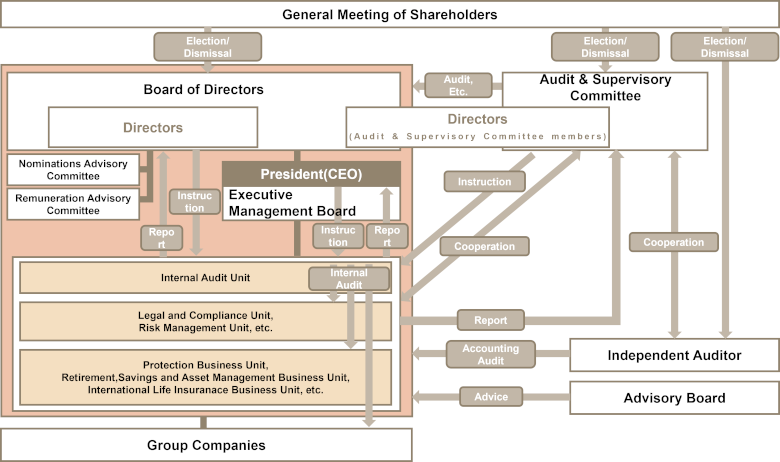

Enhancement of Management Control System

Conduct of Business

Board of Directors

The Board of Directors of Dai-ichi Life Holdings is responsible for making important decisions on the Group's management strategy, management plan, etc. and supervises the execution of business operations. The Board of Directors consists of inside directors with knowledge and experience necessary to perform management in an accurate, fair, and efficient manner and outside directors with the deep insight, rich experience, and independence necessary to fully demonstrate supervisory functions. The number of outside directors makes up one-third or more, in principle. In terms of the constitution of the Board of Directors, its diversity is taken into account, such as gender, nationality and so forth. Furthermore, the meeting of the Board of Directors shall be held no less than once in every three months and may also be held on an ad-hoc basis as necessary.

To improve management transparency, the Nominations Advisory Committee and the Remuneration Advisory Committee made up of the Chair of the Board, President, and external appointees have been established under the Board of Directors. The Nominations Advisory Committee is responsible for assessing the qualifications of candidates for directorships and deliberating on the appointment and removal of directors, and also for assessing the independence of outside directors appointed by the company based on independence criteria. The Remuneration Advisory Committee is responsible for deliberating on the remuneration system for directors and executive officers. The members and main deliberation agenda of each committee are disclosed in the corporate governance report.

Furthermore, the Advisory Board has been established as a voluntary organization regarding management matters in general for the purpose of further strengthening and enhancing governance by obtaining extensive advice from outside experts from a medium- and long-term perspective, given the external environmental change.

| Number of directors | 15 Number of directors on Office of the Audit & Supervisory Committee 5 (as of June 23, 2025) |

|---|---|

| Number of outside directors | 7 Number of outside directors on Office of the Audit & Supervisory Committee 3 (as of June 23, 2025) |

| Number of board meetings | 17 (FY2024) |

| Nominations Advisory Committee | Remuneration Advisory Committee | |||

|---|---|---|---|---|

| Members | Yasushi Shingai | (Outside Director) | Ichiro Ishii | (Outside Director) |

| Yuriko Inoue | (Outside Director) | Bruce Miller | (Outside Director) | |

| Ichiro Ishii | (Outside Director) | Satoshi Nagase | (Outside Director (Office of the Audit & Supervisory Committee Member)) | |

| Rieko Sato | (Outside Director (Office of the Audit & Supervisory Committee Member)) | Ayako Makino | (Outside Director (Office of the Audit & Supervisory Committee Member)) | |

| Seiji Inagaki | (Director, Chair of the Board) | Seiji Inagaki | (Director, Chair of the Board) | |

| Tetsuya Kikuta | (Representative Director, President) | Tetsuya Kikuta | (Representative Director, President) | |

| Number of committee meetings | 7 (FY2024) | 12 (FY2024) | ||

| Main deliberation agenda |

|

|

||

Assessment of Effectiveness of the Board of Directors

To underpin the effectiveness of decision-making by the Board of Directors, the board uses self-evaluation and other techniques to undertake an annual review of the efficiency of its meeting practices and effectiveness of its decision-making, and reports a summary of the results.

For the FY2024 evaluation, a third-party organization conducted a one-hour interview with all Directors individually, after conducting an anonymous survey of all Directors in advance. The advance survey consists of a total of 46 questions in 8 categories, which include "Overall Evaluation," "Structure," "Preparation in Advance, etc." "Operation," "Contents of Discussion" "Each Committee," "Execution Monitoring" and "Others." The third-party organization evaluated that the effectiveness of the Board of Directors is at a higher level in comparison with other companies.

