Climate Change Initiatives

- Response to TCFD

Issue Awareness

The awareness that environmental concerns, climate change in particular, are issues for the international community as a whole has increased with the Paris Agreement going into effect in 2016. The Dai-ichi Life Group, which operates life insurance and asset management businesses globally, also recognizes climate change as an important management issue that could significantly affect the lives and health of its customers, corporate activities, and social sustainability.

Based on such awareness, we positioned tackling climate change as one of the areas we will continually strengthen in CONNECT 20201, our medium-term management plan, and we are working on a variety of initiatives. Moreover, in addition to boosting management resilience through an assessment of the risks and opportunities posed by climate change, we announced our endorsement of the TCFD2 Recommendations in September 2018 in order to enhance corporate value through sound dialogue with stakeholders based on such disclosure.

1 Determined by the Board of Directors of Dai-ichi Life Holdings in March 2018

2 Task Force on Climate-related Financial Disclosures

Stance on Governance/Risk Management

The Dai-ichi Life Group practices ERM with the aim of enhancing capital efficiency and corporate value based on strategies that are in accordance with the status of profit, capital, and risk. As a part of this, we identify foreseeable risks that could have a major impact on our business, formulate business plans that take these risks into account, and engage in risk management that responds appropriately to early signs of risk. We treat climate-related risk as a risk with the potential to have a serious impact on the Group in the future due to changes in the environment. The Group ERM Committee, which is composed of the officers responsible for the Risk Management Department and the Corporate Planning Department among others, conducts analysis and assessments, and then reports to the Executive Management Board and the Board of Directors periodically and monitors.3

In addition, Dai-ichi Life undergoes an annual assessment based on PRI4, which is the global standard for ESG investment. The initiative policy based on the results of this assessment is discussed at the Responsible Investment Committee, by majority comprised from external experts, and reported to the Executive Management Board to continually upgrade ESG investment.5

Stance on Governance/Risk Management

3 For details on risk management, see

https://www.dai-ichi-life-hd.com/en/about/control/in_control/administer.html

4 Principles for Responsible Investment published by the United Nations in 2005

5 For details on the stance on promoting responsible investment, see

https://www.dai-ichi-life.co.jp/english/dsr/investment/ri.html

Stance on Governance/Risk Management

Climate-related risks

(1) Climate-Related Risks and Opportunities and the Impact on Our Business

(Results of Trial Scenario Analysis at Dai-ichi Life, a core Group company)

Main Risks and Opportunities Affecting Business and Impact (Dai-ichi Life)

| Climate-related risks | Main impacts on business | |

|---|---|---|

| Physical risks |

→Impacts could increase under the scenario of significant long-term increase in temperatures due to inadequate climate change countermeasures by each country |

Main impacts on business

|

| Transition risks |

→Impacts could increase under the scenario of reductions in long-term increase in temperatures due to adequate climate change countermeasures, such as the development of new technologies and utilization of carbon recovery and storage technology |

