The Dai-ichi Life Group understands that complying with laws and regulations, its Articles of Incorporation, social standards, and rules in the market is the basis for conducting business activities. To fulfill its social responsibilities and public mission, the Company is developing systems to promote compliance in the group's operations.

Policies and Regulations

Our Basic Internal Control Policy for the Dai-ichi Life Group includes basic matters concerning the development and management of a group compliance system. Under this basic policy, matters such as the basic approach to the promotion of group compliance are outlined in the Basic Compliance Policy for the Dai-ichi Life Group, and matters concerning management related to compliance with the prevention of corruption, including unfair transactions in violation of anti-monopoly laws, such as abuse of a dominant position and anti-competitive behavior, insider trading, money laundering, and bribery are outlined in the Compliance Regulations for the Dai-ichi Life Group. In addition, the basic approach to the protection of information assets are outlined in the Information Assets Protection and Management Basic Policy for the Dai-ichi Life Group, and other management practices are outlined in the Information Assets Protection and Management Regulations for the Dai-ichi Life Group. These policies and regulations have been enacted and revised through prescribed procedures, and the details are reported to the management of the Board of Directors and the Management Council.

Information Assets Protection and Management Policy for the Dai-ichi Life Group

Basic Concept

In light of the importance of information assets (e.g. customer information, shareholders information, material facts, and unique information) and the social responsibility of the Group which owns the information, the Company shall protect and manage information assets appropriately, while complying with applicable laws and regulations including the Act on the Protection of Personal Information.

Implementation of PMIA

The Company shall implement and manage the system for PMIA as follows :

(1) PMIA System

The Legal and Compliance Unit (hereinafter known as the “Responsible Unit”) shall supervise the PMIA of the Group.

The Responsible Unit shall properly understand the status of the Group’s PMIA, and report it to the Board of Directors or equivalent organization.

(2) Rules and Regulations

The Responsible Unit shall establish and revise the rules and regulations for PMIA.

(3) Sharing the Policy with Group Companies

The Responsible Unit shall provide this policy to the Group companies and have each Group company establish its own basic PMIA policies conforming to its business characteristics. The Responsible Unit shall collect necessary information to monitor the PMIA of the Group companies and take appropriate measures if necessary.

Risk-based compliance management

For the purpose of ensuring the execution of duties by directors, executive officers and employees in accordance with applicable laws and regulations and the Articles of Incorporation and accurately grasping important compliance risks and potential conduct risks in accordance with changes in the social environment, the Company has developed an appropriate risk-based management system from a forward-looking perspective.

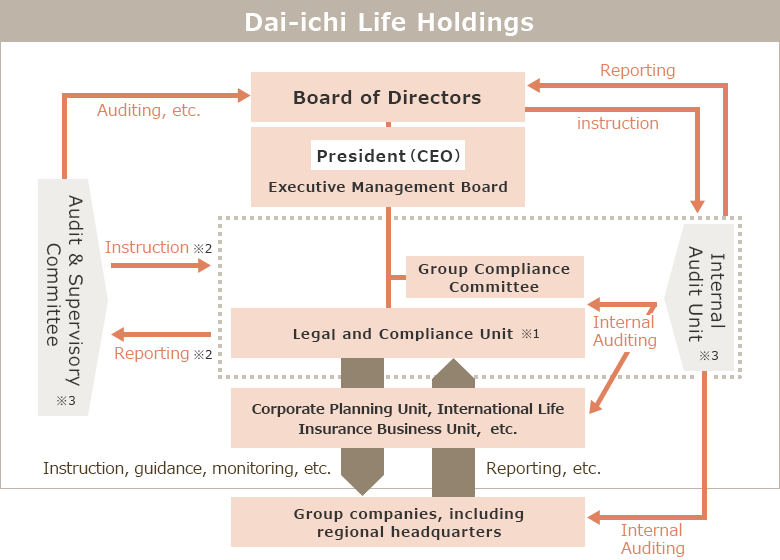

The Company has put in place a system for the Legal and Compliance Unit to supervise matters concerning Group compliance, and this Unit has developed a system to monitor the advancement of compliance at each company and provide necessary guidance and support by setting challenges which the Group should focus on, as well as reporting problems that occurred at each Group company to the Board of Directors, the President (Group CEO), the Executive Management Board and the Audit & Supervisory Committee, etc. according to their materiality.

In addition, as an organization to discuss important matters concerning the development and promotion of systems relating to Group compliance, the Company has established the Group Compliance Committee chaired by the Group CCpO (Chief Compliance Officer) to be able to practice PDCA mainly among the management.

Organizational Framework Concerning Compliance

- ※1

Legal and Compliance Unit coordinates with other units as appropriate.

- ※2

Dotted frame shows the entities which Audit & Supervisory Committee makes instruction to, and receives reporting from.

- ※3

Audit & Supervisory Committee and Internal Audit Unit coordinate with each other.

Efforts to improve systems at each Group company

The Legal and Compliance Unit provides guidance and support to improve the compliance system at each Group company and raise their awareness of compliance and enhance their education and training.

