Building a Solid Business Foundation

in Japan and Overseas

Three Growth Engines

The business foundation in Japan and overseas is underpinned by a robust financial base, talent and know-how, and strong brand.

Domestic Life Insurance Business

Three-brand structure in Japan

to accommodate diversification in customer needs

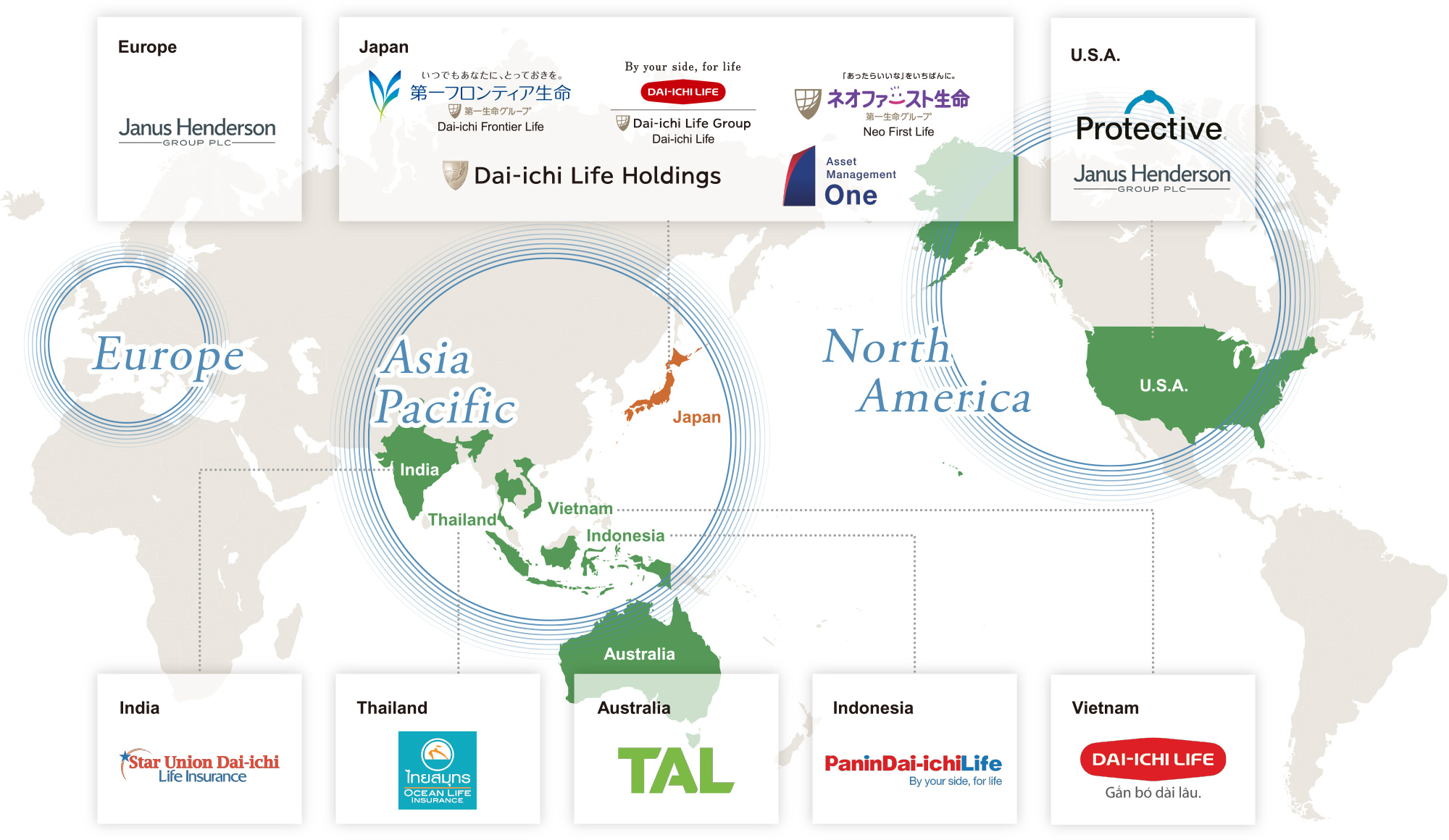

Overseas Life Insurance Business

Business operations in six countries striking a balance

between growth and stability

Asset Management Business

Business operations in Japan, the U.S.A., and Europe