The results of the FY2024 evaluation are available in an attached file.

An ongoing program is in place to improve the effectiveness of the Board of Directors by working through the PDCA improvement cycle, including by third-party evaluation to further improve the activities and deliberations of the Board of Directors.

Conduct of business

An executive officer system has been adopted to separate decision-making and supervision from the conduct of business and to strengthen functions. Executive officers are appointed by the Board of Directors and conduct business in accordance with the authority delegated to them by the Board of Directors. The Executive Management Board made up of the president and executive officers appointed by the president meets monthly in principle to discuss important management issues and business decisions.

Office of the Audit & Supervisory Committee

Office of the Audit & Supervisory Committee verifies and evaluates the effectiveness of Directors' execution of their duties (mainly with regards to their performance in managing group companies etc.) and carries out audit on their legitimacy and validity.

The Committee gathers necessary information to verify and evaluate the effectiveness of directors' activities by requiring reports from internal audit and internal control functions, participating in material meetings, interviewing directors and officers, and reviewing material documents.

Office of the Audit & Supervisory Committee executes supervisory roles to the Board of Directors by forming and providing opinions on directors' nomination and remuneration. In forming these opinions, the Committee reviews the appropriateness of the discussions and processes in the Nominations Advisory Committee and Remuneration Advisory Committee.

Staffs who provide administrative support for the activities of Office of the Audit & Supervisory Committee are assigned to Office of the Audit & Supervisory Committee's Center, and transfers and performance evaluation of these staffs are to be discussed with the members of Office of the Audit & Supervisory Committee, therefore their independence from the Board of Directors are maintained.

| Number of Office of the Audit & Supervisory Committee members | 5 (as of June 23, 2025) |

|---|---|

| Number of Outside Office of the Audit & Supervisory Board Members | 3 (as of June 23, 2025) |

| Number of Office of the Audit & Supervisory Committee meetings | 28 (FY2024) |

Reasons for appointing outside directors and their activities

| Role | Name | Reasons for appointment | Activities during FY2024 |

|---|---|---|---|

| Outside director | Yuriko Inoue | She is an experienced and trusted professor specialized in intellectual property laws, and she has had a wide range of knowledge about IT-related systems and policies backed by her expertise. She has also brought significant benefits to the Company by supervising management and advising on various legal matters and data governance in IT strategies of the Company based on her objective viewpoint at the Board of Directors meetings and other occasions. The Company believes she will continuously share her experience and expertise on oversight of management of the Group as before, and therefore proposes her as an outside director. | Attended 17 Board of Directors meetings out of all 17 meetings held |

| Outside director | Yasushi Shingai | In addition to his deep experience and insight gained through acting as business executive of a global company, he has rich experience and sophisticated and expert knowledge of corporate finance and mergers & acquisitions as the finance officer. He has also brought significant benefits to the Company by supervising management and advising on various matters of corporate management based on his global and objective viewpoint at the Board of Directors meetings and other occasions. The Company believes he will continuously share his experience and expertise on oversight of management of the Group as before, and therefore proposes him as anoutside director. | Attended 17 Board of Directors meetings out of all 17 meetings held |

| Outside director | Bruce Miller | He is a specialist in global politics and economy and has rich experience and deep insight into the life insurance business as a Non-Executive Director of TAL, a subsidiary of the Company. He has also brought significant benefits to the Company by supervising management and giving advice on various matters of corporate management based on his global and objective viewpoint at the Board of Directors meetings and other occasions. The Company believes that he will continue to share his experience and expertise on oversight of management of the Group, and therefore proposes him as an outside director. | Attended 17 Board of Directors meetings out of all 17 meetings held |

| Outside director | Ichiro Ishii | In addition to his deep experience and insight gained through acting as a business executive of a global company, he has rich experience and sophisticated and expert knowledge of M&A and post-acquisition integration processes as the officer for an overseas insurance business in a major financial institution. The Company expects that he will advise on various matters of corporate management based on his global and objective viewpoint at the Board of Directors meetings and other occasions and utilize his experience in conducting supervision of the Group's management, and therefore proposes him as an outside director. | Attended 12 Board of Directors meetings out of all 12 meetings held |

