Strengths of the Dai-ichi Life Group

Strengths of the Dai-ichi Life Group

that Drive Sustainable Value Creation

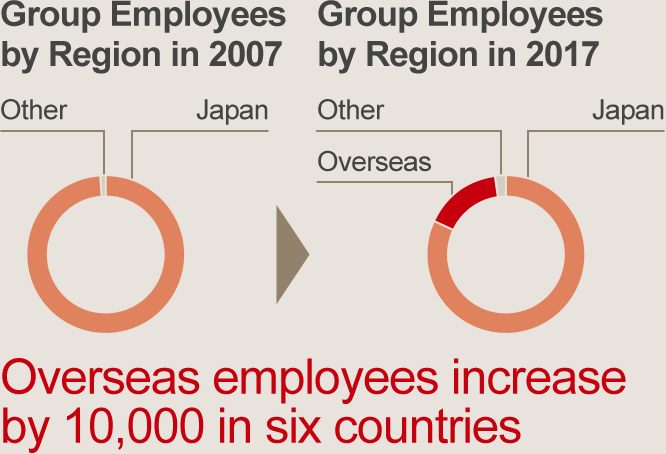

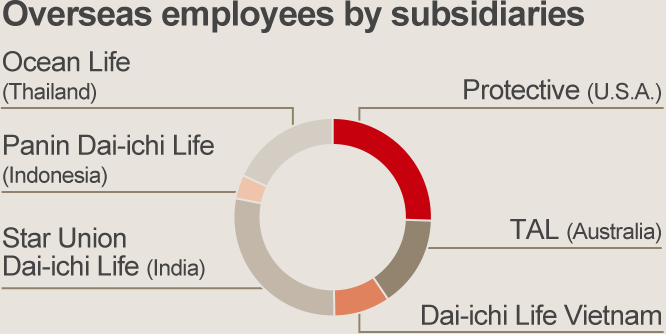

Diverse Talent

Diverse Talent

Human Capital

Our “customer first” philosophy and “spirit of innovation” are passed on to 70,000 employees with diverse talents

“High Expertise” and “Extensive Experience”

Deep knowledge and experience in the field of life insurance and financial services

*Founded in 1927, Million Dollar Round Table (MDRT), The Premier Association of Financial Professionals(r), is a global, independent association of more than 62,000 of the world's leading life insurance and financial services professionals from more than 500 companies in 69 nations and territories. MDRT members demonstrate exceptional professional knowledge, strict ethical conduct and outstanding client service. MDRT membership is recognized internationally as the standard of excellence in the life insurance and financial services business. For more information, please visit mdrt.org.

Knowledge and experience

in asset management

Knowledge and experience

in concluding M&A deals

Firm Business Foundation

Firm Business Foundation

Social and Relationship Capital

Developed into a well-known brand through a history of over a century

Various relationships with customers around the world

Intellectual Capital

Sizable amount of medical big data

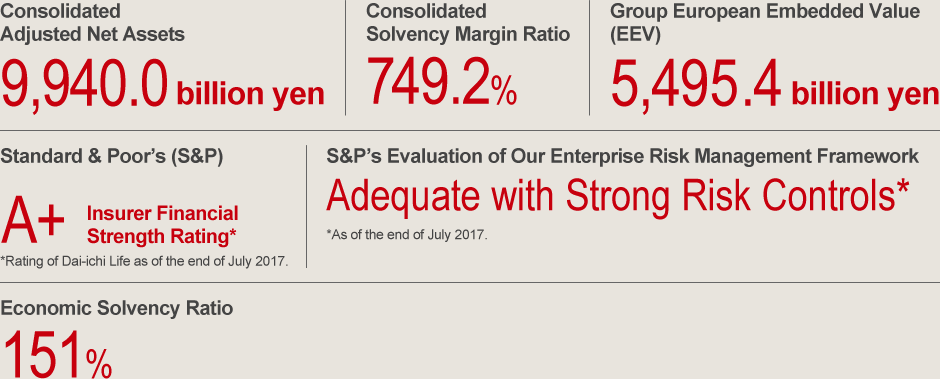

Sound Financial Position

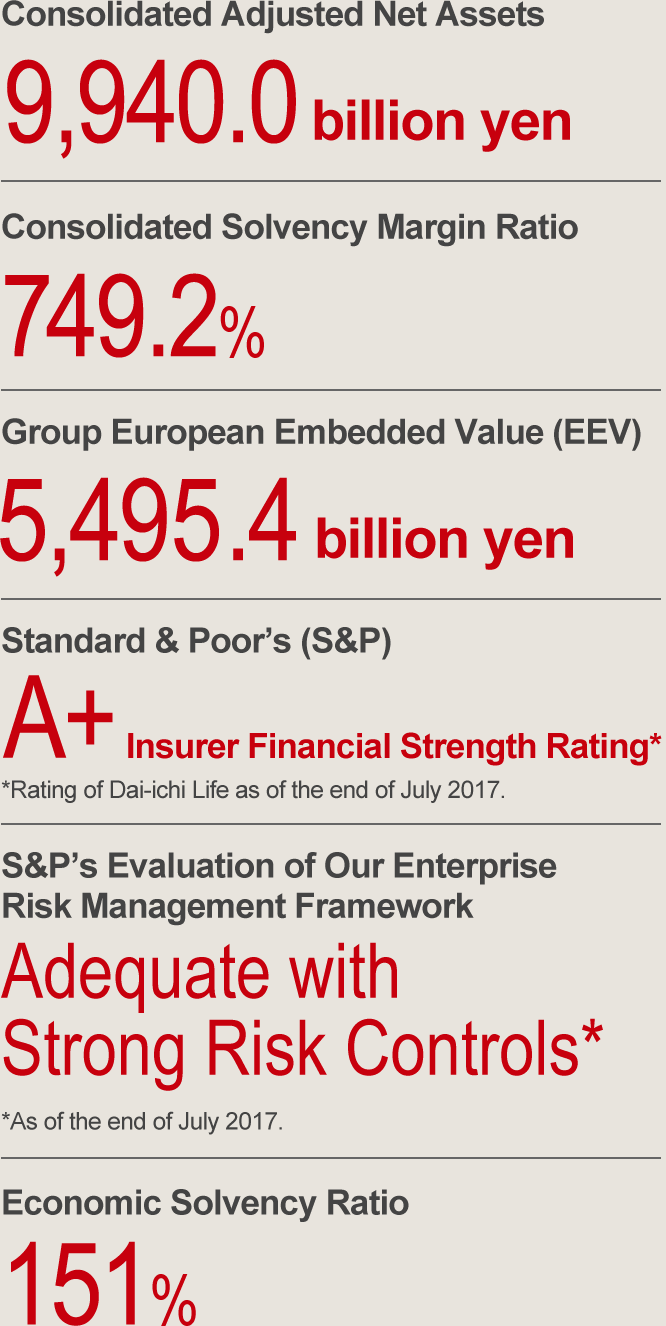

Sound Financial Position

Financial Capital

A sound financial position sufficient to accept risks of our customers

What is the Economic Solvency Ratio?

The Dai-ichi Life Group calculates the economic solvency ratio (ESR) and utilizes it in enterprise risk management. ESR reflects the market value of assets and liabilities by taking into account factors such as recent interest rates and is an indicator of capital adequacy against certain levels of stress. It is expected that the international capital standards for insurers, currently under consideration, will be based on economic value.