Where We AreOpen

The Challenges of a 100-Year Life Society

It is said that we are entering a 100-year life society. When Japan's Act on Social Welfare for the Elderly was enacted in 1963, we had just 153 people aged 100 or more but over the years this figure has grown to around 70,000 in 2018.

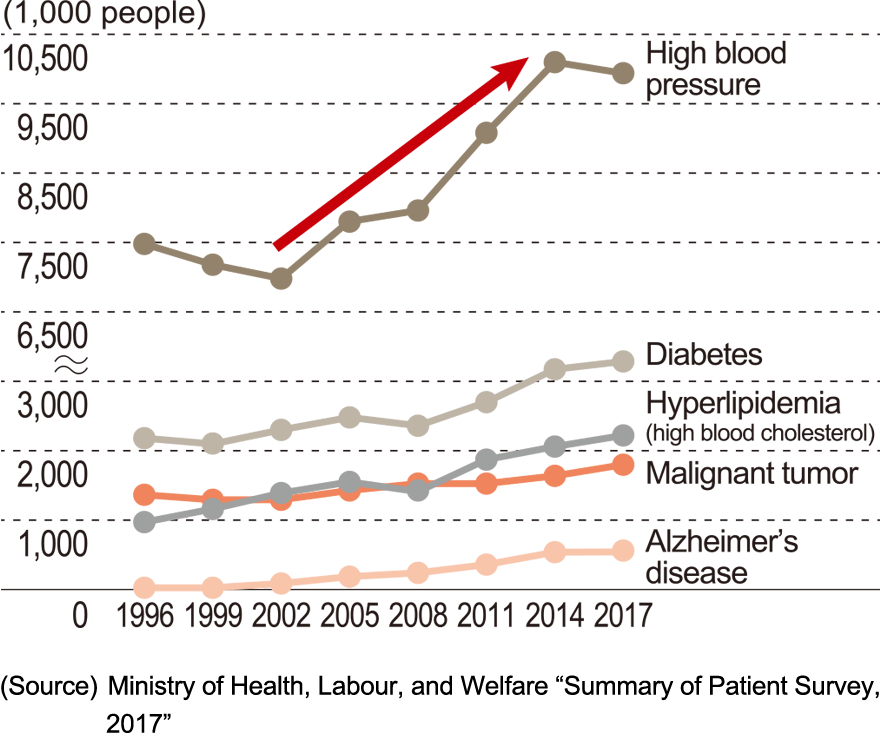

Various issues have become apparent with this change. As the population is aging, more and more people are suffering from dementia and chronic conditions, such as high blood pressure and diabetes. As more people suffer from such health conditions, the gap between average life expectancy and healthy lifespan has been widening. Specifically, a person is likely to spend an average of 10 years in an unhealthy state.

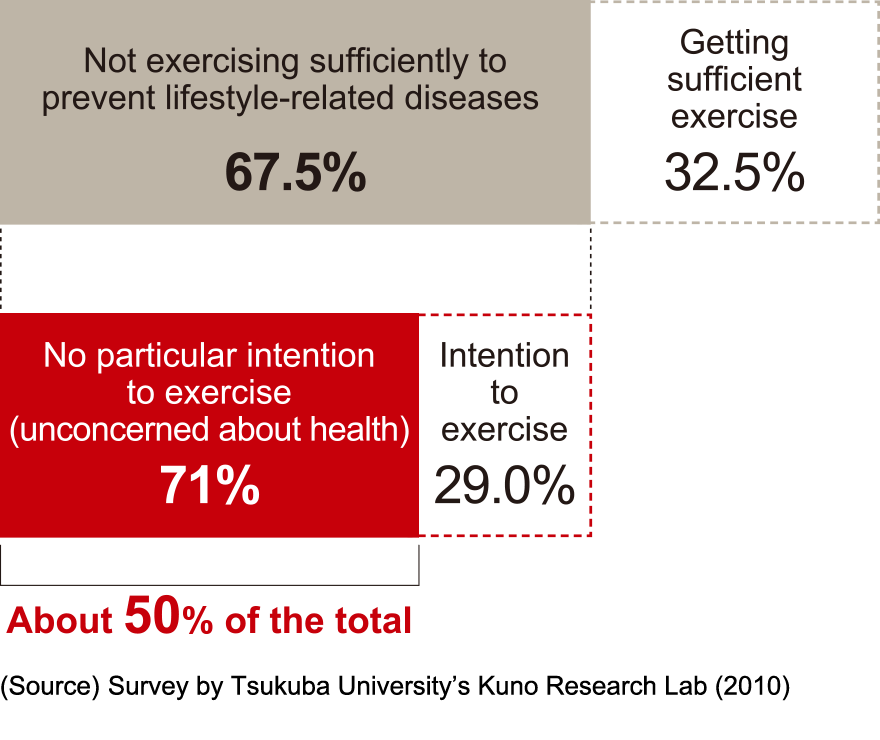

Given this situation, some people advocate the necessity of health promotion and illness prevention at an early stage and measures to stop the progression of diseases, but it seems that this message is not sufficiently influencing people. A survey revealed that roughly 70% of the population is not getting the necessary amount of exercise to prevent chronic diseases, and about 70% of this group were not concerned about their health, meaning they had no particular intention to exercise. It makes it very obvious that there is much room for improvement in spreading awareness on the necessity of maintaining and improving health.