| Outside director (Office of the Audit & Supervisory Committee member) |

Rieko Sato | She is an experienced and trusted attorney, and she has had a wide range of experiences serving as outside director and outside Audit and Supervisory Board member of various corporations. She has also brought significant benefits to the Company by supervising and auditing management as well as advising on various legal matters of the Company based on her objective viewpoint at the Board of Directors meetings and other occasions. The Company believes she could continue to take advantage of her experience in conducting audits and supervision of the Group's management, and therefore proposes her as an outside director serving as Office of the Audit & Supervisory Committee member. | Attended 17 Board of Directors meetings out of all 17 meetings held Attended 28 Office of the Audit & Supervisory Committee meetings out of all 28 meetings held |

| Outside director (Office of the Audit & Supervisory Committee member) |

Satoshi Nagase | He has had a wide range of experiences and high-level insight as a corporate manager at financial institutions and extensive experience in capital policy and finance as a CFO of other companies. In addition, he has deep experience and knowledge in the life insurance business as Director (part-time) of The Dai-ichi Frontier Life Insurance Co., Ltd., a subsidiary of the Company. The Company expects that he will actively advise on various matters of the Company based on his objective viewpoint at the Board of Directors meetings and other occasions and utilize his experience in conducting audits and supervision of the Group’s management, and therefore proposes him as an outside director serving as Office of the Audit & Supervisory Committee member. | Attended 12 Board of Directors meetings out of all 12 meetings held Attended 23 Office of the Audit & Supervisory Committee meetings out of all 23 meetings held |

| Outside director (Office of the Audit & Supervisory Committee member) |

Ayako Makino | She has rich experience and sophisticated professional knowledge as a certified public accountant, as well as a wide range of experiences serving as a non-executive board member and The chairman of the audit committee at an audit firm and other companies. The Company expects that she will bring significant benefits to the Company by supervising and auditing management of the Group and giving advice on various matters of corporate management based on her objective viewpoint at the Board of Directors meetings and other occasions, and therefore proposes her as a candidate for outside director serving as Office of the Audit & Supervisory Committee member. Although she has never been engaged in corporate management except as a non-executive board member, she is expected to duly perform her duties as an outside director serving as Office of the Audit & Supervisory Committee member for the abovementioned reasons. | - |

Remuneration of officers

Basic Policy and Basic Principles

The remuneration system for directors and officers is a critical component in terms of "fair treatment" for directors and officers who are responsible for realization of the Group Vision. The items described below shall be adopted as basic policies and principles.

Basic Policy for Remuneration of Directors and Officers

- Serves a system for realizing the sharing of value with stakeholders with a medium- to long term perspective.

- Is a fair remuneration system of an appropriate level, reflecting the magnitude of the roles and responsibilities and the degree to which capabilities were demonstrated.

- Evaluates the contributions of each director by linking their remuneration with company and individual performance, and encourages the creation of value on which the Group focuses.

Basic Principles for Remuneration of Directors and Officers

- Appropriate remuneration design according to roles and responsibilities

- Consistency with strategies on which the Group focuses

- Links to the performance of the Company and individuals

- Shares interests with all stakeholders

- Proper and competitive level of remuneration

- Ensures objectivity and transparency

Process for determining remuneration

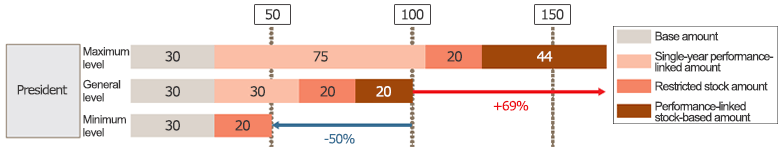

Remuneration for directors (excluding directors serving as Office of the Audit & Supervisory Committee Members and outside directors) is made up of a base amount, a single-year performance-linked amount (company performance and individual performance) and a stock amount (restricted stock and performance-linked stock-based). In the case of outside directors and directors serving as Office of the Audit & Supervisory Committee Members, remuneration is in the form of a base amount only. The level of remuneration for directors (excluding directors serving as Office of the Audit & Supervisory Committee Members and outside directors) shall be set using third-party surveys, etc. regarding remuneration of executives, and the level of remuneration for directors serving as Office of the Audit & Supervisory Committee Members shall be set using third-party surveys, etc. regarding remuneration of executives in Japanese companies. The Policy for Determining Remuneration of Directors and Executive Officers, including these policy and principles, has been decided on by the Board of Directors based on the deliberation of the Remuneration Advisory Committee, the majority of which is made up of outside committee members.

Policy on officer remuneration amounts and how to choose methods for calculating these amounts

Remuneration for directors (excluding directors serving as Office of the Audit & Supervisory Committee Members and outside directors) is made up of the base amount, the single-year performance-linked amount and the stock amount.

