Please elaborate on the Dai-ichi Life Group’s management strategies and capital policies under the low-interest-rate environment.

Please elaborate on the Dai-ichi Life Group’s management strategies and capital policies under the low-interest-rate environment.

Management Strategies

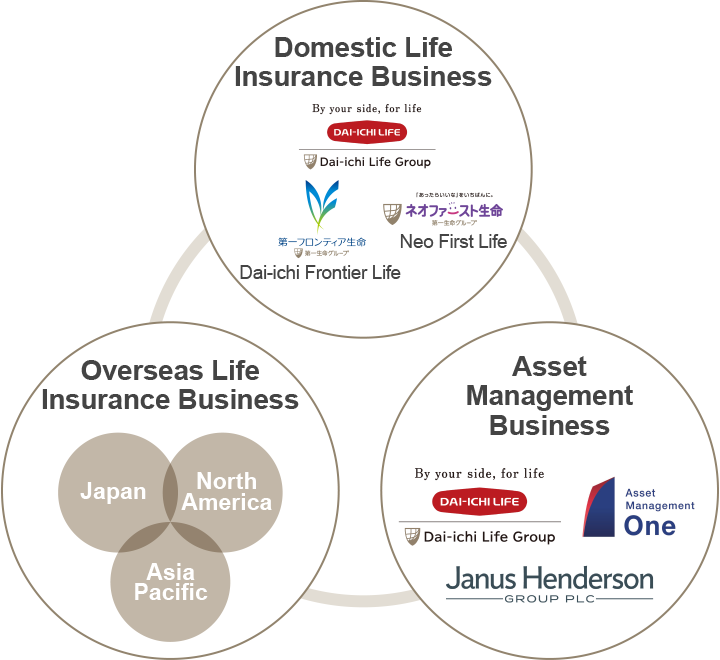

Starting from the medium-term management plan, D-Ambitious, the Group continues strengthening the domestic life insurance business, overseas life insurance business and asset management business, acknowledging them as the three growth engines of the Group.

The Group’s growth strategy based on the three growth engines stands firm despite the headwinds for the domestic life insurance business, namely, sales of insurance policies and asset management on the back of persistently low interest rates, strengthened further with the introduction of a negative interest rate policy by the Bank of Japan from 2016. Rather, as the Group has pursued diversification in its fields and regions of business. I would say we are capable of controlling the headwinds. For example, the profit contribution from the overseas life insurance business increased significantly for the first two years of the management plan. The profit contribution from asset management business is expected to grow as two Group companies develop further access to markets in Japan, the United States and Europe. In the domestic life insurance business, we are managing core insurance profits, by maintaining wide range of products and services to cater to the needs of our customers, as well as investment profits, by developing sophisticated investment strategies. The Group is set to accelerate its growth by taking advantage of its shift to a holding company structure, making sure the capital is strategically allocated and agile management decisions are made. On top of the developments in existing businesses, the Group is aggressively developing its InsTech initiatives with partners from various backgrounds in order to tackle rapid and significant changes in the business environment and diversified customer needs.

Three Growth Engines

Capital Policies

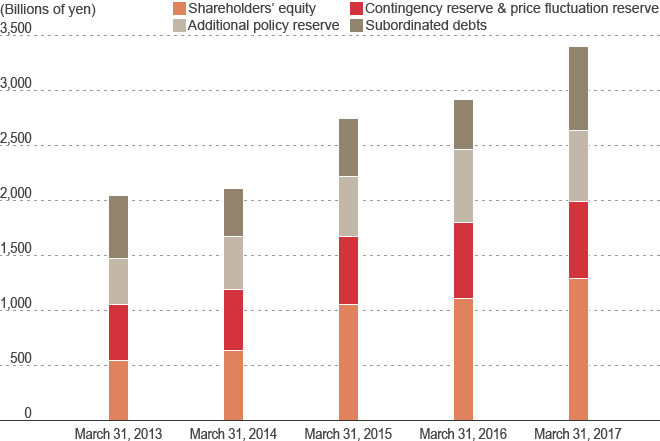

The Dai-ichi Life Group practices enterprise risk management (ERM). ERM is a means of realizing improved capital efficiency and enhanced corporate value by allocating capital to businesses that promise higher profits, while ensuring financial strength by appropriately controlling risk.

