To ensure sound and proper business operations and to ensure that we fulfill the obligations arising from our insurance policies, we identify and evaluate potential risks, take appropriate action based on the specific characteristics of each risk and comprehensively manage those risks. We are committed, on a company-wide basis, to improving soundness through the management and control of the financial base, including risk volume and capital.

We have also established a crisis management system and a risk management system to respond to catastrophes and large-scale disasters in addition to our everyday risk management system.

Policies and Regulations

Our Internal Control Policy for the Dai-ichi Life Group includes our basic philosophy and policies regarding risk management. The approach used to manage each type of risk is developed in line with Risk Management Policy for the Dai-ichi Life Group. In addition, each of the risk management regulations and standards is translated into practical rules, following our series of Risk Management Regulations for the Dai-ichi Life Group.

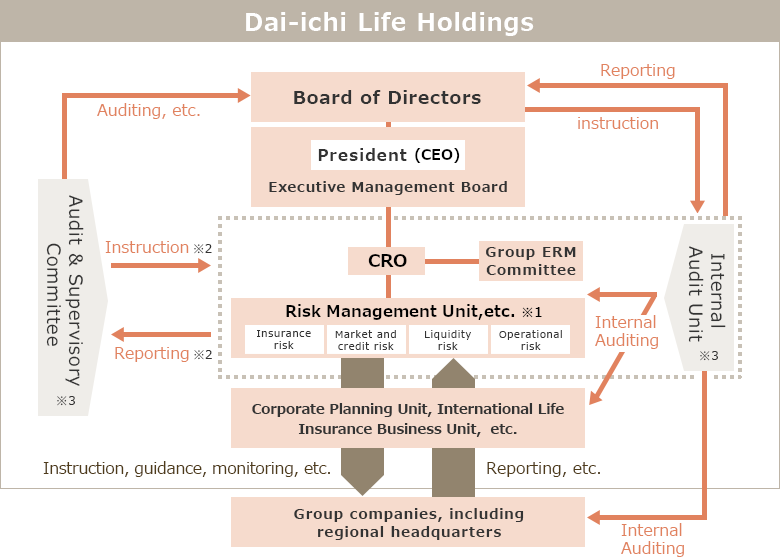

Organization

To ensure the integrity and appropriate conduct of the group, the risk management unit and units in charge of each risk coordinate and implement group-wide policies for risk management in accordance with Risk Management Policy for the Dai-ichi Life Group.

The risk management unit also plays a central role in monitoring and controlling the status and integrity of risk management across the group, while also seeking to improve how risk management is exercised.

There is also a group ERM committee,which is chaired by the CRO, that sits regularly to formulate risk management policy, monitor compliance, and conduct studies aimed at improving how risk management is exercised. The chairperson of the committee regularly reports the committee's discussions to the CEO and the Management Committee. The Internal Audit Unit assesses the effectiveness and appropriateness of this risk management infrastructure regularly. An Audit & Supervisory committee conducts audits of all aspects of risk management at the group, including management personnel.

Risk Management Framework

- ※1

Risk Management Unit and other departments in charge of each type of risk

- ※2

Dotted frame shows the entities which Audit & Supervisory Committee makes instruction to, and receives reporting from.

- ※3

Audit & Supervisory Committee and Internal Audit Unit coordinate with each other.

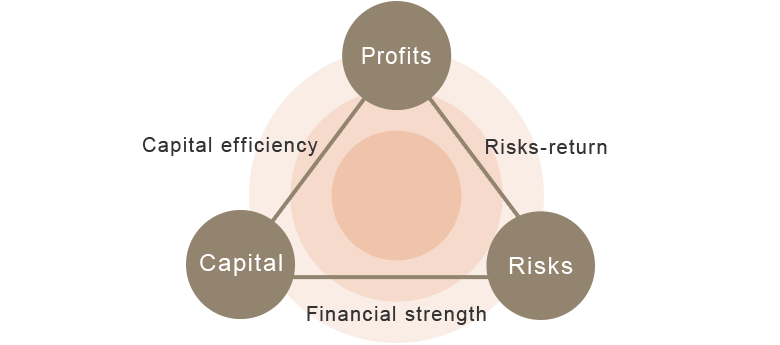

ERM

The Dai-ichi Life Group conducts enterprise risk management (ERM) whereby it undertakes its business activities based on business plans, capital strategy, that reflect the current situation regarding capital, risk, and profits.

The risk management unit assesses the suitability of business plans, capital strategy, formulated as part of ERM, and also seeks to improve group risk management while also controlling capital, risk, and profits in an appropriate manner based on the presence, nature, and characteristics of risk through activities such as setting and managing margins for risk.

The Dai-ichi Life Group controls the integrity of the group through activities such as consolidating different types of risk and making capital provision on an economic value, book value, and regulatory basis. The management of risk on the basis of economic value is conducted using embedded value (an indicator used by life insurance companies to represent corporate value) and coherent risk assessment techniques.

To identify and evaluate aspects that are not captured by the model-based quantification of risk, stress testing is conducted using worst-case scenarios based on possible future events or actual past events, such as financial market panics or large natural disasters. This is then used as a basis for analyzing the factors that influence the integrity of the organization and reporting the results to the board of directors, executive management board, and others, and for considering and implementing management and financial measures and ways to improve monitoring of market and other conditions as required.

Identifying Material Risks

The Dai-ichi Life Group engages in appropriate risk management that begins from early signs of risks by identifying foreseeable risks that could have a major impact on our business and formulating business plans that take these risks into account. We confirm that appropriate measures are being implemented to improve soundness and confirm risk tolerance through stress tests, regarding the identified risks.

See “Risk Factors” for details.

Crisis Management

The Company has a "Group Crisis Management Policy" and is pursuing a variety of crisis management responses by comprehensively identifying and managing the Group's crisis management status as well as developing a crisis management promotion system in normal times to prepare in advance for preventing crises and for reducing risks in preparation for expected crises.

Specifically, we work to avert crises by proactively detecting concerns about a crisis and instructing and alerting group companies and units, in addition to requiring group companies to report events that may cause a crisis.

In addition, in times of a crisis, we rapidly establish an initial response system, including a communication system, in order to promptly respond and accurately collect information during a crisis and to implement responses to resolve the crisis in cooperation with group companies.

Dai-ichi Life promotes business continuity management such as decentralization of operation bases so that its business, including customer service, can be continued even in case of major disaster or crisis.

For further details, please refer to the following link.