People Suspected to be Affected by Chronic Diseases

About 50% of Japanese Not Concerned about Health

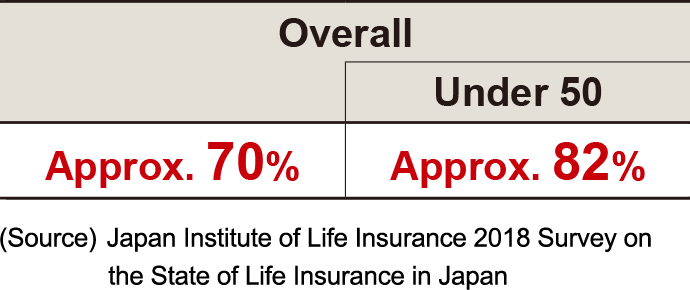

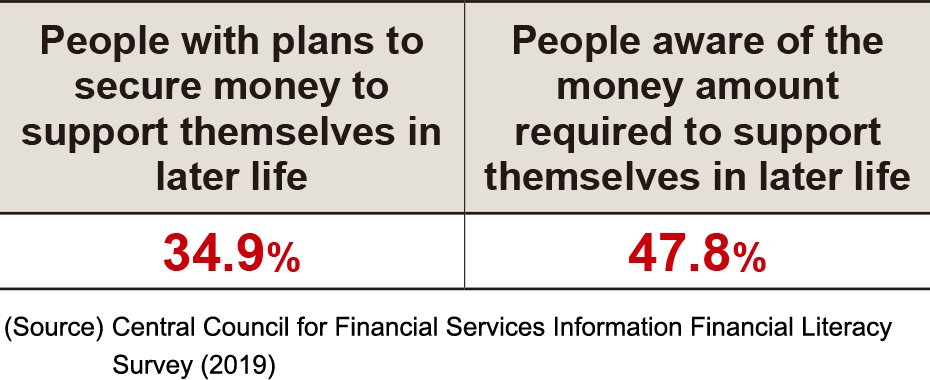

Another issue is the rising concern about not having enough money for later life. According to a survey by the Japan Institute of Life Insurance, about 70% of people in Japan are worried about supporting themselves financially in later life, and this percentage exceeds 80% of respondents under the age of 50.

Despite such concerns, a recent financial literacy survey revealed that only a little more than 30% of people had plans to save for later life, and less than half were aware of how much money they would need to support themselves in later life.

As a life insurer, we need to take these facts very seriously. The Dai-ichi Life Group has been carrying out activities to raise awareness about health and preparing for later life, and we have been providing people with information and services. However, this data suggests our efforts are not effective enough.

It is necessary to make an even greater effort to communicate to people the importance of being proactive and making proper provisions for building assets and improving their health and also we should continuously encourage them to act. This will get us even more involved in raising awareness and changing behavior, and will enable us to make a bigger contribution. Or in other words, our function is to provide a "nudge" in behavioral economics terms. I believe this is our role going forward. In this way, it is our responsibility to complement social security through our life insurance business and I recognize that expectations for us in this regard will grow in the future.

