Special Feature: Post-Merger Integration at Protective Life

Post-merger Integration of Protective Life

Corporation Starting to Bring Various

Synergistic Effects

- Seiji Inagaki

President and Representative Director,

Dai-ichi Life Holdings, Inc. - Richard Bielen

President and Chief Executive Officer,

Protective Life Corporation

The Dai-ichi Life Group has been working on the post-merger integration (PMI) with Protective Life Corporation since acquiring the company in 2015. Seiji Inagaki, president and representative director of Dai-ichi Life Holdings, Inc., and Richard Bielen, president and chief executive officer of Protective Life Corporation, recently sat down to discuss the results from Protective Life Corporation joining the Dai-ichi Life Group as well as the Group's future growth strategy.

Aiming for growth in global markets together as partners

who share common values

Inagaki

Japan's life insurance industry finds itself in a challenging business climate given the acceleration in the country's declining birthrate and aging population and ongoing low-interest-rate policy. Dai-ichi Life has actively worked on diversification in business and operating regions, with the aim of further reinforcing our business foundations. Over the past 10 years, we have established a three-pronged life insurance group in Japan after opening Dai-ichi Frontier Life and Neo First Life. At the same time, we have expanded our operations in the Asia-Pacific region with an eye on growing to become a truly global group of companies.

A major milestone in our overseas expansion was our entry into the U.S. market, which is the largest life insurance market in the world. Due to the intense competition in this market, it was extremely challenging for the Dai-ichi Life Group to establish a business foundation that fits the Group's strategy. Given this situation, we looked at Protective Life Corporation as a candidate partner, which offers an excellent business model in terms of originality and strategy, not to mention it has a history of more than 100 years in the U.S. life insurance industry.

Bielen

The approach from Dai-ichi Life about an acquisition was also welcomed by Protective. While we had been a publicly traded company for many years and both our management team and employees have a wealth of experience, we recognized that joining a worldwide financial group would make us financially stronger. We also saw value in being backed by a strong brand.

In terms of corporate culture, too, there are many aspects that resonate with us. As with Protective, Dai-ichi Life is a life insurance company with more than 100 years in the business, and its management focuses on a long-term perspective. Dai-ichi Life's long-standing "customer-first" management philosophy and commitment to be "by your side, for life" and provide customers with long-term security and peace of mind resonated with Protective's management team.

Inagaki We welcomed Protective to the Dai-ichi Life Group as a subsidiary in 2015, and I feel like the PMI process has gone very smoothly.

Bielen This is because Protective saw from the very beginning that we were welcomed openly as a new member of the Group; not purely as an investment vehicle for Dai-ichi Life. Since becoming a member of the Group, Protective has seen a number of new growth opportunities emerge.

Various synergistic effects giving rise

to new growth platforms

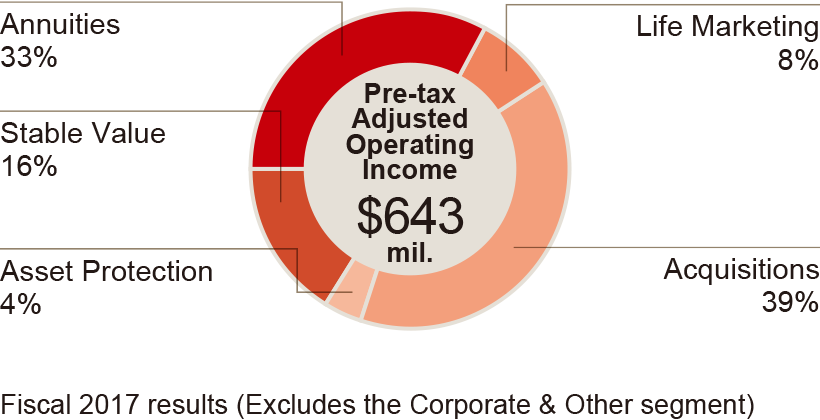

Inagaki One of the favorable results of Protective joining the Dai-ichi Life Group is its contribution to our bottom line. Protective reported adjusted profit of approximately 35 billion yen in the year ended March 2018, and now the overseas life insurance business accounts for about 20% of the Group's adjusted profit.

Bielen

From our perspective, the greatest result has been the major improvement in how we are evaluated externally now that we have become a member of a multinational corporation. With a stronger financial base, our financial flexibility has increased, which now places us in a position to examine major acquisitions that would have been very challenging when we were a standalone company.

Actually, since joining the Dai-ichi Life Group, Protective has completed three acquisitions. From first-hand experience, I feel that our ability to achieve this growth through M&A has made it possible for Protective to contribute to Dai-ichi Life Group's overall profit growth.

Inagaki

One other major achievement is that we have learned a great deal and established new growth platforms since welcoming Protective to the Group because of its distinctive businesses in the U.S. market. This can be viewed as the greatest yield in the sense of creating a foundation for becoming a company that can compete on the global stage.

There have been many synergistic effects, which have been greater than expected. One example is that we have established an innovation lab in Silicon Valley with direct access to leading venture companies. We are now moving forward with full-fledged discussions with local emerging companies in the U.S. so that new services and technologies can be rolled out here in Japan. Additionally, through this expansion into Silicon Valley, we are speeding up Insurance Technology (InsTech) initiatives focused on expanding the Dai-ichi Life Group's products and services as well as transforming the way we operate.