Main impacts on business

|

| Climate-related opportunities | Main impacts on business | |

|---|---|---|

| Resource efficiency,products and services, Markets, etc. |

|

Main impacts on business

|

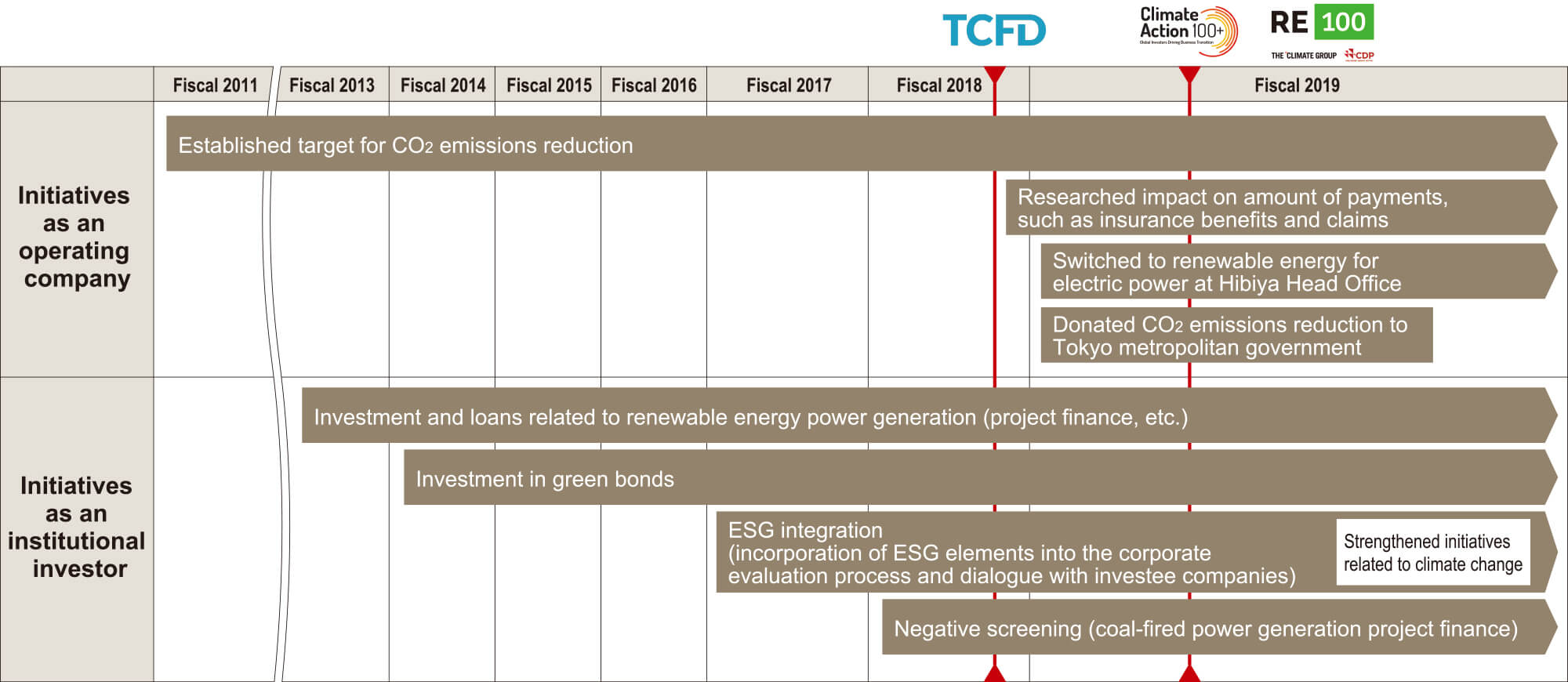

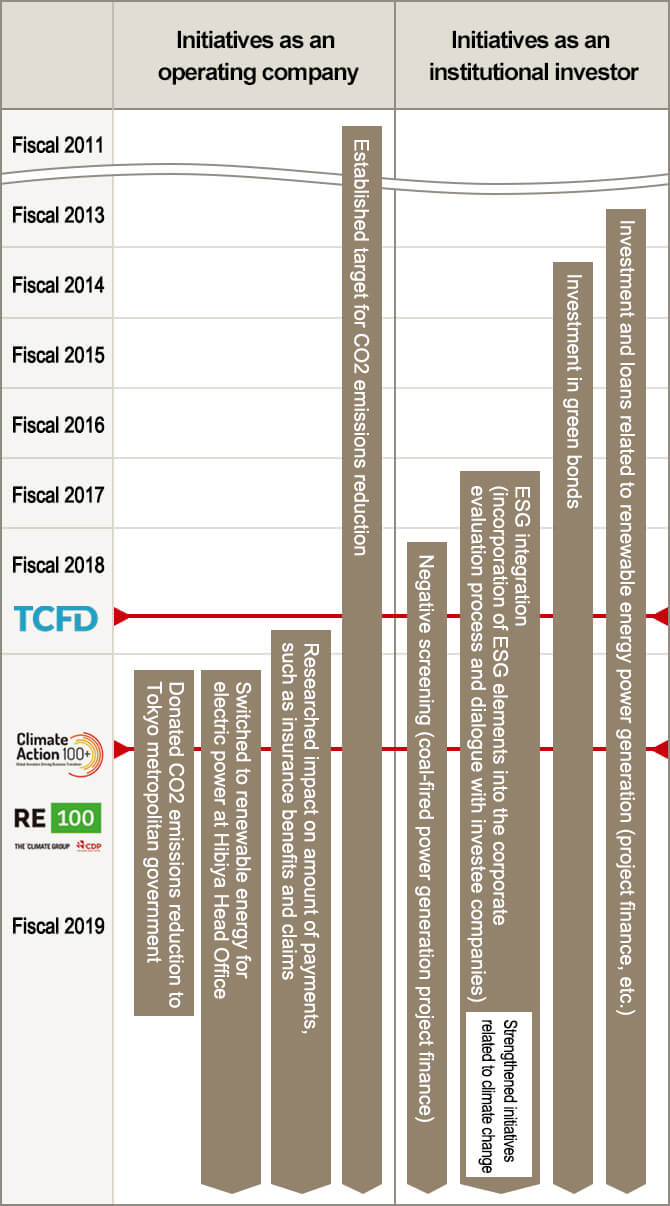

(2) Specific Initiatives

As an operating company and an institutional investor, Dai-ichi Life is boosting the resilience of its business against climate change as well as encouraging the enhancement of overall social resilience, which includes financial markets.