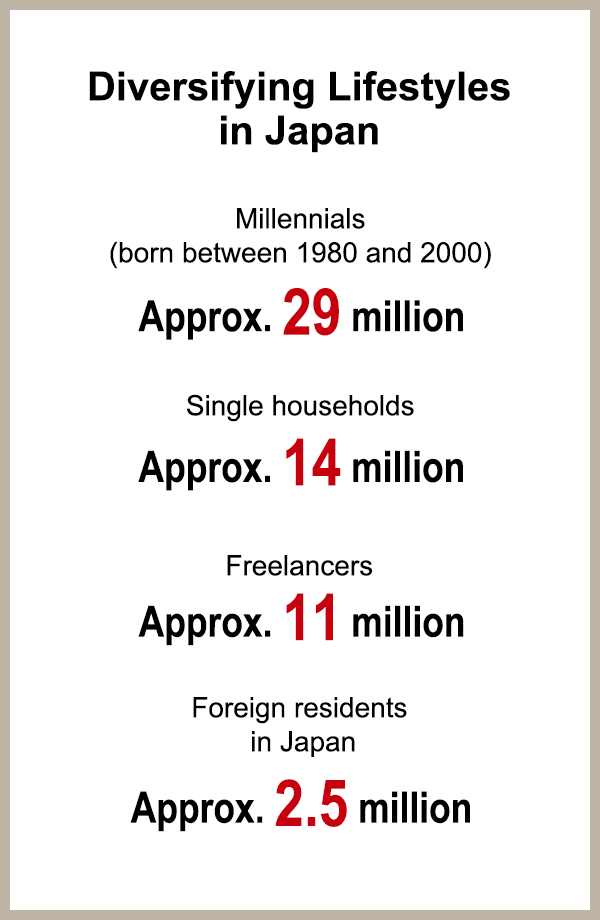

Diversifying Lifestyles

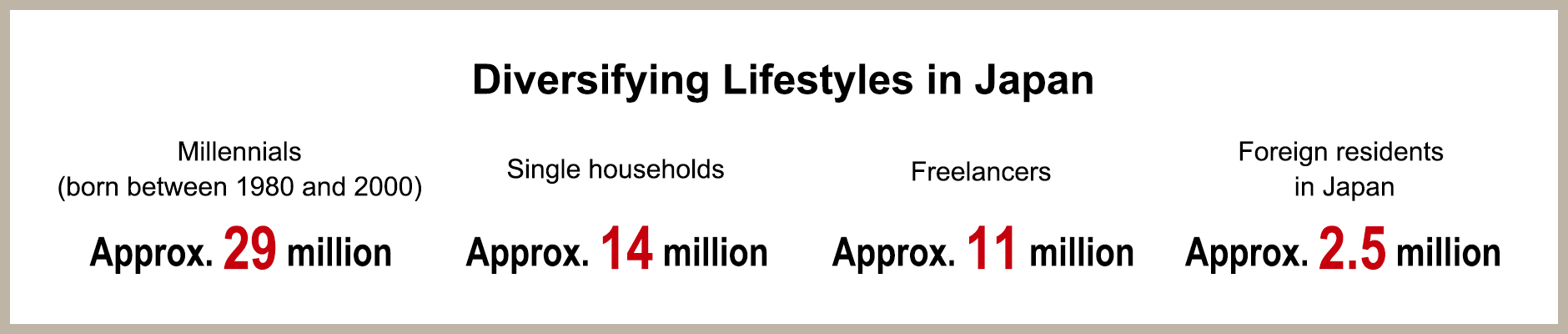

The diversification of lifestyles is being recognized more than ever before and the process seems to have accelerated since the rise of the generation born between 1980 and 2000, also known as "millennials." Millennials have lived in a digital society since their birth and have a set of values that differs completely from those of previous generations, namely sharing rather than owning, owning only what is needed, and connecting with one another through social media.

Millennials will become the core of society and have a strong influence. As this happens, the composition of society will change significantly, led by their values.

There are also other factors that will drive the diversification of lifestyles, such as an increase in single households, the spread of freelancing as a work-style, and increase of foreign residents as a result of globalization.

Such diversification also reflects the facts that individual customers have different values, and their expectations and aspirations are truly diverse. Therefore, there is a steadily growing demand for companies to provide products and services that meet these diverse needs. Also, if a company does not respond to such diversity, it will not win the support of its customers.

Life insurance is not an exception. Previously, the primary need of our core customer segment was standard death coverage. However, now insurance products cater to diverse needs, such as healthcare, nursing care, and savings for people with diverse lifestyles and values. Also, in line with customer preferences, insurance distribution channels have expanded from traditional face-to-face sales to include walk-in insurance shops, the internet, and other options.

In response to these environmental changes, we have served our customers by diversifying our products and channels. This includes adopting a multi-brand structure with three different companies in Japan and introducing non-life insurance and cancer insurance products from our business alliance partners. However, customer needs will continue to diversify and become more specific, in other words, it is not difficult to imagine a further increase in the demand for more personalized insurance and services.

In this way, if the Dai-ichi Life Group would adhere strictly to the traditional life insurance business model, we would not be able to fulfill the role demanded by society and our customers. In addition, the future of our business would also be at great risk. To solve the issues faced in a 100-year life society and to respond to the accelerating changes in the lifestyles of our customers, I think we need to respond to changes with even greater speed and agility.

Continuing to Embrace "By your side, for life,"

An Eternal Value Unaffected by ChangeOpen

We have a commitment to respond to the changes in the environment and provide new value our customers and society expects from us. By meeting these expectations, we can grow even more.

Since our founding in 1902, while contributing to solving social issues we have provided a peace of mind to embrace each of our customers through the life insurance business. We have always adapted ourselves to changes among our customers and in society. Tackling the social issues of each era could be simply summarized as the Dai-ichi Life Group's history.

The Dai-ichi Life Group's mission, "By your side, for life," expresses the pride and commitment of the employees who have inherited this history. This continues unchanged even within the current structure of the Group's business foundation, comprising of 10 life insurance companies and two asset management companies in Japan and around the world.

The driving forces behind "By your side, for life" are "pursue what's best" and "spirit of innovation," values passed down from our founder Tsuneta Yano. "Pursue what's best" is a pledge to always work hard with integrity to ensure the value we provide is the best it could possibly be and will earn us maximum support in order to contribute to the happiness of people and the progress of society. "Spirit of innovation" reflects the philosophy of having the agility to do whatever is required to realize "pursue what's best" and without fear to boldly change business practices when the occasion demands.

Since becoming president, I have used a quote from the founder to share my thoughts with employees about how we should approach work to reflect "By your side, for life." Our founder used to say "Think about whether what we are doing will delight people around us, or will it be dismissed as something they can live without. People will recognize the value when a product or service is beneficial and convenient, and society will appreciate what we do and grow it larger. Therefore, ultimately we engage in our business for the sake of society."

This is the essence that allows us to continue being "By your side, for life," the eternal value that enables us to grow and continue to be chosen by customers and society.

Going forward, we must never lose sight of this essence, and create and provide value that responds to new customer needs and social issues with integrity and agility. I would like the Group's 70,000 employees to share this ideal so that we can come together and strive for new growth.

New Value Creation We Pursue:

Improving Quality of LifeOpen

As we face new challenges accompanying diversifying lifestyles and entry into an age of a 100-year life society, the Dai-ichi Life Group has decided to pursue new value creation by contributing to the improvement of quality.

We see improving quality of life as "enabling the lives and lifestyles each and every person aspires to." The upcoming era will demand not only quantitative abundance, but also qualitative abundance, and we assume what people will desire most is to improve their quality of life. Naturally, what could improve the quality of life will vary from person to person, as the value provided by companies would also likely be diverse.

