We ensure adequate capital levels

and improve capital efficiency through

disciplined allocation of capital

for

sustainable

enhancement of

corporate value.

Tatsusaburo Yamamoto

Managing Executive Officer

Corporate Planning Unit

We ensure adequate capital levels

and improve capital efficiency through

disciplined allocation of capital

for

sustainable

enhancement of

corporate value.

Tatsusaburo Yamamoto

Managing Executive Officer

Corporate Planning Unit

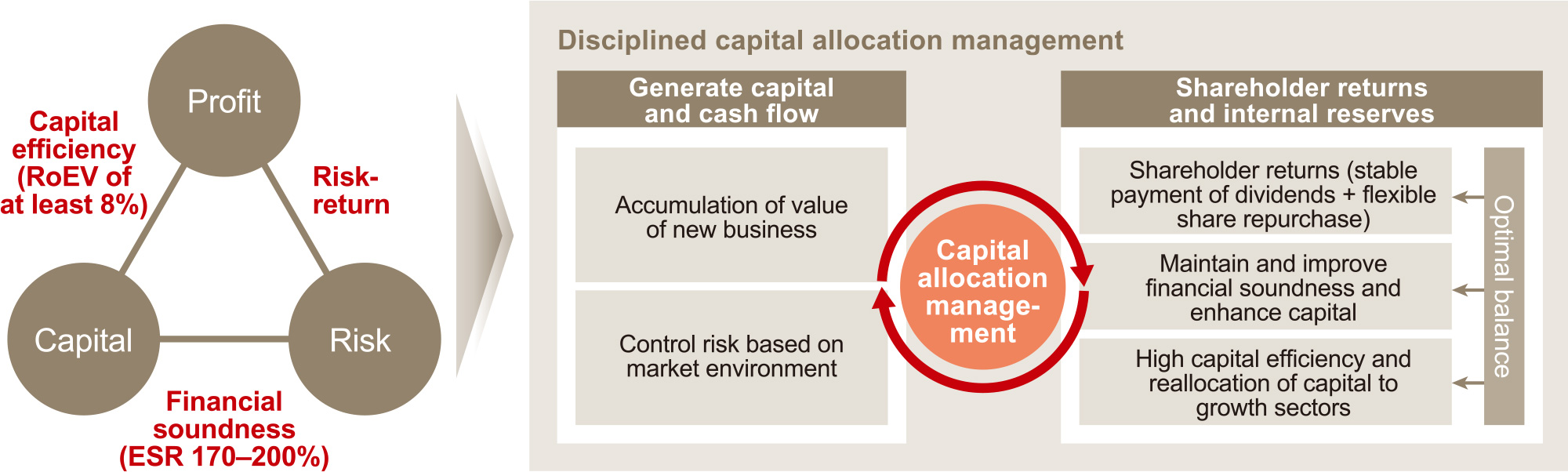

The Dai-ichi Life Group practices enterprise risk management (ERM). ERM is a means of appropriately controlling risk and ensuring financial soundness, while improving capital efficiency and enhancing corporate value by allocating capital to businesses that promise higher profits.

During fiscal 2017, despite factors such as the improvement in the monetary and economic environment in Japan and overseas, there were also adverse conditions that included the persistent low-interest-rate environment accompanying the negative interest rate policy in Japan and mounting global geopolitical risk. Moreover, the environment surrounding the Group has been drastically changing with intensified global competition to create new value with the advances in cutting-edge technologies and new entrants to the insurance business from other industries among other factors.

Especially because we are in an era of such radical change, the Group will aim for sustainable enhancement of corporate value by further strengthening initiatives based on our ERM framework to ensure adequate capital levels and improve capital efficiency through disciplined allocation of capital. In addition, we will continue to maintain and enhance our financial soundness given that new capital regulations on internationally active insurance groups are under consideration.

The Group aims to achieve capital efficiency that is higher than the Group's cost of capital and aims to realize an average of at least 8% EV growth (RoEV) over the medium- to long-term.

The Group appropriately manages capital allocation considering cost of capital. For fiscal 2017, initiatives included using derivative transactions to reduce interest rate risk primarily at Dai-ichi Life, investment in the InsTech field, and the acquisition of in-force blocks of individual insurance and annuities in the United States by Protective Life in addition to accumulation of value of new business.

As a result of these efforts, looking at Group EEV as of March 31, 2010 through March 31, 2018, the annualized average rate of change in EV over the eight-year period since our demutualization stands at 11.5%, achieving our medium- to long-term vision of at least 8%.