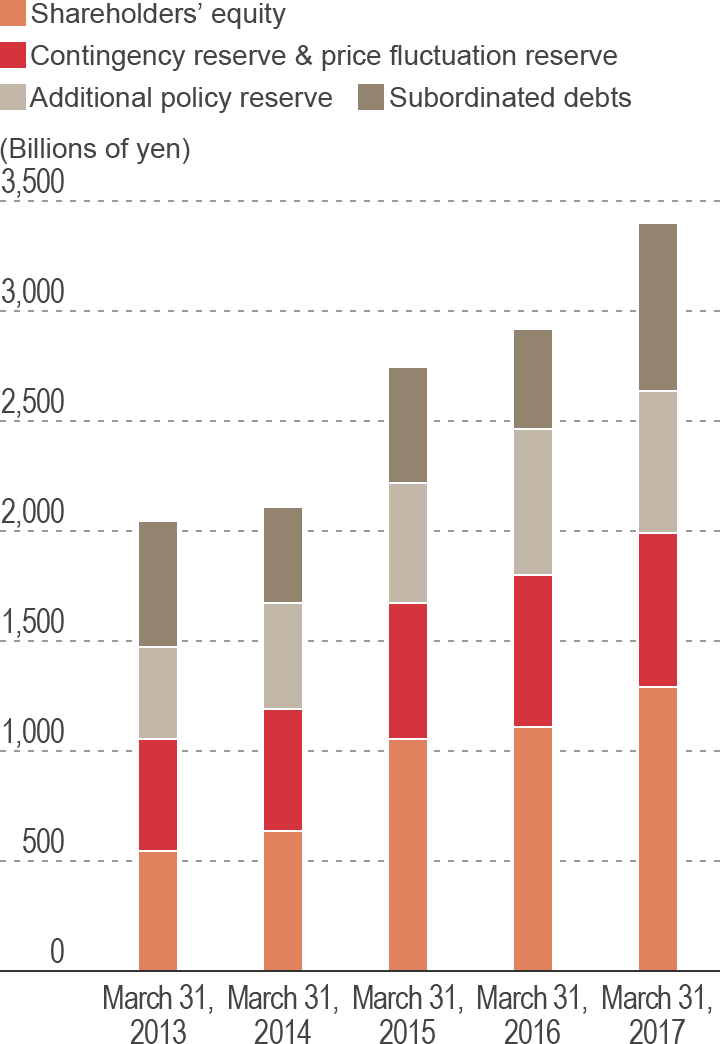

During the fiscal year, Dai-ichi Life led the Group-wide initiative to manage interest rate risk with financial derivatives, controlling the sale of single-premium savings-type products and revising the discount rate applied to prepaid premiums. While the Group companies concentrated on improving the capital position by building cash flow from core businesses, Dai-ichi Life issued 2.5 billion US dollars in perpetual subordinated notes in July 2016, contributing to an improvement in the financial soundness of the Group.

The Group is committed to improving capital efficiency and corporate value in order to meet the expectations of stakeholders by building an optimal business portfolio and by improving the profitability of each business. In light of the headwinds in economic and financial markets, the Group continues to enhance initiatives based on the ERM framework and improve financial soundness in view of possible regulations for internationally active insurance groups.

Capital Base of the Dai-ichi Life Group

Why did the Group change targets of the medium-term management plan?

Why did the Group change targets of the medium-term management plan?

Since the start of D-Ambitious in April 2015, the Dai-ichi Life Group has implemented initiatives building on its three growth engines, while strengthening the management and governance structure to support growth. During the period of the plan, the business environment went through a series of unexpected events, including monetary policy changes in Japan, and a referendum on EU membership in the United Kingdom. The Group reacted to the changes in the environment in a timely manner, controlling investment risks and increasing contributions from the overseas life insurance business, and the bottom line of the Group improved significantly compared to the previous medium-term management plan.

