through these efforts, building public trust, and creating customers' empathy, we aim to help form a sustainable society and ultimately accelerate the sustainable growth of our business.

- *1

For details of the policy, please refer to the respective pages on our website, as listed below.

Vision and Group Action Principles for Environmental Initiatives:

https://www.dai-ichi-life-hd.com/en/sustainability/environment/initiative.html

Responsible Investment:

https://www.dai-ichi-life-hd.com/en/sustainability/investment/index.html - *2

Glasgow Financial Alliance for Net Zero. Please refer to P.83 on Integrated Report 2024 for details of this initiative and the Group's initiatives.

Integrated Report 2024 PDF - *3

The Group Purpose: "Partnering with you to build a brighter and more secure future."

Governance

Roles of the Executive Management Board and Board of Directors

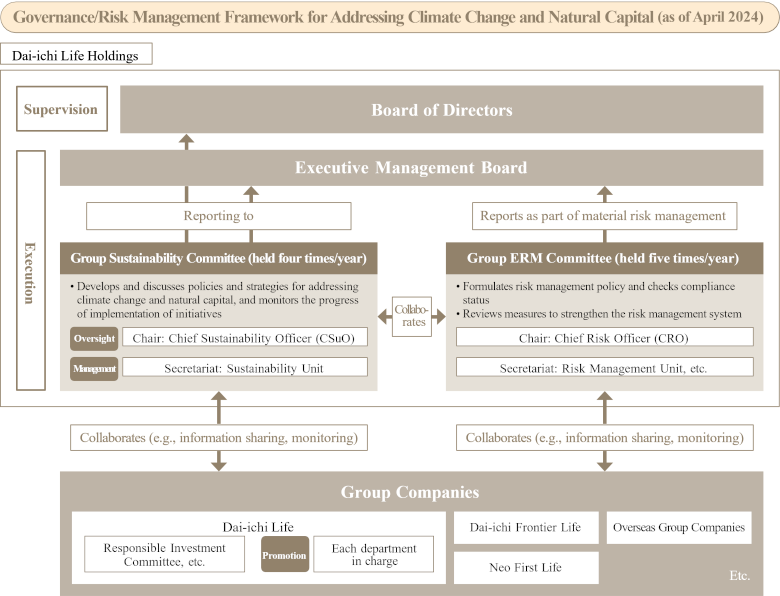

The Group pursues climate-related initiatives through the Group Sustainability Committee and the Group ERM Committee. These efforts are supervised by the Board of Directors and are based on business plans related to climate change which are formulated under the leadership of the Executive Management Board. The progress status of initiatives (Direction of initiatives including Group targets, responses to risks, etc.) is reported regularly to the Executive Management Board and the Board of Directors, and the Board of Directors provides supervision to further strengthen climate change initiatives.

Initiatives to strengthen governance structure

As one of the measures to strengthen the Group's governance structure, the Group Sustainability Committee was established in April 2021, and since April 2023 the Committee has been chaired by the Chief Sustainability Officer. Under this structure, the Committee is responsible for developing sustainability-related policies and strategies, including measures to address climate change and natural capital, and monitoring the implementation of these measures. In addition, starting in July 2022, sustainability indicators*4, including an indicator related to progress in reducing CO2 emissions, have been included as part of performance-based stock remuneration for the Company's executives. In April 2024, we reorganized the Sustainability Office into the Sustainability Unit. We beefed up the workforce by coordinating the sustainability policies and activities of the entire Group, thereby reinforcing our contributions to a decarbonized society and nature-positive activities.

- *4

Please see P.105 of Integrated Report 2024 for details on the remuneration system for directors and executive officers

Integrated Report 2024

Risk Management

Risk Management System

The Group is implementing risk management that takes appropriate measures at an early stage by specifying foreseeable risks with the potential to significantly impact its business as "material risks" and formulating business plans that take these risks into account*5.

We rate the impact*6 of the risks and the possibility of their occurrence on a scale of one to four based on the results from identifying material risks affecting Group companies. Using a heat map, the Risk Management Unit specifies material risks and reviews them every fiscal year. With the Paris Agreement taking effect in 2016, there is a growing recognition that environmental issues, particularly climate change, are a challenge to be tackled by the international community as a whole, and the Group recognizes that addressing climate change is an important management issue that could have a significant impact on customers' lives and health, corporate activities, and social sustainability. In response to this, since fiscal 2019 we have selected climate change–related risks as one of our material risks and have been strengthening our risk management. Specifically, the Group ERM Committee, chaired by the Chief Risk Officer, discusses how to assess and respond to physical and transition risks, and reports to the Executive Management Board and the Board of Directors as necessary.

- *5

Please refer to the following webpage for details on risk management:

https://www.dai-ichi-life-hd.com/en/about/control/in_control/administer.html - *6

Degree of impact is assessed based on economic loss, reputational damage (impact on sales, management responsibility, and stock price), and other factors.

Strategy / Metrics and targets- Climate Change Initiatives -

Net Zero Transition Plan

As a financial institution, we produced and disclosed our Net Zero Transition Plan in August 2023 to promote a more integrated response to climate change issues aimed at transitioning to net zero in the real economy. This plan was formulated in reference to the transition plan guidance of GFANZ, etc.

The current transition plan is formulated mainly focusing on the activities of Dai-ichi Life, the Group's core subsidiary in Japan.

It is overseen by the CSuO and administered by the Sustainability Unit, with relevant departments of Dai-ichi Life in charge of promoting their respective initiatives. Its implementation progress is monitored and discussed by the Group Sustainability Committee, which reports its findings to the Executive Management Board and is supervised by the Board of Directors.

In March 2024, we set new interim reduction targets for GHG emissions, aiming to reduce Scope 1 & 2 emissions by 75% by FY2030 (compared with FY2019 levels), and a common target for Dai-ichi Life and Dai-ichi Frontier Life to reduce Scope 3 (investments) emissions by 50% by 2030 (compared with 2020 levels). As of the recent time period, Scope 1 & 2 emissions have been reduced by 62% (compared with FY2019), and Scope 3 (investments) emissions have been reduced by 31% (compared with 2020, on an absolute emissions basis) and 34% (compared with 2020 on an intensity basis) at Dai-ichi Life and Dai-ichi Frontier Life, respectively, demonstrating steady progress toward our goals.

Please refer to "Initiatives as an Institutional Investor" on page 79 to learn more about our performance and targets for investments contributing to environmental and climate change solutions.

For details of Climate Change and Natural Capital Initiatives, please refer to Sustainability Report.