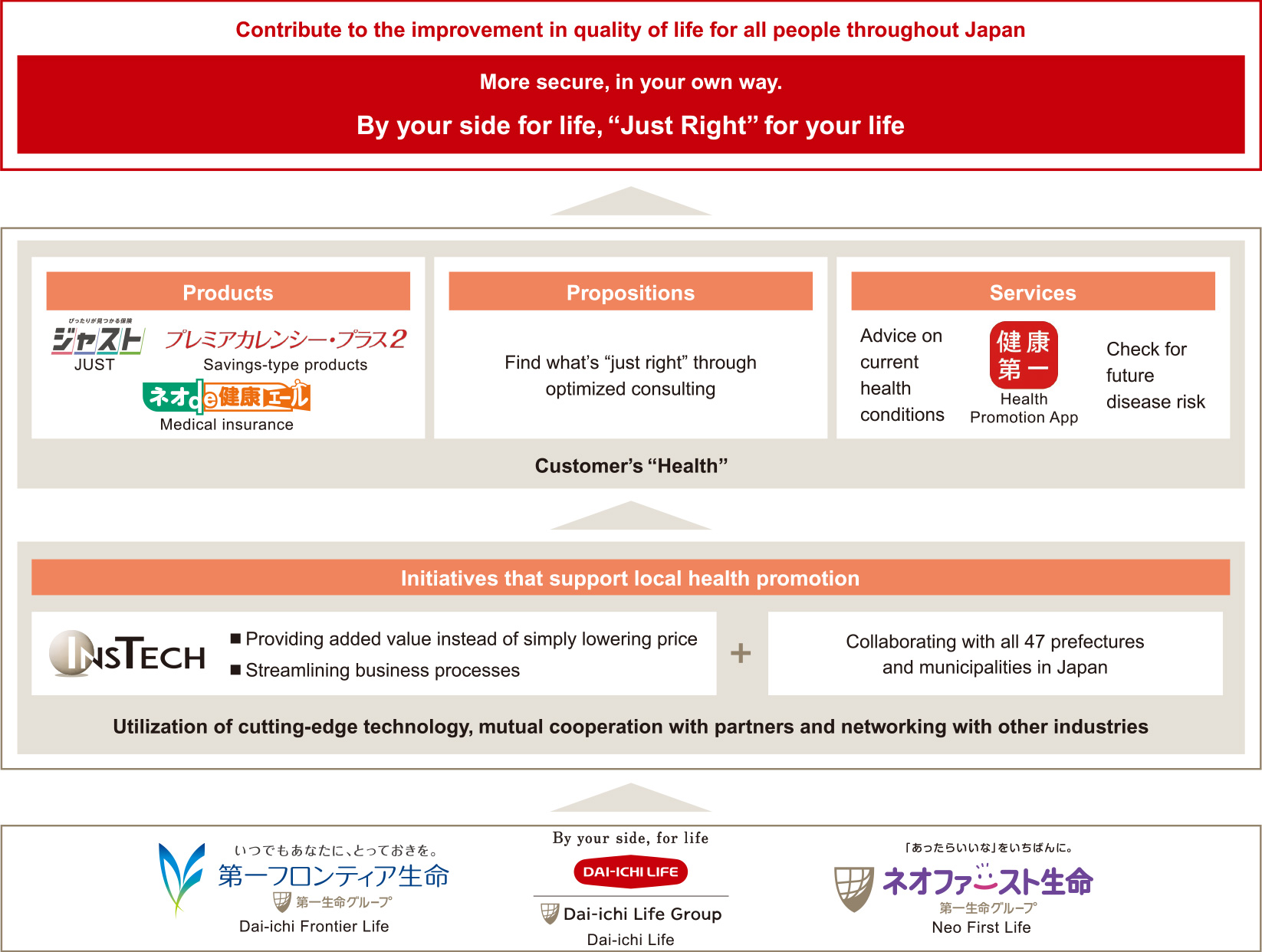

The environment surrounding the life insurance industry is changing dramatically due to such factors as the decline in the working age population, the advent of a super-aging society, the diversification in the lifestyles of customers, and technological innovation.

As we stand "By your side, for life" with our customers, the Group is building a multi-brand, multi-channel structure to deliver products and services provided by the three domestic companies, Dai-ichi Life, Dai-ichi Frontier Life, and Neo First Life, through the optimum channel (Total Life Plan Designers, banks, walk-in insurance shops, etc.) to respond quickly and accurately to the changing social environment and customer needs. Moreover, in order to provide customers with high-value-added products and services and to build an efficient administrative system, we are making Group-wide efforts to promote our highest priority management strategy, InsTech, which leverages cutting-edge technology.

