Shareholder Return Policy

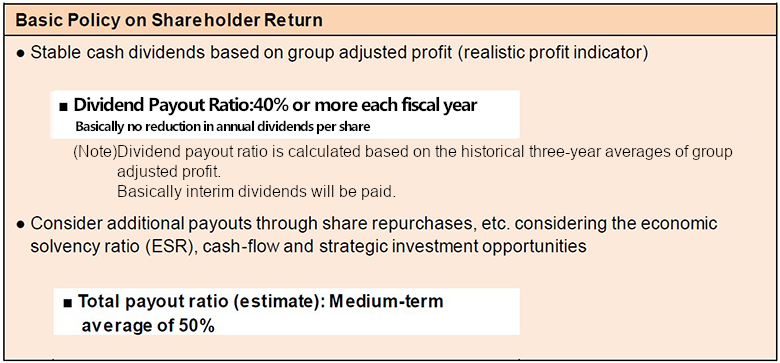

Our basic policy is to enhance our corporate value by balancing (1) the securing of our retained earnings, which are necessary to ensure financial security in order for us to be able to respond to future changes in the economic environment and to maintain our growth strategy and (2) appropriate distributions of profits to shareholders with consideration paid to our cost of capital.

- Note:

Total payout ratio = (dividends + stock repurchases) / (group adjusted profit)

Dividend History and Forecast

| Interim Dividend (per Share) |

Year-end Dividend (per Share) |

Annual Dividends (per Share) |

|

|---|---|---|---|

| Fiscal Year Ending March 31, 2026 |

24yen | 28yen (forecast) |

52yen (forecast) |

| Fiscal Year Ended March 31, 2025 |

15.25yen (61yen) |

19yen (76yen) |

34.25yen (137yen) |

| Fiscal Year Ended March 31, 2024 |

- | 28.25yen (113yen) |

28.25yen (113yen) |

| Fiscal Year Ended March 31, 2023 |

- | 21.5yen (86yen) |

21.5yen (86yen) |

| Fiscal Year Ended March 31, 2022 |

- | 20.75yen (83yen) |

20.75yen (83yen) |

| Fiscal Year Ended March 31, 2021 |

- | 15.5yen (62yen) |

15.5yen (62yen) |

- Note:

The Company conducted a 4-for-1 stock split of shares of common stock on April 1, 2025 and the dividends for the fiscal year ended March 31, 2025 and prior are shown taking such stock split into consideration. Figures in parentheses represent actual dividends before the stock split.