In addition, given the risk that related laws and regulations of foreign countries could be applied extraterritorially associated with the global business development of the Group, the Legal and Compliance Unit also works to strengthen systems to prevent money laundering, terrorism financing, corruption, bribery, protect personal information. In order to control such risks, each Group company has established internal policies and rules, and is disseminating them through education and training for employees. In the event of violations by officers and employees, disciplinary actions are taken in accordance with the employment regulations. The results of disciplinary actions are also reflected in employee performance evaluations and compensation.

AML/CFT

The Guideline for Development of Anti-Money Laundering Framework for Dai-ichi Life Group has been developed to outline the Group's fundamental approach to anti-money laundering (AML) and, countering the financing of terrorism (CFT) as well as ensuring compliance with economic sanctions. These guidelines set out practical considerations for each Group company to develop and operate systems aimed at preventing such activities and ensuring regulatory compliance. Based on these guidelines, Dai-ichi Life Holdings and each Group company develop and promote appropriate AML frameworks tailored to their respective business environments and product offerings. The Legal and Compliance Unit supports and monitors the development and enhancement of these frameworks across the Group.

ABC (Anti-Bribery and Corruption)

The Guideline for Development of Anti-Bribery and Corruption Framework for Dai-ichi Life Group has been developed to outline the Group's fundamental approach to anti-bribery, including the prohibition of facilitation payments. The guidelines set out practical considerations for each Group company to develop and operate systems aimed at preventing bribery and ensuring compliance with relevant regulations. Key areas include establishing anti-bribery frameworks involving third parties (such as external vendors, advisors, and consultants), the developing rules for managing business entertainment and gifts provided to both public officials and private individuals, and the implementing regular officer and employee training. Based on these guidelines, Dai-ichi Life Holdings and each Group company develop and promote appropriate anti-bribery frameworks tailored to their respective business environments. The Legal and Compliance Unit supports and monitors the development and enhancement of these frameworks across the Group.

Operation of whistleblowing system

We have established an internal whistleblower center where directors, employees (including retirees within one year), etc. of group companies can directly report and consult on compliance-related matters, such as violations of laws and regulations*1. The Company has also established an external contact point (outside law firm*2) that is independent of management. These contact points can be used anonymously.

In addition, in accordance with the Whistleblower Protection Act, we have established internal regulations (internal reporting regulations) to thoroughly ensure privacy and confidentiality by ensuring that legitimate whistleblowers and consultants are not treated disadvantageously for doing so, and that the contents of reports and information learned during investigations are not leaked without a legitimate reason. In addition, we do not tolerate any acts of retaliation, and stipulate that disciplinary action may be taken against those who investigate or treat whistleblowers and consultants disadvantageously. By making these known, we are strengthening the thorough protection of whistleblowers and the establishment of a system.

Additionally, we post information about the contact points and how to use them on posters, manuals, and the company intranet, and regularly hold training sessions to raise awareness among executives and employees of each group company and encourage them to use the hotlines appropriately.

- *1

This includes violations of the Insurance Business Law, the Companies Act, the Financial Instruments and Exchange Law, and other laws and regulations, as well as matters related to bribery, corruption, discrimination, harassment, and other human rights issues.

- *2

Mori Hamada & Matsumoto

[Results of the Whistleblower Hotline (Dai-ichi Life Holdings, Inc. and The Dai-ichi Life Insurance Company, Limited)]

FY2024 : 840 cases*

Among the above, cases in which human rights violations such as harassment were recognized and disciplinary action was taken : 2 cases

- *

Including opinions and suggestions from employees that do not fall under the category of whistleblowing

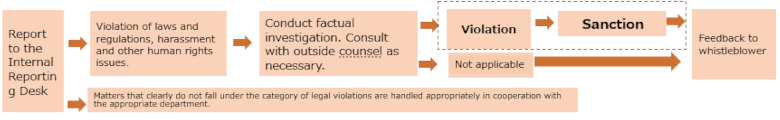

Response Flow of the Whistleblower Hotline

In cases where there is a suspicion of violation of laws and regulations, harassment, or other human rights issues, the facts are investigated, and disciplinary action is taken in accordance with the employment regulations if there is any violation.

We accept whistleblowing reports from business partners and clients regarding violations of laws and regulations such as the Insurance Business Act, Companies Act, and Financial Instruments and Exchange Act, as well as bribery, corruption, and human rights violations such as discrimination and harassment by officers and employees of our group.

- *

Whistleblowers will not be subjected to Unfavourable treatment. In addition, any Information about whistleblowers and the contents of their reports will be managed strictly in accordance with our company regulations.

【Whistleblower hotline】

- mail:

1-13-1 Yurakucho, Chiyoda-ku, Tokyo 100-8411

Dai-ichi Life Holdings, Inc., Legal and Compliance Unit, "Speak Up Desk" - Email:

speakup@daiichilife.com

【Department/Person in Charge】

- Department

Legal and Compliance Unit Incident Management Group

- Person in Charge

Executive Officer in Charge of Legal and Compliance Unit Group Chief Compliance Officer