In developed markets, such as North America, stable growth is expected through economic growth and other factors. Growth is expected to continue in the future for emerging markets in Asia and other regions due to high economic growth and increases in insurance penetration rates.

The Dai-ichi Life Group is building a portfolio in its overseas life insurance business that strikes a balance between stable contribution to profits in developed markets and positive impact of growth over the medium to long term in Asian emerging markets. The Group also strikes a balance between its growth strategy and capital policy through its efforts in ERM* that take into account the growth stage and capital level of each company while aiming for profit growth over the medium to long term.

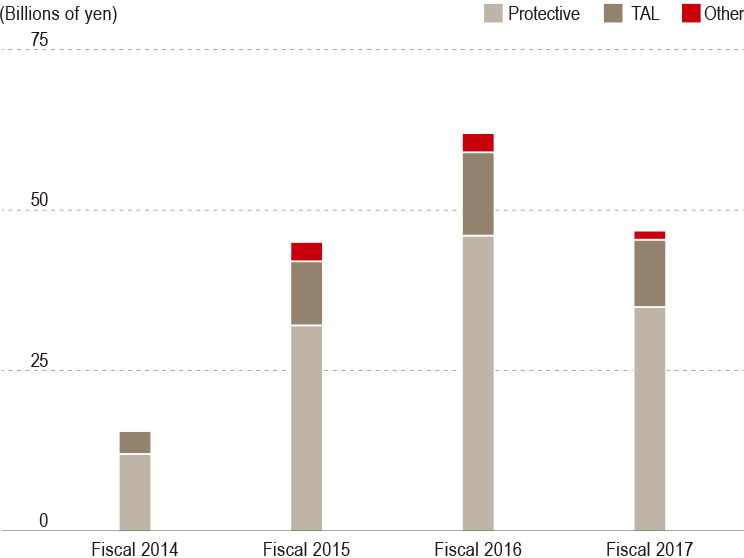

As a result of these efforts, the contribution of the overseas life insurance business to Group adjusted profit was approximately 20% in the fiscal year ended March 31, 2018.

* Enterprise risk management (ERM) is an effort to increase capital efficiency and corporate value by formulating strategies according to profits, capital, and risks, taking into account the types and characteristics of the risks.