As a Responsible Institutional Investor

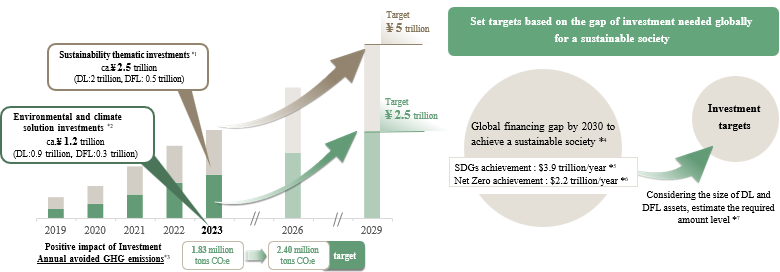

Investment Target for Solving Social Issues

■Cumulative total amount of ESG-themed investment (mainly for QOL improvement, mitigation of climate change, and regional development and revitalization) reached approx. JPY 1.3 trillion as of the end of FY2021. We will expand the cumulative total investment to over JPY 2 trillion by the end of FY2024 to create further positive impacts on society.

■We will increase the cumulative total investments to facilitate mitigating climate change to over JPY 950 billion by the end of FY2024 to bolster our response to climate change, or the top priority theme of our responsible investment. (Cumulative total investment as of the end of FY2021: Approx. JPY 510 billion)

- *

climate change solution : Investment to facilitate solving climate change, such as green bonds and renewable energy power plant projects.

For other investment and loan results, please refer to the Responsible Investment Report of Dai-ichi Life, the Group's core company.

Responsible Investment Report (4,341KB) PDF

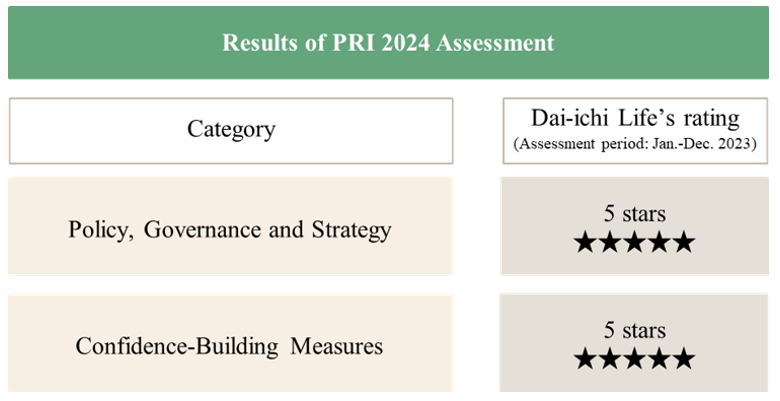

2021 PRI Assessment Results

■In the 2021 PRI Assessment, we received the highest "5" rating for our investment and stewardship policies as well as real estate investments. Dai-ichi Life will continue to promote more sophisticated responsible investment initiatives.

- *

Voting and listed equity include the average assessment of two modules (fundamental / REITs, etc.) and fixed income includes the average assessment of four modules (SSA, corporate, private debt, and securitized).

Click here for information on climate change initiatives as an institutional investor.