Having said that, the progress in some of the KPIs of the plan were affected because of the above financial conditions and factors outside our original assumptions, such as persistently low interest rates and a stronger yen against the US dollar. The Group believes it is not in the interest of the stakeholders to overreact to short-term fluctuations in the financial market, as it could lead to a negative spiral where excessive risk control affects the Group’s ability to grow and generate earnings in the long run. In order to maintain positive initiatives on medium- to long-term growth strategies, the Group adjusted the KPIs of D-Ambitious, such as RoEV, the economic solvency ratio*1 and accounting profit.

Economic value indicators such as embedded value and the economic solvency ratio based on current economic conditions, which we believe are at an extreme level, assume that conditions stay the same well into the future and thus they put us in a difficult position if we have to offset the impact only through the underwriting of new insurance policies. The background of the targets reflects our belief that the Group will make it the highest priority to achieve capital efficiency above the cost of capital and improve the economic solvency ratio over the long term. So the Group considers these KPIs part of a medium- to long-term vision rather than as targets in three years. The significant changes in interest rates and foreign exchange rates caused us to revise our financial guidance for the fiscal year ending March 2018. On top of that, the Group took advantage of its transition to a holding company structure to redefine shareholder return indicator to group adjusted profit*2 in order to better reflect the result of cash flow management among the Group.

The Group strives to achieve sustainable growth rather than reacting to short-term fluctuations in economic conditions.

- *1 The Dai-ichi Life Group calculates the economic solvency ratio (ESR) and utilizes it in enterprise risk management. ESR reflects the market value of assets and liabilities by taking into account factors such as recent interest rates and is an indicator of capital adequacy against certain levels of stress. It is expected that the international capital standards for insurers, currently under consideration, will be based on economic value.

- *2 Please refer to Question 3 in the next page for details of group adjusted profit.

Group Medium- to Long-term Vision

| Average EV Growth (RoEV) | Aim for average RoEV of over 8% during the medium- to long-term time frame |

|---|---|

| Economic Solvency Ratio (ESR) | Aim for 170%–200% during the medium- to long-term time frame |

Group Management Objectives (Quantitative Targets)

| Group In-force Annual Net Premium | Increment of 9% from March 2015 (as of March 2018) |

|---|---|

| Group Adjusted Profit | 180 billion yen in fiscal 2017 (modified definition) |

| Total Payout Ratio Based on Group Adjusted Profit | 40% during D-Ambitious |

Please comment on your shareholder payout policy after the transition to a holding company structure.

Please comment on your shareholder payout policy after the transition to a holding company structure.