The Company sets Key Performance Indicators of the single-year performance-linked amount so that such remuneration serves as an appropriate incentive in achieving objectives under the medium-term management plan.

Outside directors and directors who are Office of the Audit & Supervisory Committee members receive basic remuneration only.

The level of remuneration for directors (excluding directors serving as Office of the Audit & Supervisory Committee Members and outside directors) shall be set using third-party surveys, etc. regarding remuneration of executives, and the level of Remuneration for directors serving as Office of the Audit & Supervisory Committee Members shall be set using third-party surveys, etc. regarding remuneration of executives in Japanese companies.

Directors Remuneration Structure

| Directors (excluding directors serving as Office of the Audit & Supervisory Committee members) |

Directors (Office of the Audit & Supervisory Committee members) |

Remarks | ||

|---|---|---|---|---|

| Inside | Outside | |||

| Base amount | ○ | ○ | ○ | Remuneration according to duties and responsibilities |

| Single-year performance-linked amount | ○* | - | - | Linked to the single-year level of achievement of performance indicators |

| Restricted stock amount | ○ | - | - | Set for the purpose of achieving management objectives in the medium-to long-term and sharing interests with shareholders |

| Performance-linked stock-based amount | ○* | - | - | Linked to the level of achievement of the indicators selected in light of the management objectives as an incentive for enhancing corporate value |

*Excluding Directors who are not in charge of business operations

Diagram of Remuneration (Example : Representative Director, President)

(when key performance indicators achievement is at standard level total remuneration is set as 100)

Key Performance Indicators (KPIs) for Performance-linked Amounts

KPIs for the performance-linked amount in Medium-Term Management Plan covering FY 2024-26

| Business Perspective |

KPI |

|---|---|

| Economic value | Group ROEV |

| Group Value of New Business | |

| Equity・Interest Rate Risk / EV | |

| Accounting profit | Group Adjusted ROE |

| Group Adjusted Profit | |

| Market Valuation | Relative TSR |

| Soundness | Required Economic Solvency Ratio (ESR) |

- (Note 1)

The above are KPIs for the single-year performance-linked amount (company performance) and performance-linked stock-based amount.

- (Note 2)

Equity・interest rate risk / EV is set as an indicator that has a certain correlation with elements of capital cost that can be reduced through self-help efforts, and is calculated as (equity risk amount + interest rate risk amount) ÷ EV.

- (Note 3)

Group adjusted ROE is calculated according to the following formula: Adjusted profit / (Net assets - Goodwill - Unrealized gains / losses on fixed-income assets)

- (Note 4)

TSR stands for total shareholder return and means shareholders' total return on investment, which is a total of capital gains and income gains.

- (Note 5)

Relative TSR is a comparison with the following 14 companies in total:

-

5 insurance companies operating in Japan-JAPAN POST INSURANCE, T&D Holdings, Tokio Marine Holdings, MS&AD Insurance Group Holdings, and Sompo Holdings; and

-

9 companies that operate life insurance business globally-Aflac, AXA, Manulife, MetLife, and Prudential (US), AIA, Prudential (UK), Allianz, Zurich.

Total Remuneration Details for Fiscal 2024

| Directors (excluding Directors serving as Office of the Audit & Supervisory Committee member and Outside Directors) | Directors serving as Office of the Audit & Supervisory Committee member (excluding Outside Directors) | Outside Directors (excluding Directors serving as Office of the Audit & Supervisory Committee member) | Outside Directors serving as Directors serving as Office of the Audit & Supervisory Committee member | |||

| Total remuneration (Millions of yen) | 436 | 104 | 74 | 76 | ||

| Remuneration components (Millions of yen) | Basic remuneration | 221 | 104 | 74 | 76 | |

| Single-year performance-linked amount | Company performance amount | 39 | - | - | - | |

| Individual performance amount | 20 | - | - | - | ||

| Non-monetary amount (stock amount) |

Restricted stock | 68 | - | - | - | |

| Performance-linked stock | 85 | - | - | - | ||

| Others | 0 | 0 | - | - | ||

| Number of board members | 7 | 3 | 5 | 4 | ||

- Total consolidated remuneration for each officer

| Name | Total consolidated remuneration (unit: million yen) |

Classification of Directors | |||

|---|---|---|---|---|---|

| Tetsuya Kikuta | 193 | Director | |||

| Toshiaki Sumino | 116 | Director |

- (Note)

Only the director whose total consolidated remuneration exceeds 100 million yen is listed.

Independence Standards for Outside Directors

As part of its approach to strengthening corporate governance, Dai-ichi Life has established its own standards to determine the independence of its outside directors.