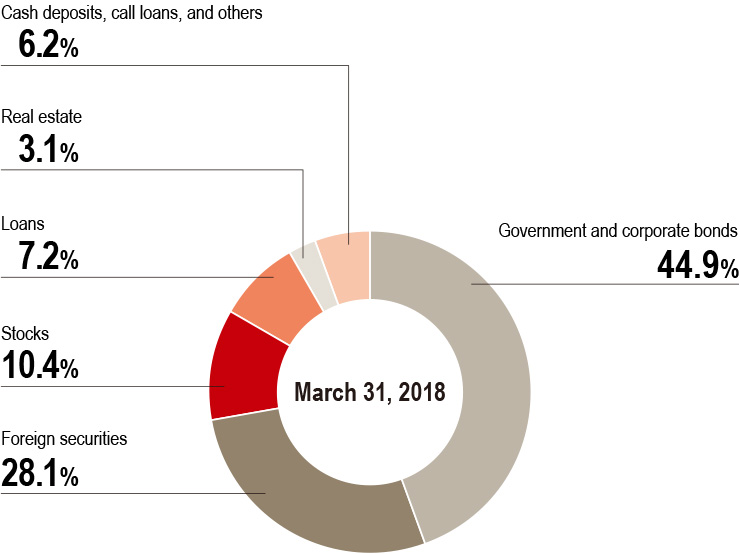

Dai-ichi Life conducts asset management with a focus on ALM based on the nature of its insurance policies (insurance liabilities), mainly investing in fixed-income assets in order to fulfill its obligation to pay out claims and benefits over a long period of time in a stable manner. We also strive to increase profitability by flexibly allocating capital to risk assets by taking market trends into account, but only after ensuring the soundness of these assets.

In addition, we are also focused on responsible investment as an institutional investor based on its social responsibilities. As part of these efforts, we carry out stewardship activities that aim to enhance the corporate value of investees and ESG investment* that balances social responsibilities and profitability.

* ESG investment: An approach to investment that considers environmental, social and corporate governance (ESG) criteria