In this sense, how can the Dai-ichi Life Group contribute to improving quality of life? In order to continue fulfilling our mission "By your side, for life," what are the areas in which we can provide unique value that will lead to the improvement of people's quality of life and in which our customers and society are expecting from us? We have reconsidered these questions based on our awareness of the environment around us, the characteristics of our business, our strengths, etc.

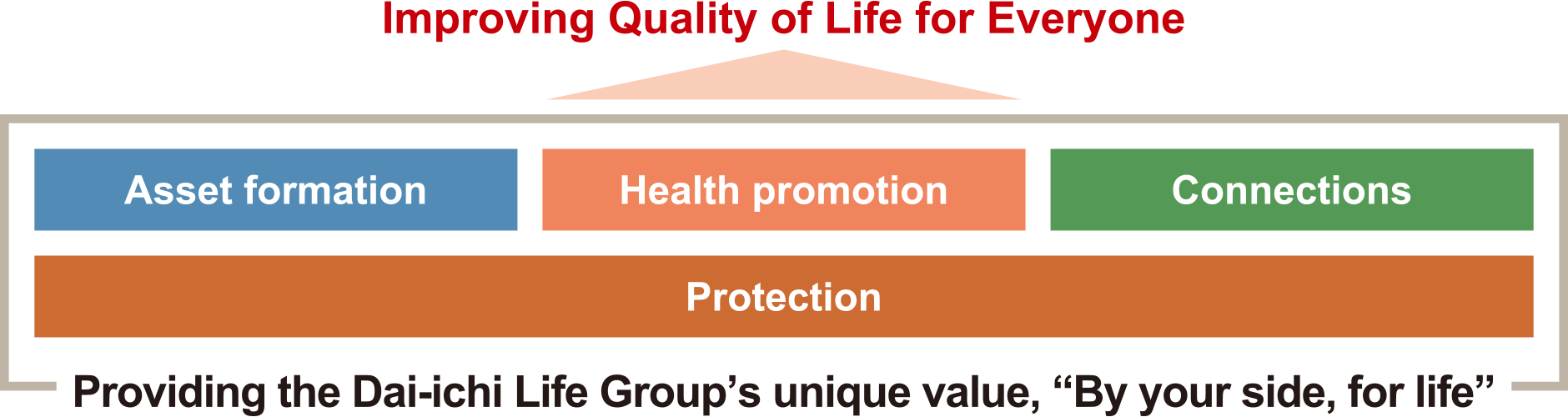

As a result, the Dai-ichi Life Group is earnestly expanding into areas in which it can provide value through our business in asset-building, health promotion, and enhancing connections, which will be crucial for everyone in order to realize better quality of life, in addition to our traditional role of providing protection. We will also leverage advances in technology to further improve this value aiming to contribute to customers and society. In this way the Dai-ichi Life Group is helping to improve quality of life.

In order to engage in this new value creation, we will go beyond our traditional role of an insurance company, to take on the challenge of evolving the Dai-ichi Life Group's business model. When taking on this challenge, we will leverage all our advantages, such as our strong business foundations in Japan and overseas (customer bases and channels), the brand power we have cultivated, the exceptional and diverse personnel and know-how at our Group companies in Japan and overseas, and the resources offered by business partners outside the Group.

Let us share here the four values we will provide going forward and how our efforts regarding each of these will lead to quality of life improvement.

Four Values Offered: 1. Protection

In Japan, we will contribute to improving people's quality of life by catering more closely to the diversifying protection needs that accompany lifestyles.

Dai-ichi Life's "Just," which was launched in 2018, is a highly versatile product that, in addition to death coverage, enables customers to prepare in great detail for various healthcare, illness, and nursing care needs. This has resulted in "Just" being popular among customers from a wide range of age groups and, as of April 2019, we had sold more than 1.3 million policies. Furthermore, we have been employing a multi-brand strategy in Japan. As a result of catering to customer needs in detail through a range of products from three Group companies, in fiscal 2018 we sold 1.43 million new policies, an increase over the previous fiscal year.

In overseas markets, our Group companies have been providing protection customized to the needs of each country and in particular, recently we are also expanding our business into the Mekong region. We have begun operations in Cambodia and have acquired provisional approval to begin business in Myanmar.

In this way, we are responding to the needs of many customers in Japan and other countries to contribute to improvement of quality of life by reducing the burden on household finances in case of emergency or when they become ill or injured, by enabling them to live with a peace of mind.