Initiatives as an Operating Company

Dai-ichi Life will strengthen resilience in the life insurance business through measures such as researching the impact of climate change on the life insurance business. Moreover, in addition to initiatives to reduce CO2 emissions, Dai-ichi Life will contribute to enhancing overall social resilience through initiatives such as environmental protection.

- Resilience of the Life Insurance Business

-

- Provisional estimates of increase in payments, including insurance claims, due to heat strokes and infectious diseases in Japan

- Going forward, continue to research other impacts in regions outside of Japan

- Overall Social Resilience

(CO2 reduction, etc.) -

- Established a CO2 emission reduction target in 2011. Promoting reductions in energy consumption associated with business site activities through introduction of energy-saving equipment, etc. to achieve target

- Introduced renewable energy (switched all electricity for the Hibiya Head Office building in Tokyo to renewable energy derived from hydro-electricity in April 2019 with an expected annual reduction in CO2 emissions of approximately 3,600t)

- Donated a 41,966t credit for excess CO2 emission reductions to Tokyo Metropolitan Government under the Cap-and-Trade Program to help with Tokyo Metropolitan Government efforts aiming for a Zero Emission Tokyo, a sustainable city with no CO2 emissions

Initiatives as an Institutional Investor

Based on the awareness that climate change could have a medium- to long-term impact on investment performance, Dai-ichi Life is upgrading its climate-related risk analysis and promoting initiatives to reduce that impact, obtain opportunities for profit, and boost overall social resilience.

- Asset Management Resilience

-

- As a general rule, we have a policy of not investing in, or loaning to, coal-fired power generation project financing given the risk that the asset value of investee companies will decline due to the transition to a low carbon society (no record of investment in, or loans to, such projects to date)

- Introduced climate change factors into corporate evaluation processes to increase resilience of owned assets against climate change

- Overall Social Resilience

-

- Proactively investing in assets, etc. that help solve the climate change problem

- Promoting disclosure of information based TCFD Recommendations through dialogue with investee companies

● Renewable energy project financing

Since fiscal 2013, Dai-ichi Life has been investing proactively in solar, wind, and biomass power generation projects in Japan and overseas, and our investment to date exceeds 100.0 billion yen.

● Investment in green bonds, etc. of international development financial institutions

In June 2019, Dai-ichi Life invested approximately 10.8 billion yen in both green bonds issued by the International Bank for Reconstruction and Development (IBRD), part of the World Bank Group, and environmental conservation bonds issued by the European Bank for Reconstruction and Development (EBRD).

● First Japanese life insurance company to participate in Climate Action 100+

Dai-ichi Life joined a global initiative by institutional investors to engage in constructive dialogue on emissions reductions efforts and disclosure of information about those efforts with companies that have high levels of greenhouse gas emissions.

Indicators and Targets

Dai-ichi Life, which operates a large-scale business, has established medium- to long-term CO2 emission reduction targets of 40% by fiscal 2030 and 70% by fiscal 2050 (both compared to fiscal 2013). The Dai-ichi Life Group is also working toward a target of 1% year-on-year reductions in CO2 emissions. Performance in fiscal 2018 was approximately 155,300t (Scope 1: 12,500t and Scope 2: 142,800t), maintaining the target pace of a 1% year-on-year reduction.

● First Japanese Insurance Company to Join RE100*

Dai-ichi Life joined an international initiative that has set a goal of switching to 100% renewable energy from the perspective of promoting increased use of renewable energy to prevent global warming.

* RE100 (Renewable Energy 100%) was launched in 2014 under the leadership of The Climate Group, an international NGO. It operates in collaboration with CDP (a not-for-profit charity that collects information about action on climate change from businesses and provides it to investors).

The target is to procure 100% of the electricity consumed in business activities through renewable energy, and more than 190 of the world's leading companies have joined as of August 2019.

TOPICSExamples of Environmental Protection Initiatives

Supporting Three Urban Greening Awards

In 1990, Dai-ichi Life established the Green Environmental Plans Award to support urban greening initiatives. Dai-ichi Life now supports three awards, by adding the Green Cities Award and the Competition for Specialized Greening Technology for Rooftops and Wall Facings. Approximately 200 green spaces have been subsidized up until to 2018. As a result of this initiative, Dai-ichi Life received the Minister of Land, Infrastructure, Transport and Tourism's Award for Service in Urban Greening in 2000 and 2014.

Planting Mangroves

Panin Dai-ichi Life (Indonesia) engages in activities to plant mangroves, which absorb large volumes of CO2 and act to protect the coastline from erosion. The company also puts efforts into activities to protect the natural environment, including sponsoring groups that carry out afforestation.

Forest Conservation

Protective (U.S.) works with natural environment protection groups carrying out activities to conserve the aquatic environment and ecosystems and preserve the beauty of nature in Alabama.