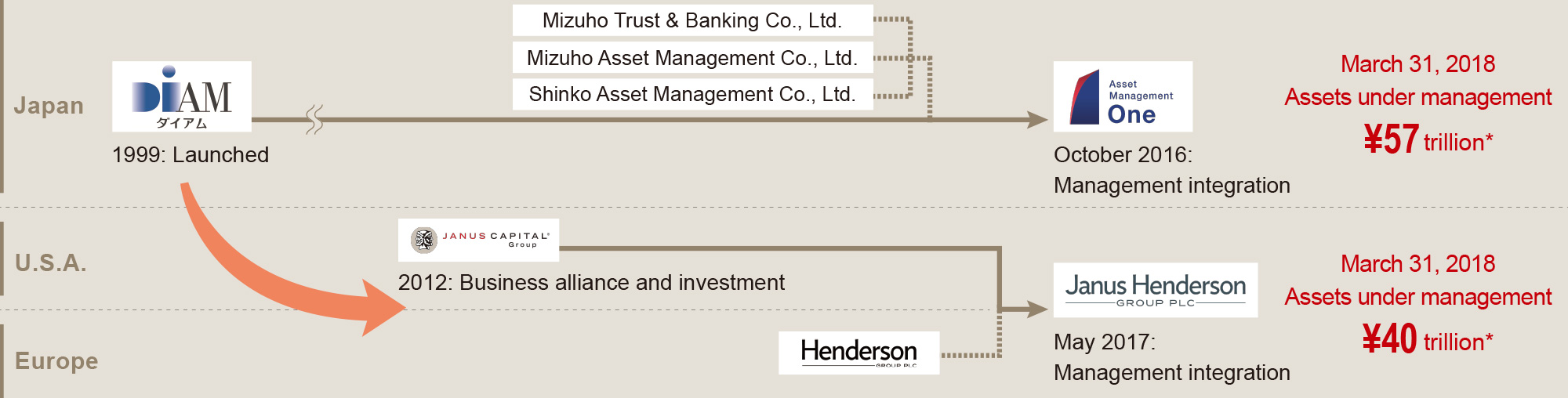

With the launch of Asset Management One and Janus Henderson, the asset management business at the Dai-ichi Life Group developed into a trilateral structure (Japan, the U.S.A., and Europe), which can benefit from the growth prospects in the world's leading markets.

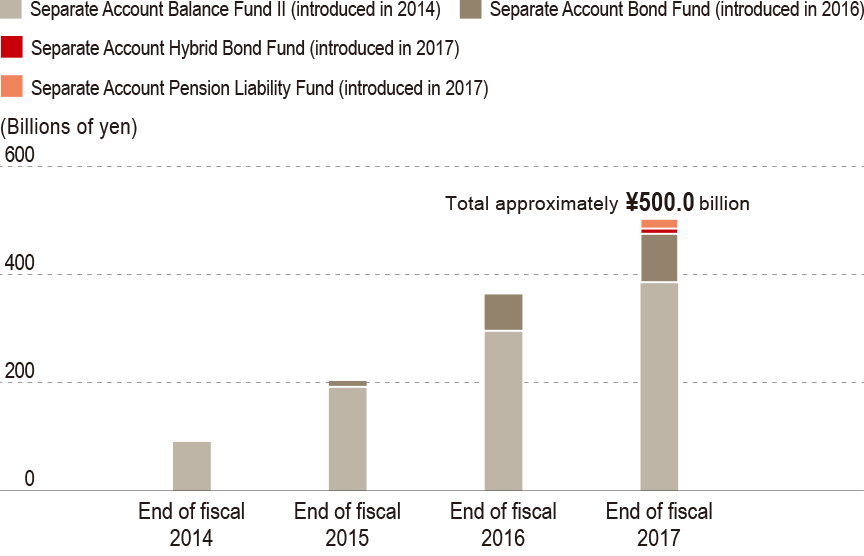

We also steadily expanded Group synergies, including increasing the provision of asset management capabilities to Dai-ichi Life and Dai-ichi Frontier Life and commencing the provision of asset management capabilities to Protective in the U.S.A. As an example of these synergies, assets under management in the separate account, co-developed by Asset Management One and Dai-ichi Life, have continued to increase steadily.

Where We Are and

Our Strategy in the Market

The asset management business at the Dai-ichi Life Group is carried out by Asset Management One, which we co-founded with Mizuho Financial Group in Japan, and Janus Henderson Group (Janus Henderson) in global markets, primarily the U.S.A. and the U.K.

The global asset management market is a huge market exceeding ¥9,000 trillion, and high growth in this market is expected to continue due to rising retirement needs in developed countries and economic growth in emerging countries.

Through its entry into the asset management business, the Dai-ichi Life Group aims to benefit from the high market growth prospects and high profitability of asset management companies. In addition, we are pursuing unique Group synergies by providing expertise and advanced asset management capabilities of asset management companies to Group life insurance companies in Japan and overseas, accepting funds for management, co-developing products and other efforts.