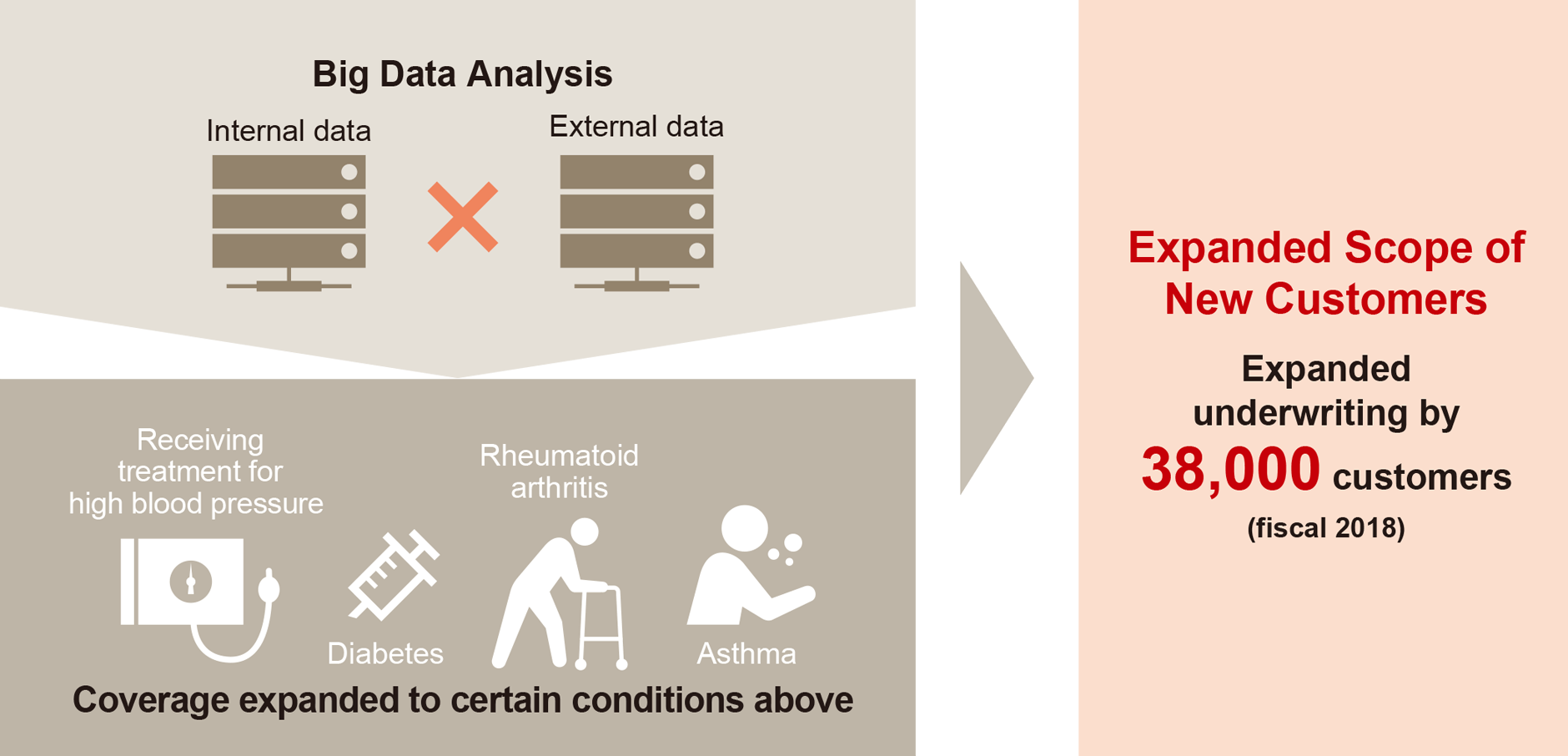

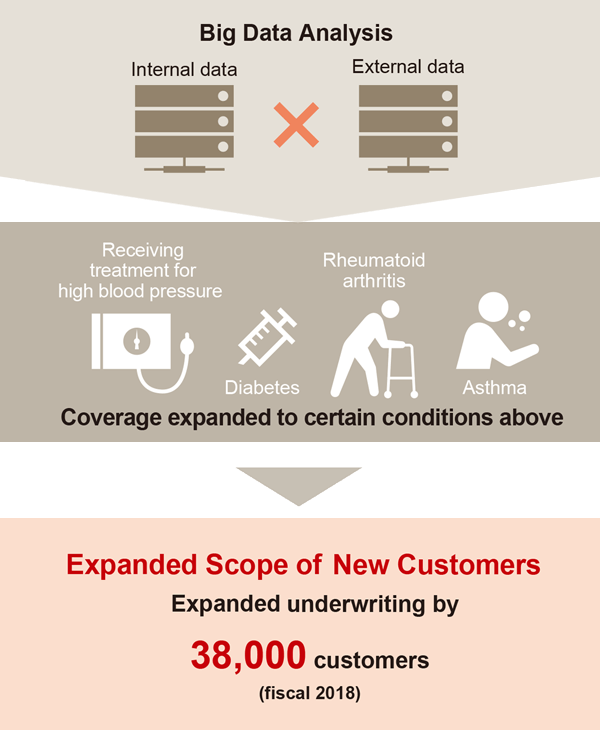

Furthermore, by utilizing technology, one of our strengths, we are expanding the scope of the protection we can provide. The Group refers to initiatives for fostering unique innovation by combining the insurance business with technology as "InsTech," and promotes it as a top priority strategic initiative. As part of InsTech, medical big data analysis and analysis of specific illnesses and hospitalizations allowed us to expand underwriting by 38,000 policies for patients with conditions such as high blood pressure and diabetes (equivalent to about 3% of Dai-ichi Life's annual new policies).

Expanding Underwriting Through Big Data Analysis

Naturally these achievements have meaning in directly leading to sales increase, but the provision of protection to even just one extra person is groundbreaking because it contributes to the improvement of quality of life and the stability of the lives of a greater number of customers, and going forward, we will further advance the expansion of underwriting through our data analysis.

Also, as the result of providing a line-up of products that flexibly cater to medical advances and increasingly segmented needs, the payment of claims related to healthcare and nursing care are increasing annually, and in fiscal 2018, a total of about 1.2 million claim payments were made by Dai-ichi Life and Neo First Life combined. Each year we are increasing the degree to which we contribute to providing stability in people's lives through not only death protection, but also paying claims and benefits that support longer lives.