Through these initiatives, we will continue to upgrade our products, propositions, and services to contribute to improvement in the quality of life for all people throughout Japan.

Where We Are and Our Strategy

in the Market

Initiatives to Improve Quality of Life

for All People

Reflecting on Our Previous Medium-term Management Plan,

"D-Ambitious"

Dai-ichi Life

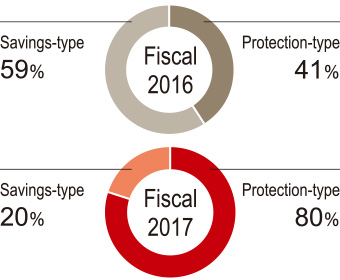

Dai-ichi Life worked to enhance the consulting capabilities of Total Life Plan Designers and to diversify sales channels through such means as increasing commissioned sales agents. In fiscal 2017, the year ended March 31, 2018, as a result of focusing on sales of protection-type products, there was a dramatic expansion in annualized net premiums from new third-sector policies, and these policies accounted for 80% of sales.

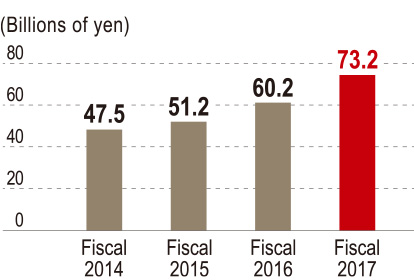

Annualized Net

Premium from New Third-Sector Policies (Dai-ichi Life)

Percentage Breakdown of Annualized Net Premium from New Policies (Dai-ichi Life)

Dai-ichi Frontier Life

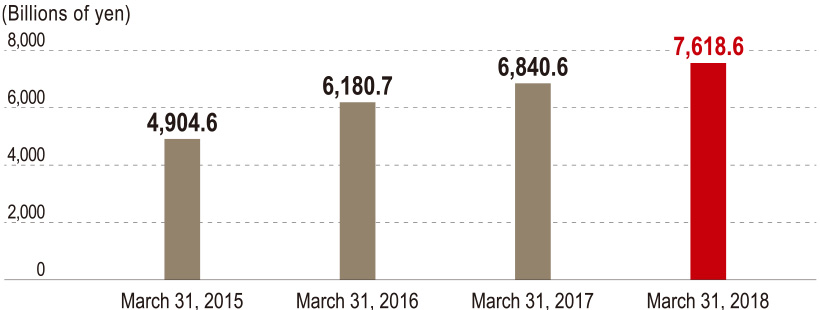

In addition to flexibly launching new products to meet diverse customer needs, including asset formation and inheritance, Dai-ichi Frontier Life worked to strengthen relationships with financial institution agencies and increased its number of product-commissioned agents. As a result of these efforts, policy amount in force steadily increased, and Dai-ichi Frontier Life established its position as a top runner in the financial institution over-the-counter sales market.

Policy Amount in Force (Dai-ichi Frontier Life)

Neo First Life

Neo First Life achieved steady growth by introducing distinctive products, such as a product with premiums that are based on the policyholder's Kenko Nenrei®* (Health Age) instead of actual age at the time of enrollment in the policy, and increasing the number of commissioned agents, such as banks and walk-in insurance shops. The number of new policies increased steadily, and policies in force topped 100,000.

* Kenko Nenrei (Health Age) is a registered trademark of JMDC Inc.

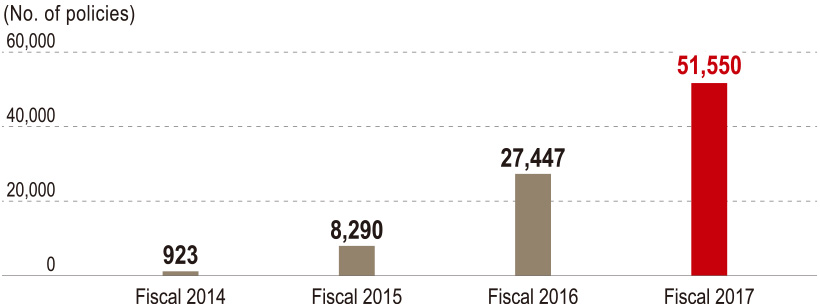

Number of New Policies (Neo First Life)