Improving Capital Efficiency and

Corporate Value through ERM Practices

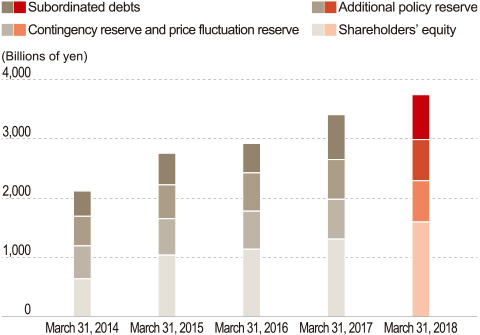

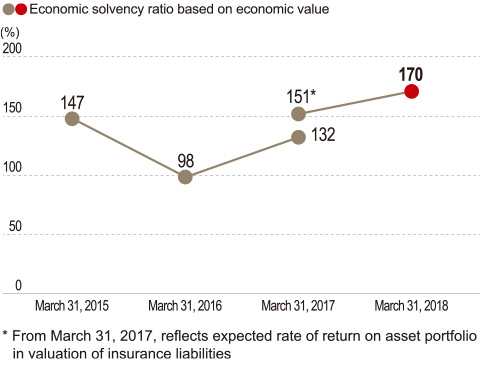

The Dai-ichi Life Group controls financial soundness by integrating various risks and measuring it against shareholders' equity and other figures on an economic value, an accounting and regulations basis.

During fiscal 2017, in order to improve financial soundness, the Group worked on increasing capital levels by accumulating profits through business activities and controlling risk assets.

The Group also continually refined its risk management indicators given that new capital regulations on internationally active insurance groups are currently under consideration.

Taking advantage of the grace period until the introduction of international capital regulations, the Group will aim for an economic solvency ratio (ESR) that is stable in the 170-200% range over a medium- to long-term time framework through disciplined risk control.

Capital Base of the Dai-ichi Life Group

Dai-ichi Life Group's

Economic Solvency Ratio (ESR)

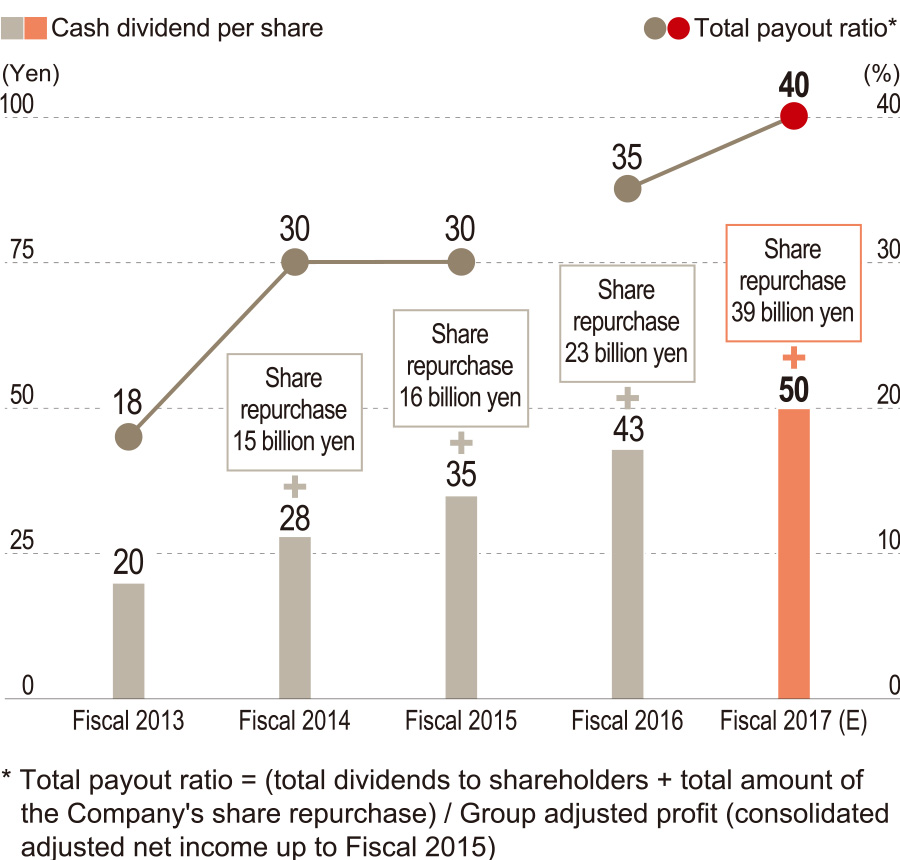

For fiscal 2017, shareholder dividends were 50 yen per share, an increase of 7 yen from the previous fiscal year. Together with the repurchase of the Company's shares (up to 39.0 billion yen) announced on May 15, 2018, we expect to achieve a total payout ratio of 40%, which was set out as our objective for the term of our previous medium-term management plan, D-Ambitious. In addition, shareholder dividends have increased for five consecutive fiscal years, and the repurchase of the Company's shares has been initiated for four years in a row.

Going forward, stable payment of dividends is our basic direction for shareholder returns. The Group seeks to maintain a total payout ratio of 40% based on adjusted group profit, while aiming to enhance shareholder payout through profit growth. We will determine yearly dividends by taking into account factors including our financial results, the market environment and any regulatory changes. We intend to examine whether to repurchase shares by taking into account factors including our financial results and capital position.

Shareholder Payout History