Four Values Offered: 2. Asset Formation

The Dai-ichi Life Group offers a wide range of products that help customers with their asset-building needs primarily through Dai-ichi Frontier Life. In fiscal 2018 we recognized the increasing needs for inheritance and transferring assets and responded by timely introducing new products. We also expanded the sales channels to include over 180 financial institutions across Japan, as well as Dai-ichi Life's Total Life Plan Designers, which is a face-to-face channel. In this way we are solving one of the issues being faced in the age of a 100-year life society by helping a broad range of customers to "save, use, and transfer," or in other words, extend the longevity of assets.

In the 11 years since it started business, Dai-ichi Frontier Life's in-force policy amount, an indicator of our contribution to customers' asset-building, has risen to 8.9 trillion yen and the amount of annuities Dai-ichi Frontier Life pays each year has risen to 261.3 billion yen. This way it is playing a role in complementing the social security pension system.

Also, Dai-ichi Life, is offering Tontine Pension, a product designed to increase the amount paid as a future pension by lowering the amount paid in the event of death before the customer reaches a pensionable age. This provides a new option for securing needed funds for later life as society ages.

Four Values Offered: 3. Health Promotion

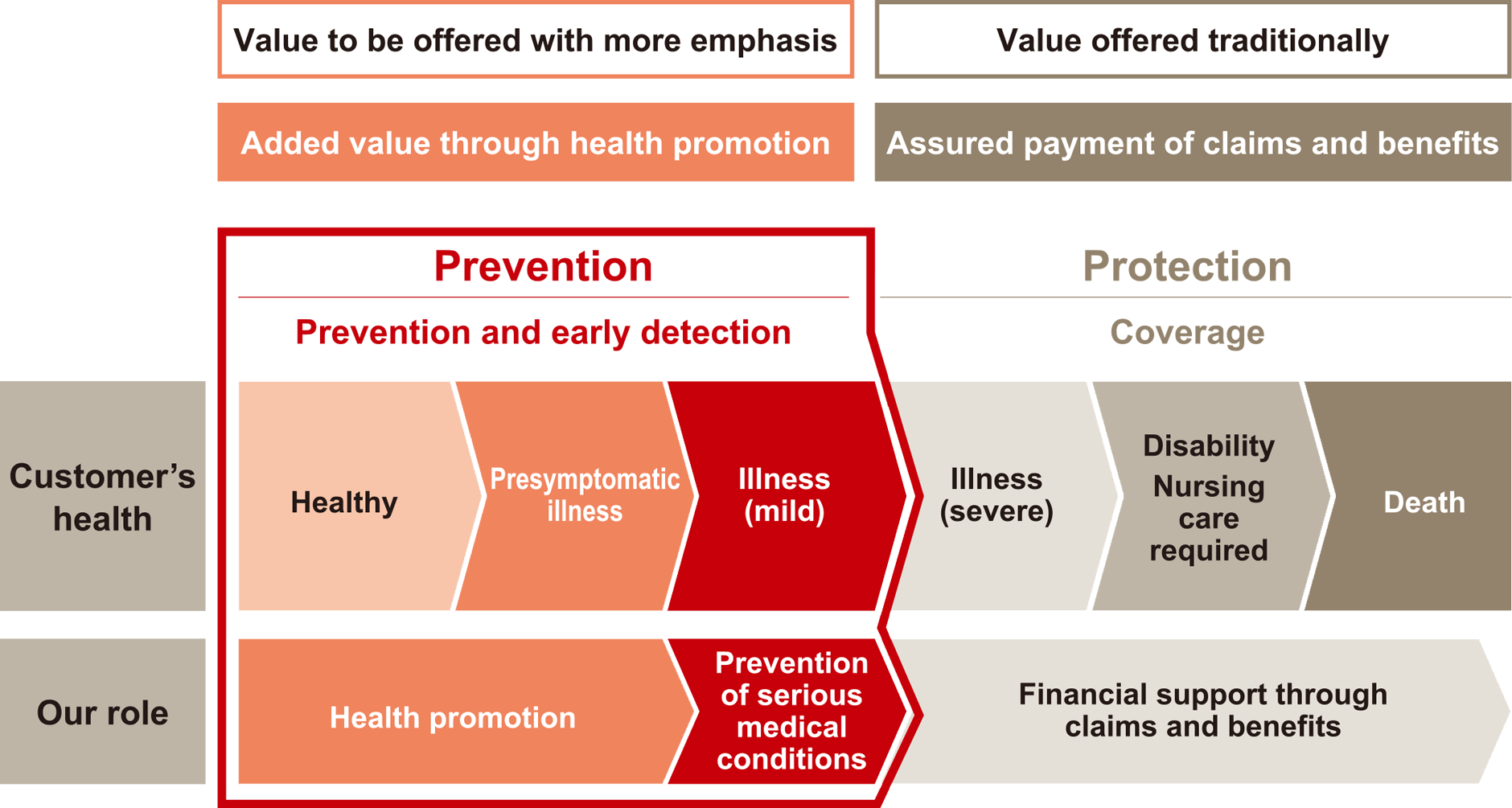

In health promotion, we aim to contribute to quality of life improvement considering expected increase in chronic conditions and dementia in the age of a 100-year life society. To achieve this, we will expand the value we provide to prevention and early detection, in addition to protection.

With traditional protection we offer financial support in case a customer suffers from an unexpected death or serious disease. Going beyond protection, the Dai-ichi Life Group is adding products and services that promote health and prevent serious medical conditions in everyday life, contributing to prevention and early detection.