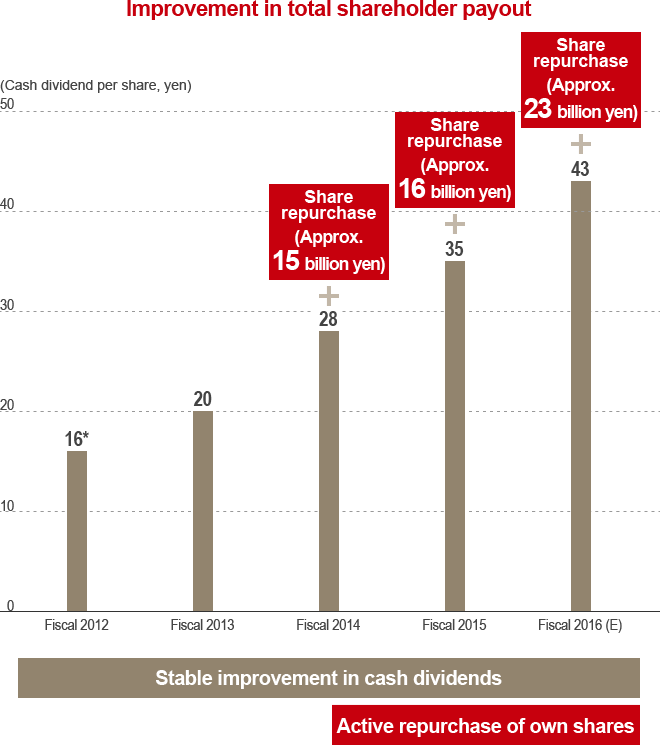

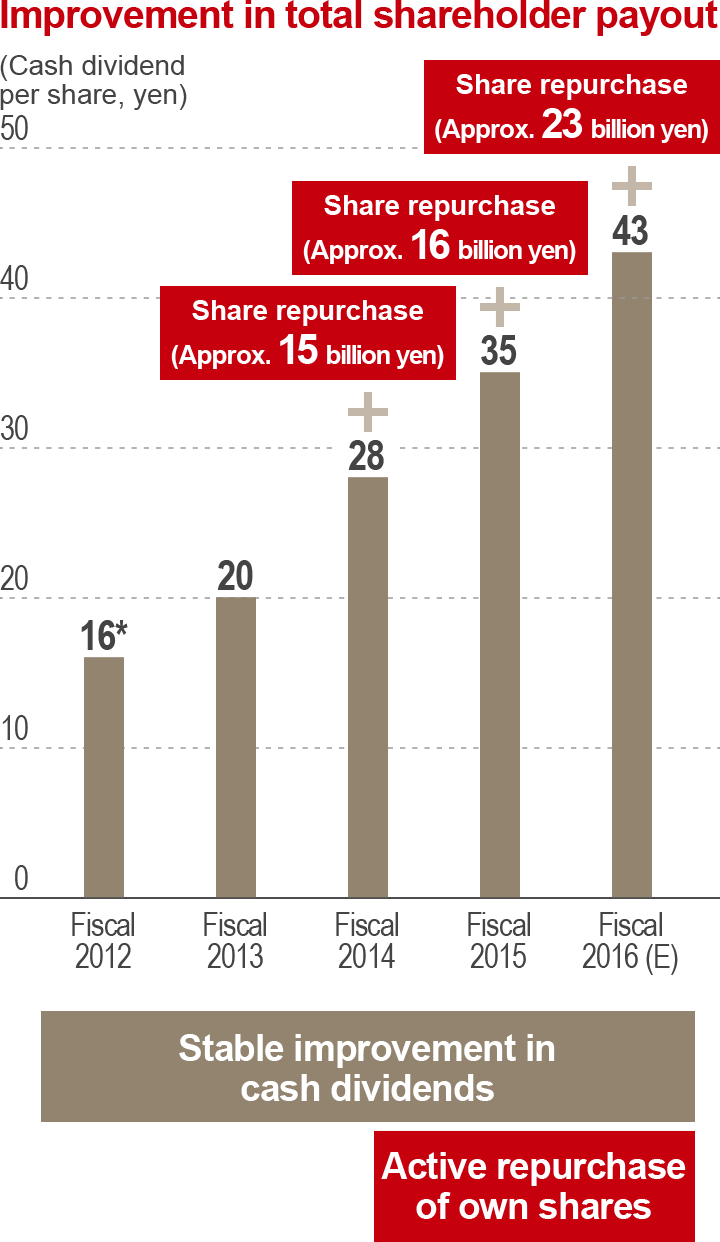

Shareholder payout for the fiscal year ended March 2017 comprised a 43-yen-per-share cash dividend, an increase of 8 yen against previous year, and the repurchase of our own shares of up to 23.0 billion yen if completed as announced on May 15, 2017, representing an expected total shareholder payout of 35%. This represents the fourth consecutive year of increases in cash dividends and the third consecutive year of stock repurchases. The Group is committed to achieving a 40% total shareholder payout during the current medium-term management plan through the combination of stable cash dividends and share repurchases, taking into account financial results and the status of capital.

Shareholder payout for the fiscal year ended March 2017 was based on a revised definition of profit available for shareholder payout. As the Group went through a transition to a holding company structure, the Group decided to use the profit of Group companies with a cash backing as the basis of shareholder payout. The new indicator, “group adjusted profit,” makes an adjustment for non-cash accounting items such as amortization for goodwill, valuation gains or losses on change in equities or step acquisitions or the reorganization of Group companies.

With the transition to a holding company structure, the Group is reinforcing cash flow management within the Group. That will enable the Group to effectively allocate capital within the Group, supporting growth and improving capital efficiency. That, we believe, will lead to a better appropriation of profits and better meet the expectations of stakeholders.

Shareholder Payout History

*Adjusted for a stock split implemented on October 1, 2013.