Responsible investment promotion system

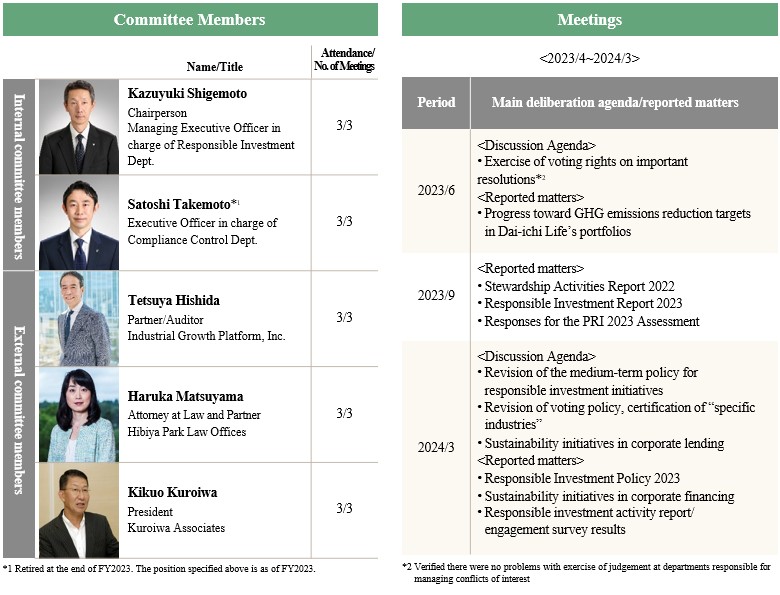

We formulate policies of responsible investment through deliberations at the Responsible Investment Committee of which the majority of its members are external members. Matters of particular importance are also reported to the Board of Directors and Management Meeting.

We promote efforts in the entire investment department thorough activities including progress follow-ups and holding discussions at the Responsible Investment Meeting comprised of members engaged in responsible investment. We analyze the annual assessment results for the Principle for Responsible Investment (PRI) to raise the level of our effort based on global standard.

We continuously seek to enhance the sophistication of our framework, which has included appointing ESG analysts from to carry out cross-assets ESG analyses.

Responsible Investment Committee System / Holding Results

The majority of outside experts have a wealth of expertise in management strategy, governance, ESG investment, etc., and the system is designed to reflect a wide range of outside opinions. In addition to outside experts, the officer in charge of compliance is added to the committee to deliberate and confirm important policies for responsible investment and the exercise of important voting rights from the perspective of managing conflicts of interest with life insurance contracts.

Main Initiatives to Achieve Carbon Neutrality in Investment Portfolios

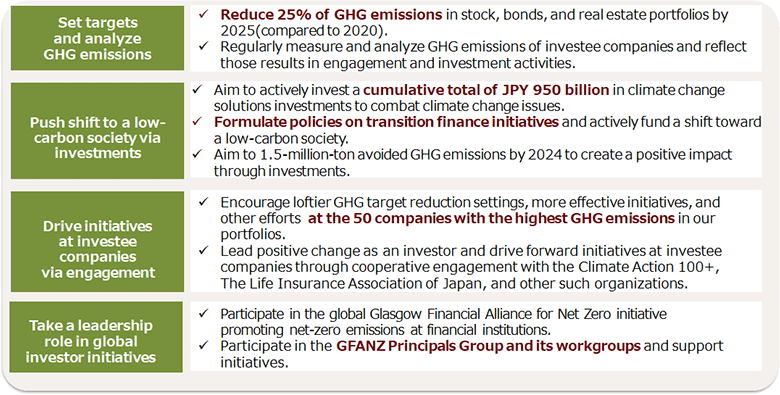

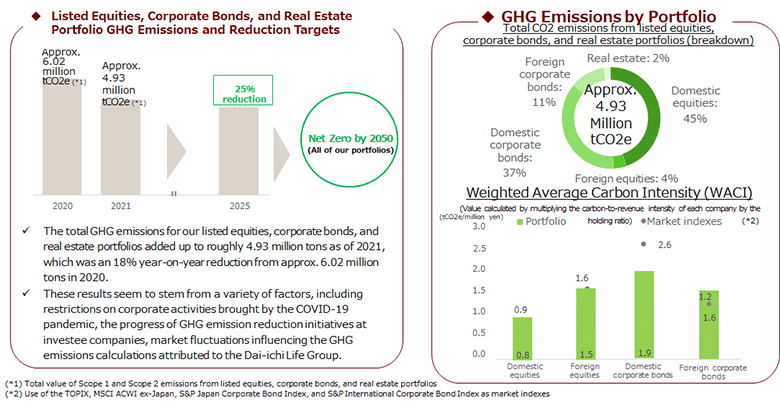

■Formulate mid-term reduction targets every five years, monitor progress, and strive to expand assets subject to these targets according to the Net-Zero Asset Owner Alliance Target Setting Protocol as a member to achieve carbon neutrality in portfolios by 2050.

■Support initiatives of any investee company via engagement and expand investments that help resolve climate-related issues to support a shift to a low-carbon society and efforts toward new environmental innovations.

GHG Emission Reduction Target Settings and GHG Emission Analysis

■We have designated climate change as the highest priority issue for responsible investments. In February 2021, Dai-ichi Life joined the Net-Zero Asset Owner Alliance for the first time in Japan to publicly share its commitment to shift to carbon neutral portfolios by 2050.

■We will set targets to reduce GHG emissions by 25% in equity, bond, and real estate portfolios (compared to March 31, 2020) and analyze the level of GHG emissions of each portfolio based on the TCFD recommendations.

Policy on Transition Finance

■For realizing a decarbonized society, it is important to steadily advance a long-term transition strategy centered in high GHG emitting industries.

■In order to achieve net-zero portfolio by 2050 and contribute to the realization of a decarbonized society, we established a policy on Transition Finance by actively supporting the financing of companies that pursue such strategies.

The full text of the “Policy on Transition Finance” is disclosed on the Company's website.

Progress of Emission Reduction Initiatives at 50 Companies with the Highest GHG Emissions

■Dai-ichi Life continuously engages in dialogues around themes on climate change. In fiscal year 2021, we identified and entered into dialogues with the 50 companies in our portfolios that have the highest GHG emissions.

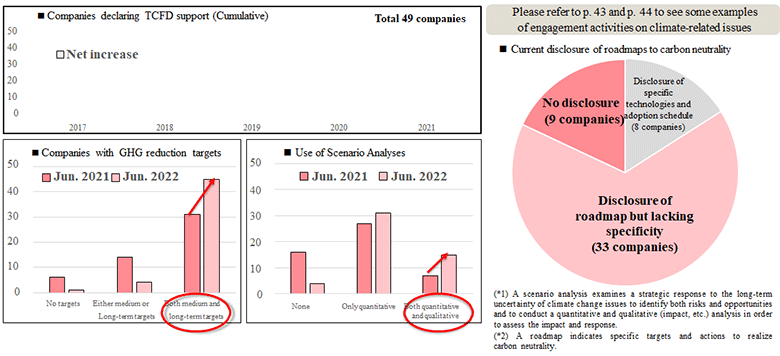

■A large number of these 50 companies have shown a significant increase in adopting the TCFD recommendations to set targets toward achieving carbon neutrality by 2050. However, only a few have drafted quantitative scenario analyses(*1) on climate-related issues and created a specific roadmap(*2) to carbon neutrality.

■In the future, we will continue to engage in these dialogues to encourage these companies to disclose quantitative scenario analyses and formulate and execute specific roadmaps toward GHG reductions.