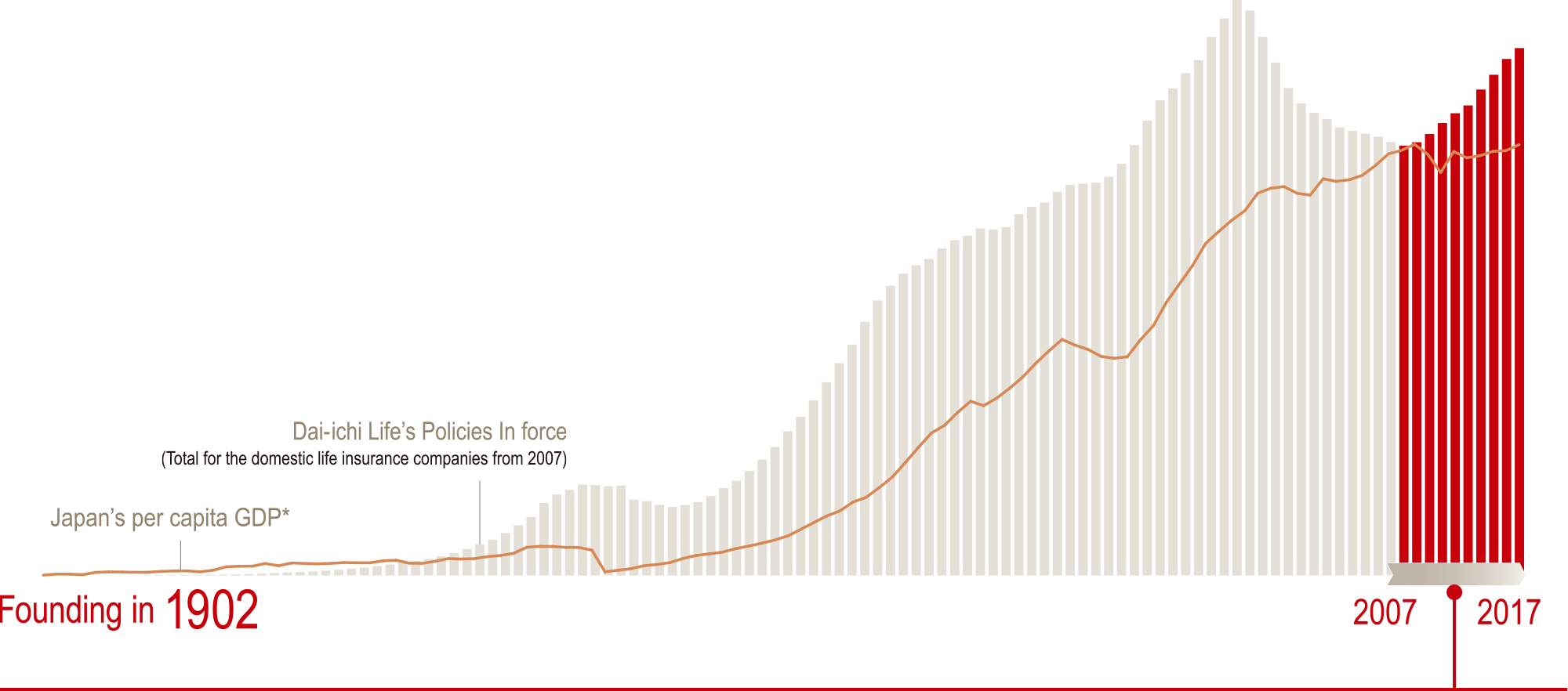

The Dai-ichi Life Group's History of Reform for the Past 10 Years

Significantly increased business scope through the development of a multi-channel strategy in Japan and actively expanded into overseas life insurance and asset management business

Organizational Structure

Developed governance to support global business expansion

-

2010

New foundation as a listed company

-

2015

Establishes regional headquarters in New York and Singapore

-

2016

Transition to a holding company structure

Domestic Life Insurance Business

Established three brands in the domestic life insurance market to respond to diversified customer needs

Overseas Life Insurance Business

Established a balanced business portfolio by covering both growth and stable markets

-

2007

Vietnam

Dai-ichi Life Vietnam becomes a subsidiary

India

Establishes Star Union Dai-ichi Life

-

2008

Thailand

Acquires share of OCEAN LIFE

Australia

Acquires share of Tower Australia Group Limited (currently TAL Group)

-

2011

Australia

Tower Australia Group Limited becomes a subsidiary

-

2013

Indonesia

Acquires share of Panin Life (currently Panin Dai-ichi Life)

-

2015

U.S.A.

Protective becomes a subsidiary

Asset Management Business

Established a global trilateral structure covering three major markets

-

2012

Acquires share of Janus Capital Group Inc.

-

2016

Asset Management One begins operations

-

2017

Janus Henderson Group plc begins operations

* Maddison Project Database, version 2018. Bolt, Jutta, Robert Inklaar, Herman de Jong and Jan Luiten van Zanden (2018),"Rebasing 'Maddison': new income comparisons and the shape of long-run economic development" Maddison Project Working Paper, nr. 10, available for download at www.ggdc.net/maddison. Please refer to www.ggdc.net/maddison for documentation and explanation of the data series.