As an institutional investor that manages roughly 3.5 trillion yen of Japanese stocks, Dai-ichi Life engages actively in stewardship activities that include dialogue with the companies it invests in and the exercising of voting rights. Through these stewardship activities, we encourage the companies we invest in to aim for sustainable growth, which helps to boost our equity investment return over the medium to long term.

In Fiscal 2017, Further Reinforced Our Stewardship Activities

Dai-ichi Life has always promoted responsible investments based on its social responsibilities as an institutional investor given the nature of the assets it manages as a life insurance company. Our responsible investments are based on stewardship activities that aim to enhance sustainable corporate value and ESG investment* that seeks to have both profitability and contribution to solving social issues stand together through providing funds.

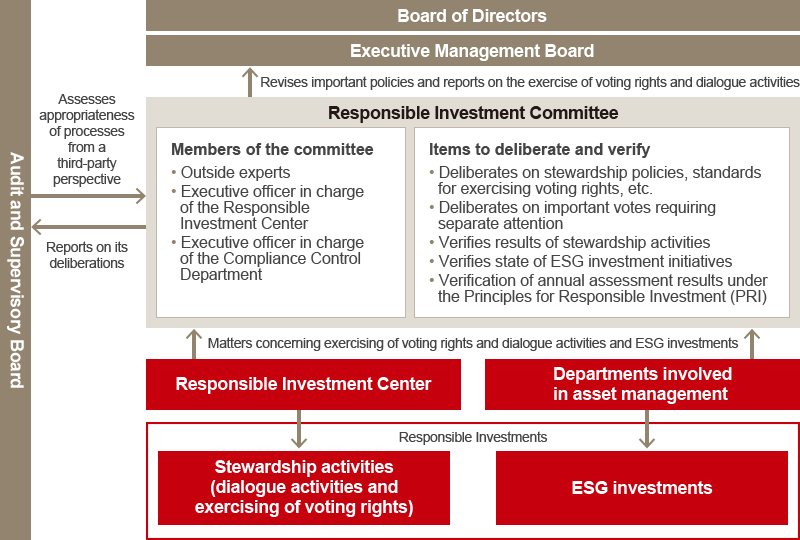

In fiscal 2017, we established the Responsible Investment Center as an organization dedicated to stewardship activities and we established the Responsible Investment Committee to discuss and confirm important policies regarding our stewardship activities.

Stewardship activities require expertise and experience with corporate governance, in addition to knowledge unique to each industry and financial analysis skills. Therefore, the Responsible Investment Center is staffed mainly with former equity analysts, people who have experience with venture investments and knowledge in a broad range of industries, and people with in-depth understanding of corporate governance who have served as outside directors for other companies.

More than half of the members of the Responsible Investment Committee consist of outside experts. The committee discusses and confirms policies and regulations on stewardship activities and makes decisions on whether or not to approve important issues, which helps to enhance the effectiveness of our stewardship activities.

*ESG investment: an investment method that considers the elements of environmental, social and corporate governance (ESG) when investing.

Progress of Stewardship Activities

- May 2014

- Announced support of Japan’s Stewardship Code

- November 2015

- Signed the UN Principles on Responsible Investment (PRI)

- April 2017

- Established the Responsible Investment Center and Responsible Investment Committee

- May 2017

- Established and released initiative policy for the revised version of the Stewardship Code (compliance with all principles and guidelines)

- July 2017

- Appointed two outside members to the Responsible Investment Committee

Implementation System for Stewardship Activities

Promoting Constructive and Purposeful Dialogue

Our stewardship activities emphasize constructive and purposeful dialogue from the standpoint of supporting the enhancement of corporate value and sustainable growth of the companies we invest in.

Themes of dialogue mainly include reinforcement of corporate governance, sustainable improvement of business performance and capital efficiency, and enhanced shareholder returns. Dialogue sessions with the companies we invest in mainly take place with the executive officer in charge of finance or management strategy. Some of the companies we have held dialogue with have since implemented measures aimed at enhancing corporate value, such as electing multiple independent outside directors, rebuilding unprofitable businesses and subsidiaries, and disclosing their capital policy.

Implementation Rate of Constructive and Purposeful Dialogue

| Fiscal 2015 | Fiscal 2016 | |

|---|---|---|

| Based on number of companies | 21% | 24% |

| Based on market value of held stocks | 62% | 82% |

Titles of Attendees

| Fiscal 2015 | Fiscal 2016 | |

|---|---|---|

| Directors and executive officers | 60% | 70% |

| General managers, etc. | 40% | 30% |

Exercising Voting Rights from the Perspective of Enhancing Medium- to Long-term Corporate Value

We exercise the voting rights on each investment from the standpoint of maintaining and enhancing medium- to long-term corporate value based on our dialogue with the company we have invested in, rather than making clear-cut and rigidly uniform decisions based solely on factors such as short-term business performance and the share price. However, voting rights are exercised following certain uniform criteria when it comes to important mechanisms on corporate governance. For example, we vote against proposals for the election of auditors who have had many years of tenure.

To enhance the transparency of the results following our exercising of voting rights, we disclose criteria used to determine which way to vote and in fiscal 2017 we began disclosing the results for each individual company and proposal.

Looking forward, as a responsible institutional investor, we will continue to engage actively in stewardship activities so as to encourage the companies we invest in to achieve sustainable growth and enhance medium- to long-term equity investment returns. At the same time, we will strive to contribute to vitalizing stock markets.