For example, Dai-ichi Life's "Health Checkup Discount" is a system that offers a discount for submitted health checkup results when buying a life insurance policy. Our aim here is not just to appeal to the customer through a discount, but also to contribute to their health. Dai-ichi Life's analysis suggests that people who get regular health checkups have a significantly lower ratio of suffering from the three major diseases (cancer, strokes, and heart attacks) and untimely death. Therefore, we think that offering the "Health Checkup Discount" will encourage people to get health checkups, thereby promoting health and preventing future illnesses.

Also, in 2018 we launched dementia insurance. As there are currently no conclusive treatments or drugs for dementia, preventing its inception or stopping its progress is seen as the most effective way of tackling. Therefore, Dai-ichi Life's dementia insurance not only provides dementia coverage, but also it is enhanced with unique ancillary services which focus on preventing dementia and improving cognitive functions. This is a new value we are providing to improve quality of life by enabling customers to have longer, healthier lives.

It is my perception that introducing these products and services could have a significant impact on society. In fiscal 2018, Dai-ichi Life sold 500,000 new policies with discounts for submitted health checkup results, a 2.5 x increase over the previous fiscal year, and just in four months since the launch of dementia insurance, 100,000 new policies had been sold.

This is in part attributable to a high level of product development capability, enhanced with technology by InsTech initiatives and also attributable to the encouragement or "nudge" carried out by the Total Life Plan Designers, a face-to-face channel, on a daily basis.

Till now, Dai-ichi Life's about 40,000 Total Life Plan Designers in collaboration with municipalities have verified and included the status of having health checkups for approximately 3.6 million people across Japan. At every possible opportunity they have been communicating the importance of having health checkups and making preparations for coping with dementia. These activities toward raising health awareness and the "nudge" for changing behavior is impacting people and society, by making many more people, including those who are "unconcerned about health," to be more health conscious. The strength that our 40,000 face-to-face channel representatives demonstrated when fulfilling their role of giving a "nudge" and the success of initiatives, including this one, leading to an increase in new policies can be seen as a response to the Group's business direction.

Going forward, we want to raise efforts to provide value that leads to health promotion in every possible way, including our products and services themselves as well as these kinds of initiatives, in order to solve social issues such as extending healthy lifespans and reducing medical expenses.

Four Values Offered: 4. Connections

The Dai-ichi Life Group is leveraging its strengths in the life insurance business all over Japan and helping improve quality of life by building communities that are easy to live and work in through the provision of various "connections" and "opportunities to connect" in each region. By utilizing our strength of being the only Japanese life insurance provider that has established collaboration agreements with all 47 prefectures in Japan, we are launching initiatives that tackle various issues affecting each region, such as taking care of the elderly, supporting child raising, and vitalizing business and industry, by working with local authorities.

We are also using our real estate around Japan to encourage the creation of childcare facilities, enabling us to collect an income from real estate while at the same time helping to promote the participation of women in the workplace and supporting child raising. We have successively expanded facilities with the aim of providing places for 2,500 children, about 10% of the number who were on waiting lists for childcare facilities in 2011, and currently we are able to accept 1,615 children.

Improving Quality of Life by Solving Social Issues and Realizing Group Sustainable Growth

In this way, the Dai-ichi Life Group is raising its efforts to provide these four values to improve quality of life for diverse lifestyles of our customers. In addition to playing our conventional role in complementing social security systems, we will also contribute to solving social issues, including ensuring stability in the lives of citizens, extending healthy lifespans and asset longevity, and ensuring the sustainability of communities.

As a life insurance company we will manage the premiums from policyholders by engaging in ESG investment more actively so that it contributes to innovation, regional vitalization, and mitigating climate change.

In fiscal 2018, we took the first step toward realizing these initiatives and going forward we aim to further improve the value we provide through our business. As a result, we hope to further increase the support we receive from our customers and society, and expand our business foundation by reaching more customers in every country, leading to sustainable profit growth for the Group.

Also, all the values we aim to provide are based on the goals and targets of the UN's Sustainable Development Goals (SDGs), so we think that our business activities will contribute to realizing the SDGs.

And in order to continue being recognized by customers and societies as a company with our mission of "By your side, for life" and contributing to improving quality of life, we need to further improve every aspect of our customer-first business operations. However, there are some challenges in this aspect as well. Namely, we have received reports from some customers that foreign exchange risk was not sufficiently explained when they purchased foreign-currency denominated savings-type products, and requests to treat our elderly customers with greater care when they sign up for policies.

The Dai-ichi Life Group is taking this situation seriously and we are advancing with improvement measures, such as enhancing our explanations from customer's perspective and verifying whether our explanations are effective. However, there are no end goals to our customer-first initiatives. Going forward, we will strive continuously to consider customer's perspective and ensure that the Group's value creation serves for "pursuing what's best" for each individual customer.

Medium-Term Management Plan, CONNECT 2020:

Progress in Fiscal 2018Open

Our current medium-term management plan, CONNECT 2020, is focused on improving quality of life. We will increase connections with a greater number of customers and communities and realize growth for the Group by strengthening connections with Group companies in Japan and overseas and with outside business partners, while at the same time increasing the value of our products, services, and channels.

In Japan, we further developed our multi-brand, multi-channel approach by enhancing the mutual distribution of products within the Group and expanding the agent channel. Also, new products introduced in 2018 are contributing to improved business results.