Bielen

Protective feels the same way about access to new areas of technology. We had discussed partnership opportunities with Silicon Valley companies before Dai-ichi Life's acquisition proposal, but have found that as a member of Dai-ichi Life Group, we can leverage the merits of scale in the exploration and research of new areas of technology. This is another achievement of the acquisition that I would like to emphasize.

I feel another major advantage is that Protective is now able to approach new initiatives aimed at long-term growth, since we are now able to benefit from the strong support of the Dai-ichi Life Group. Protective is now working on operational improvements in various areas, including expanding customer services and agent support, development of a platform in direct channels, and the simplification of underwriting using big data, to name a few.

The common value of "respecting each other, learning from each other, growing together" as a basic tenet of Group management

Bielen The policy of Dai-ichi Life Holdings to empower local management has been a major factor facilitating the efficient execution of business by Protective even after we joined the Group. Our speed of decision making at the senior management level hasn't changed since joining the Group.

Inagaki Protective's Board of Directors has a wealth of experience and is quite diverse. I really respect the management decisions made there. Our policy to entrust operations to management teams in each country is the same for all of our Group companies, regardless of region. Chairman Watanabe, who pursued overseas M&A, presented the basic stance of Group management based on "respecting each other, learning from each other, growing together." I feel like our philosophy fits into this statement concisely. Life insurance is a highly localized business, and I feel that in terms of Group governance the best option is to have excellent systems developed in each country.

Bielen I appreciate such a policy. Protective's growth strategy is centered on a virtuous cycle involving our retail lines and acquisitions. We have achieved strong growth by acquiring the in-force blocks of other life insurance companies as a way of effectively increasing the scale of our retail lines. When it comes to acquisitions, it is vital that decisions can be made swiftly.

Inagaki As for Protective's acquisitions, we trust and respect President Bielen's leadership and the wealth of experience of local employees. Of course, we are always monitoring the situation, including the results of due diligence on acquisition candidates and information concerning deals that did not materialize. We have also established rigorous decision-making rules based on the value of a deal, including a hurdle rate.

Bielen I believe "trust" and "transparency" represent the key words symbolizing the relationship between operating company and holding company. We report and seek advice in a prompt manner about various forms of information necessary for governance, such as business strategy and appointment of officers. Resolutions by Protective's Board of Directors are reported regularly to the holding company, and I travel to Japan three to four times a year to meet face-to-face with the holding company's management team.

Inagaki I believe that we will need to develop a global governance system in the future. The next step will be to hold discussions with Mr. Bielen as well as the top management of TAL in Australia and Dai-ichi Life Vietnam, to gather local information from each Group company for use in the Group's strategy.

Achieve further growth by expanding business overseas

Inagaki My desire is to achieve further growth globally through the mutual utilization of knowledge, know-how, and resources of Group companies. Protective has been providing a great amount of knowledge and know-how for creating new business ideas to the Group.

Bielen We have a shared interest in creating more diversity of thought and experience in Protective and across the group. I believe one aspect of how we contribute to this is through our partnerships with different industries. For example, in our relationship with Costco Wholesale Corporation, we have achieved excellent results by selling directly to Costco members online. This relationship is extremely rare in the U.S. life insurance industry, and it also highlights how we are addressing the trend of digitalization.

Inagaki This is precisely the story that we are looking for. While all of our Group companies have been working on the challenge of securing sales and distribution channels that efficiently open up relationships with new customers, Group companies reflect such precedents in their own initiatives. Going forward, I believe that continuing to share knowledge and know-how between Group companies through venues such as the Global Management Conference, where management from our Group companies gather, will become a major strength of the entire Group.

Bielen Protective has grown with a virtuous cycle at retail lines and acquisitions, and we have a team dedicated to acquisitions. This team has established its own unique approach to acquisitions along with accumulating a great deal of experience and know-how. I believe if we can share this with Group companies in other regions, taking into account the characteristics of each market, it will be extremely beneficial for the growth of the Group.

Inagaki I couldn't agree more. The Dai-ichi Life Group entered the period covered by its new medium-term management plan called CONNECT 2020 in fiscal 2018. In the overseas life insurance business, we will work to achieve sustained growth with a balanced business portfolio that combines steady profit growth in Protective and developed-country markets with revenue growth in the emerging markets of Asia. I have high expectations that the overseas insurance business will be a major driver behind our growth.

Bielen Protective will also seek out new and greater synergistic effects so that we can achieve the targets of CONNECT 2020. I look forward to building a strong relationship as a good partner to Dai-ichi Life Group.

Protective continues to grow with its distinctive business model

More than 110 years in the life insurance business

Founded in 1907, Protective has been in the life insurance business for more than 110 years. Headquartered in Birmingham, Alabama, the company has operations in all 50 states and approximately 8.3 million policies in force (as of April 2018).

Growth via a virtuous cycle involving the retail lines and acquisitions

Protective has established a distinctive business model that combines the retail lines (life insurance and annuities) and acquisitions. The company has successfully completed 56 acquisitions (as of May 2018) since the 1970s as part of its aggressive acquisitions of in-force blocks of life insurance and annuities. Protective continues to grow by efficiently allocating capital for new M&A opportunities.