FY2018-2020 Overview of

the New Medium-term Management Plan

With the changes in the external environment and intensification of competition, Dai-ichi Life Group launched a new medium-term management plan, CONNECT 2020, from fiscal year 2018. This plan aims to leverage the Group's strengths and further reinforce and expand our business foundation. As a result, we will achieve growth by further enhancing each Group business by focusing on the CONNECT concept, and contributing to the improvement of the quality of life for all.

Strategic Direction

- • We will offer products and services using different distribution channels that help improve quality of life by building stronger relationships with customers, communities, and diverse business partners in a rapidly changing environment.

- • We will create unique synergies by leveraging our global network as a competitive advantage and nurture the growth of each group company by strengthening our ties within the group in an intensely competitive market.

The Four Aspects

That Express the CONNECT Concept

-

CONNECT better with customers

Deliver products

and services that

improve quality of life -

CONNECT deeper with communities

Address

social issues

through our business -

CONNECT with diverse partners

Expand

opportunities with

outside partners -

CONNECT tighter as a group

Further synergies

between

group companies

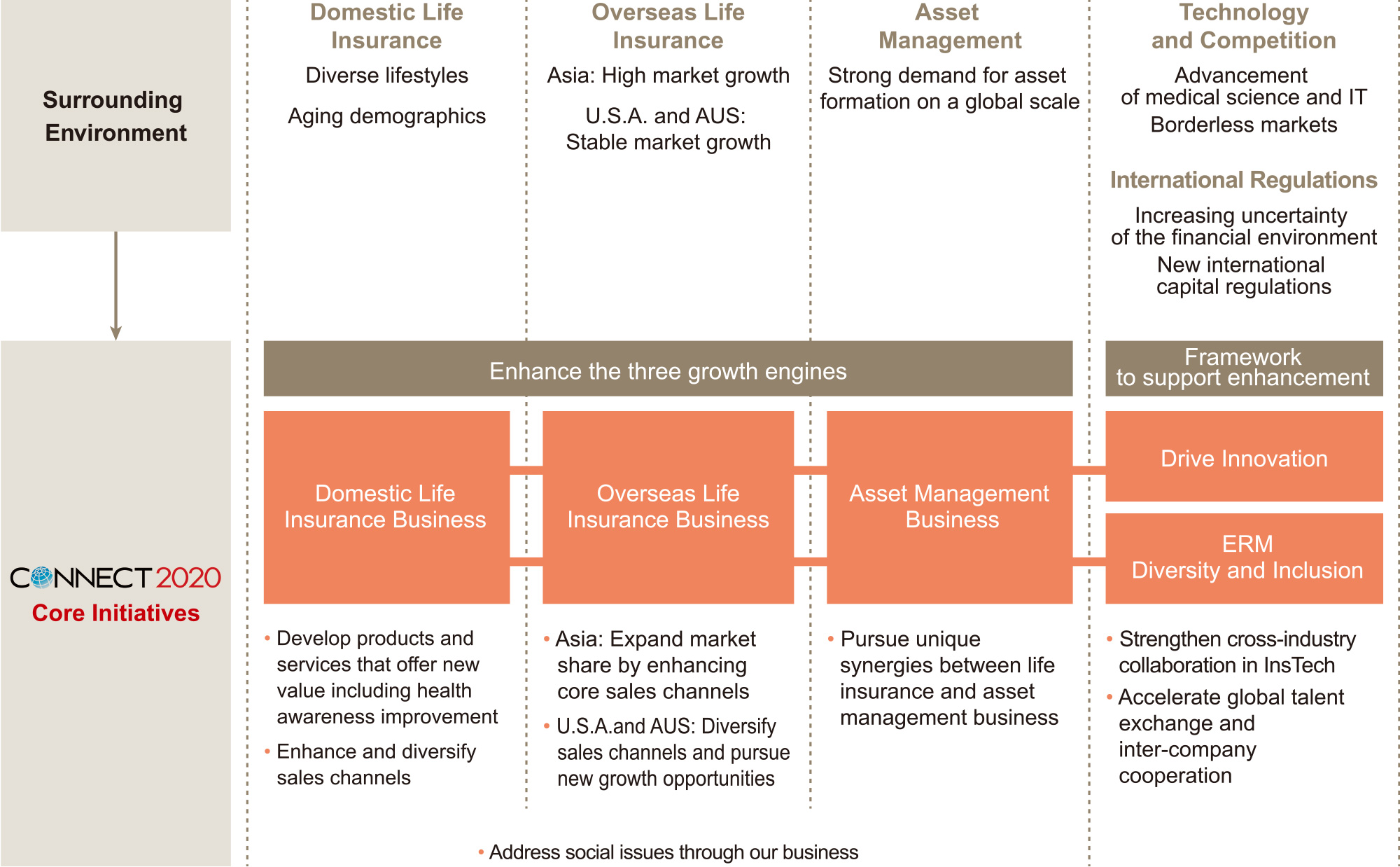

Surrounding Environment and

Core Initiatives

Under CONNECT 2020, we will further enhance the three growth engines that make up our strengths against changes in the surrounding environment through the core initiatives below.

Management Objectives and Medium- to Long-term Vision

Group Management Objectives

(Quantitative Targets)

| Indicators | Objectives | |

|---|---|---|

Group Management Objectives (Quantitative Targets) |

Accounting Profit Group Adjusted Profit |

250 billion yen in FY2020 |

Future Profit (Economic Value) Group Value of New Business |

230 billion yen in FY2020 |

Group Medium- to Long-term Vision

| Indicators | Targets for the Medium- to Long-term | |

|---|---|---|

Group Medium- to Long-term Vision |

Capital Efficiency Average EV Growth (RoEV) |

At least 8% average growth |

Financial Soundness Economic Solvency Ratio (ESR) |

170% to 200% range |