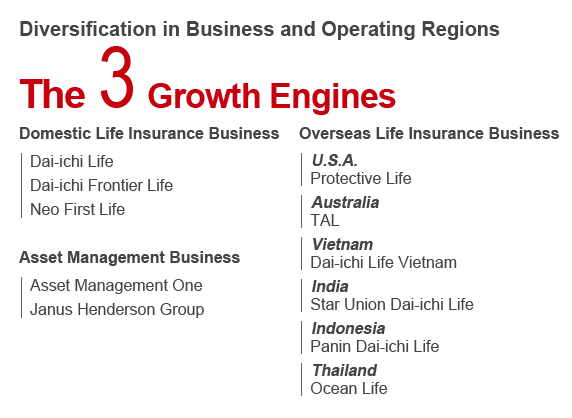

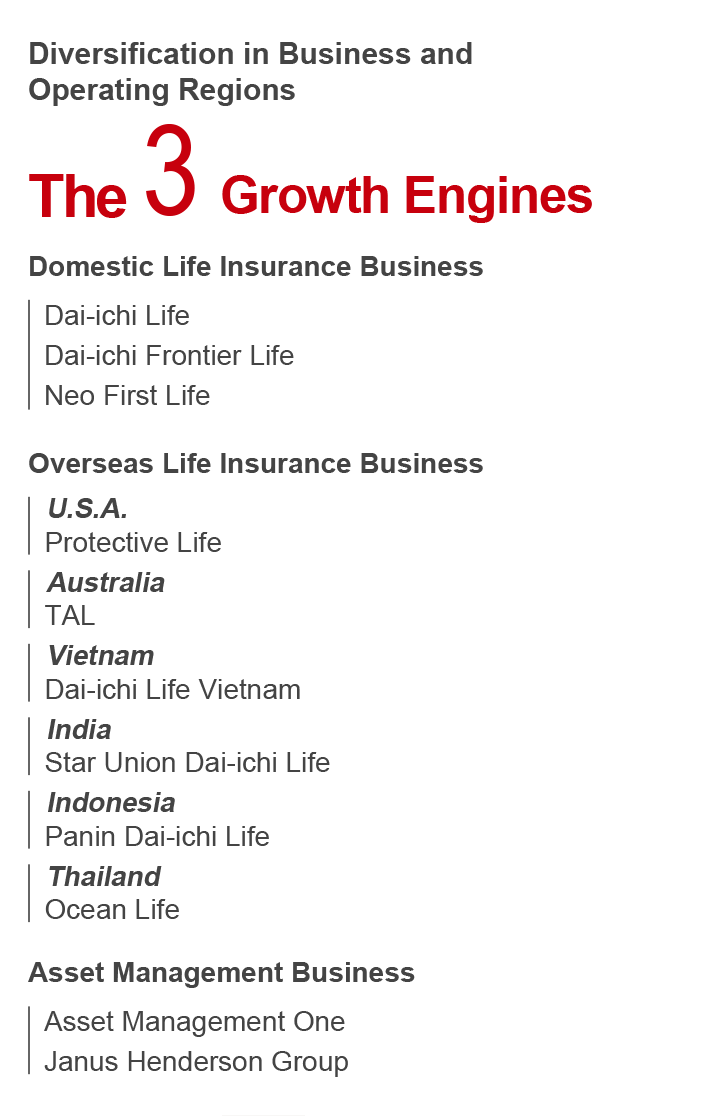

Since our founding in 1902, the Dai-ichi Life Group has never failed to put customers first while demonstrating the spirit of innovation as needed as time shifts and society changes. In recent years, we have formed partnerships with domestic financial institutions, expanded our life insurance business to overseas markets, become the first major life insurance company in Japan to go public, and last year we transitioned to a holding company structure. These initiatives represent our effort to transform ourselves to carry out our mission in the society, offering peace of mind to our customers as we stand “By your side, for life.” Moving forward, in a time of dramatic change and complexity, we continue to demonstrate the spirit of innovation in order to provide “Peace of mind. In communities and around the world.” And we continue to take on challenges, creating an ideal future for our customers by forging the future through innovation.

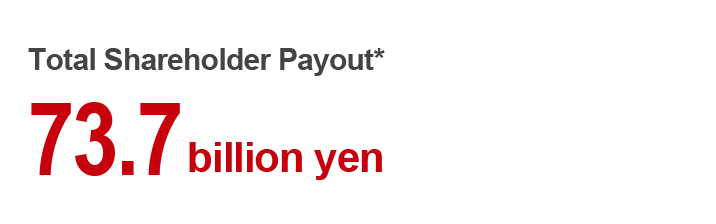

*Total shareholder payout includes the upper limit of the Company’s stock repurchase of 23.0 billion yen resolved by the Board of Directors on May 15, 2017.