History of the Asset Management Business

* Total assets under management translated into yen using the exchange rate as of March 31, 2018

Reflecting on Our Previous Medium-term Management Plan, "D-Ambitious"

Trends in Assets under Management

(Dai-ichi Life, Separate Account Products)

"CONNECT 2020"

Strategies and Initiatives

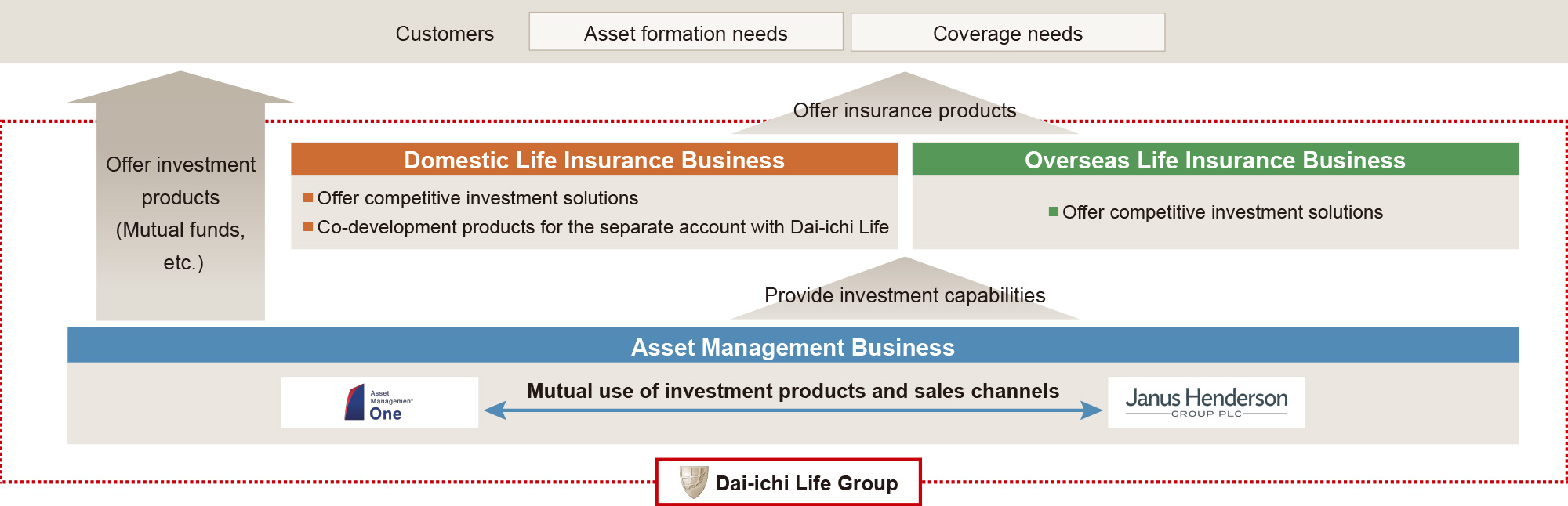

In anticipation of the completion of post-merger integration, Asset Management One and Janus Henderson, which were launched through their respective management integrations, will shift to the stage of achieving synergies from this integration and aim for profit growth going forward.

In May 2018, the Company completed the conversion of Janus Henderson into an affiliated company, and going forward we will continue to benefit from the high profit growth at both Asset Management One and Janus Henderson, and the two companies will expand their profit contribution to the Group.

We will also work to strengthen collaboration between the companies, including the mutual use of investment products and sales channels, the expansion of cross-selling of mutual funds, and the commencement of co-development of investment products. In addition, we will increase the provision of competitive asset management capabilities and solutions to Group life insurance companies in Japan and overseas, as we continue further accelerating initiatives aimed at Group synergies.

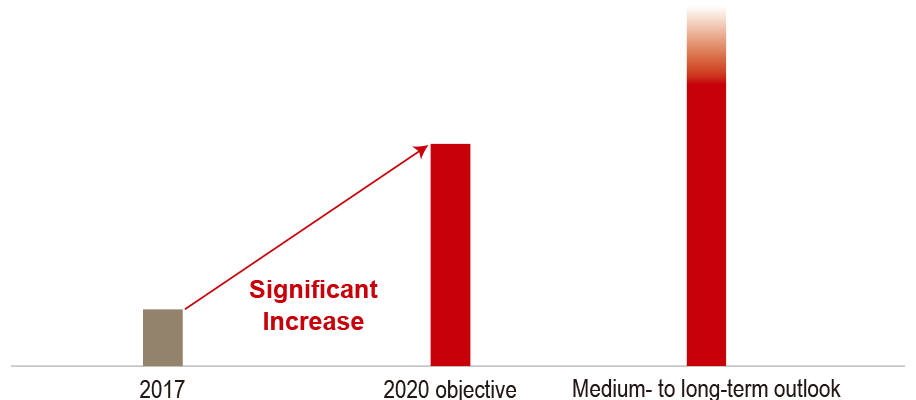

Accelerate Profit Contribution by Maximizing Integration Synergies

We expect a significant increase in the adjusted profit of the asset management business by maximizing integration effects, including the creation of Group synergies, to drive profit growth for the Dai-ichi Life Group as a whole. We will also aim for further growth over the medium- to long-term.

Adjusted Profit in the Asset

Management Business

Social Value We Create through Contribution to Improving Quality of Life

We will aim to increase the social value we create through meeting the needs of even more customers for asset formation, and contributing to improving quality of life by creating a stronger connection between the two companies in the asset management business and Group companies in the life insurance business in Japan and overseas.

Role of Asset Management Business

-

Sense of security

in later life -

Stability through

insurance