Protective

High profit growth based on its unique business model of yielding synergies between retail and acquisition business

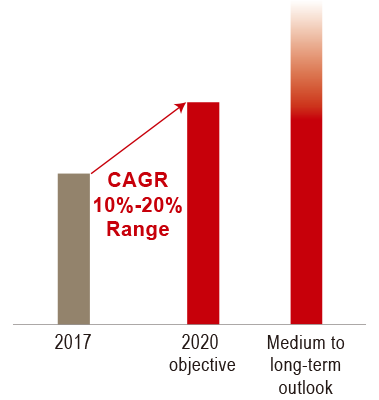

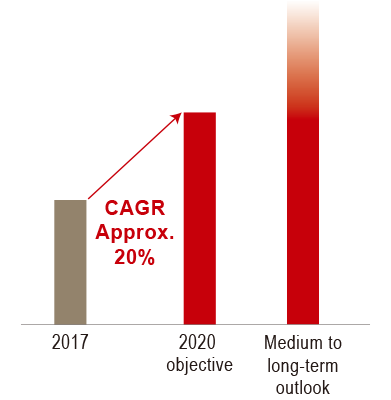

Protective operates its business across the U.S. and has achieved growth with a unique business model by which it generates capital through the retail business (life insurance and individual annuities) and expands its business by acquiring blocks of insurance business using the earnings from the retail business to realize sustainable growth.

Going forward, Protective will aim to further increase profit by strengthening and expanding new alliances and through new acquisitions.

Protective Business Model