In emerging markets overseas, as a result of concentrating on business growth focused on the top line in each country, we have expanded our contribution to providing stability in our customers' lives through life insurance. For example, Dai-ichi Life Vietnam has grown to become the top foreign-affiliated life insurance company based on first year premiums. Also, Protective in the U.S. and TAL in Australia have expanded their business foundations through M&A, and we can expect them to make greater contributions to profits going forward.

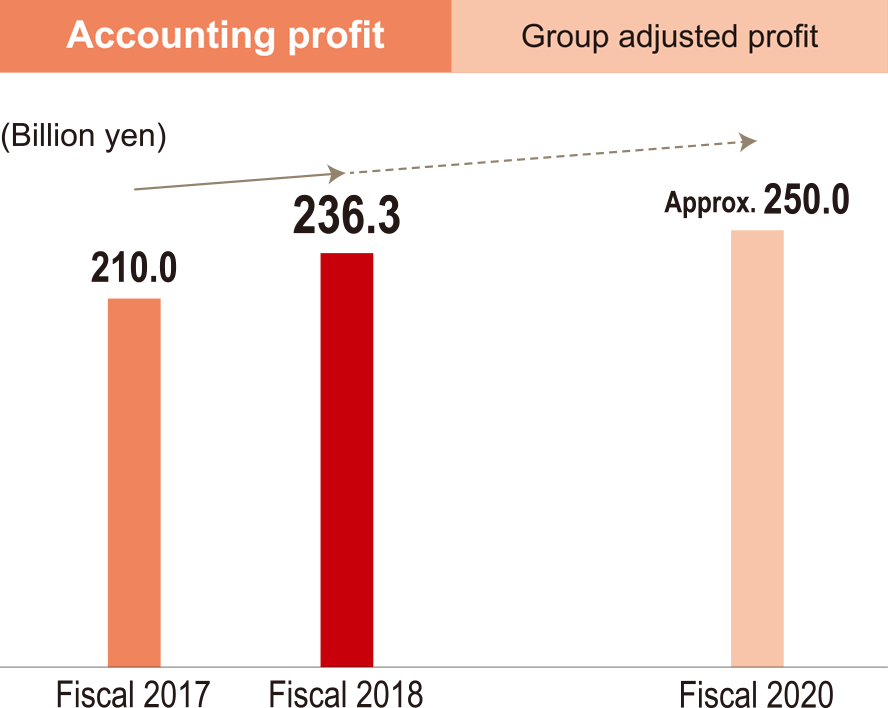

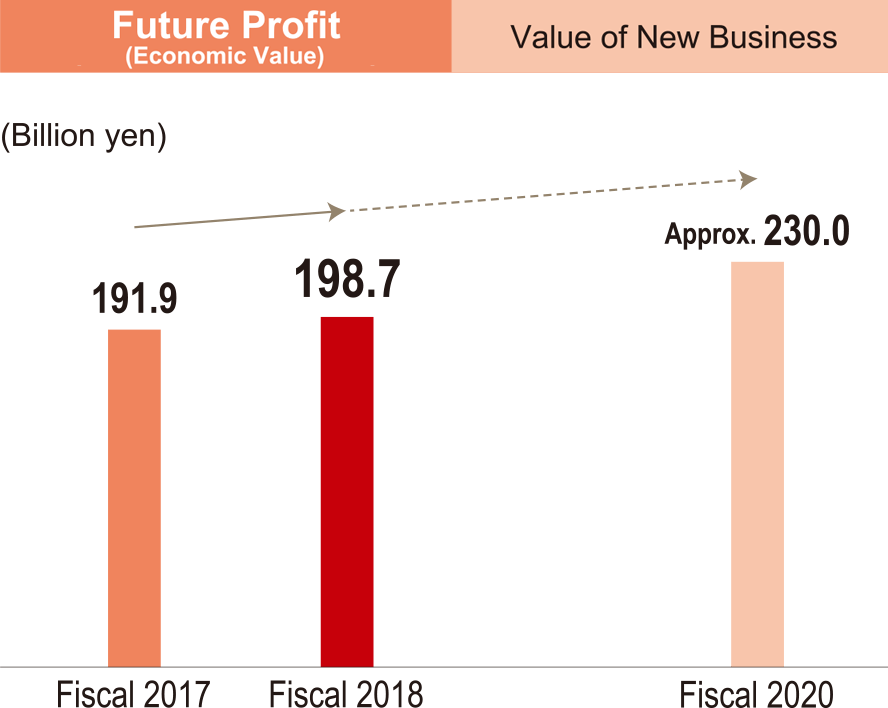

As a result of these initiatives, in fiscal 2018, the first year of the medium-term management plan, progress was generally smooth.

In addition to exceeding the Group's adjusted profit forecast of 236.3 billion yen, we also increased the value of new business, an indicator for future profits, year on year to 198.7 billion yen. We will continue to hone our ability to create value by contributing to quality of life in Japan and overseas and aim to achieve our targets in fiscal 2020.

In ClosingOpen

Heading toward a rapidly changing future, each Dai-ichi Life Group employee, both in Japan and overseas, must demonstrate their spirit of innovation so we can apply our collective strengths to "pursue what's best." We will aim to realize sustainable growth by being "By your side, for life" to improve customers' quality of life and contribute to solving social issues.

Last but not least, I would like to thank everyone sincerely for your continued support for the Dai-ichi Life Group.