with two companies operating in Japan and overseas

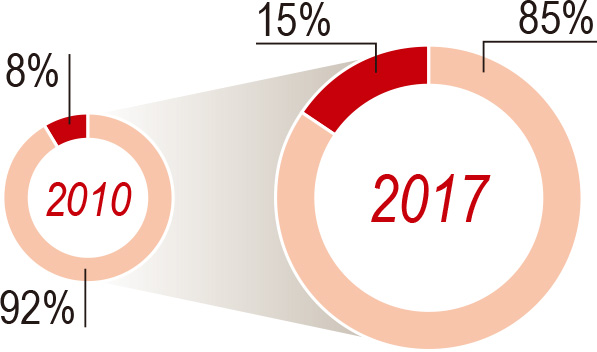

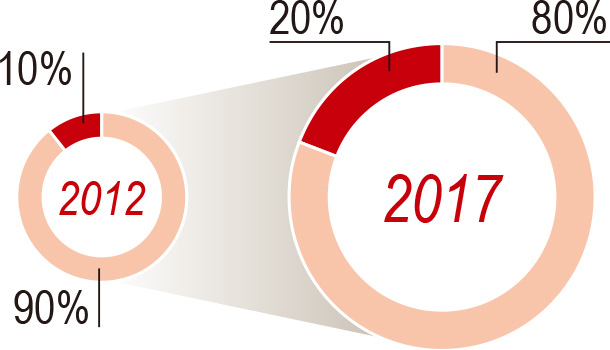

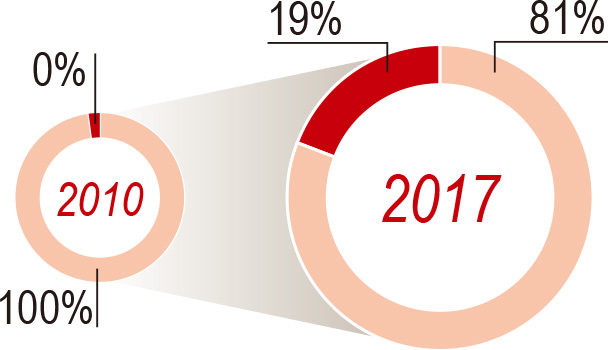

Significant Progress in Global Business Diversification

-

Number of Group Employees

-

Group Adjusted Profit

-

Consolidated Premium and Other Income

- Japan

- Overseas

Financial Position

Sufficient and Sound Financial Position to Support Our Growth and Achievements

-

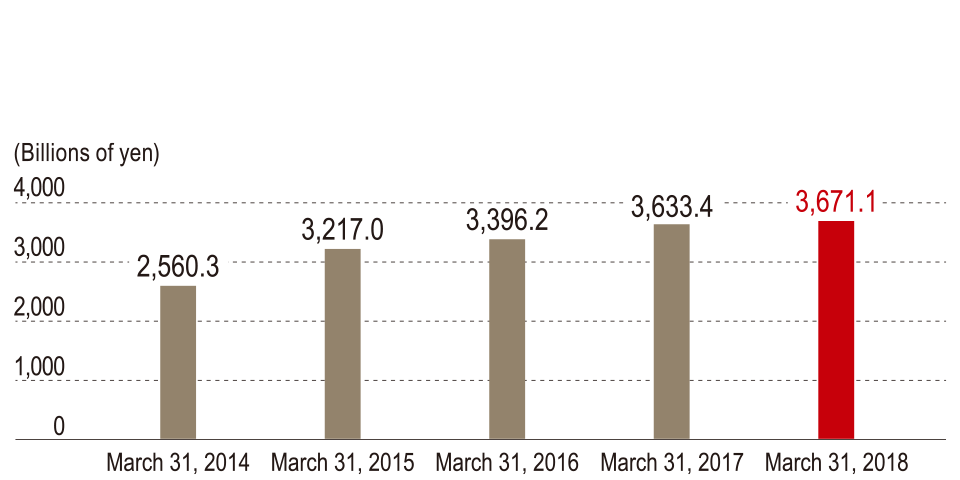

Top-Line Indicators

Annualized Net Premium from Policies In force

3,671.1billion yen

-

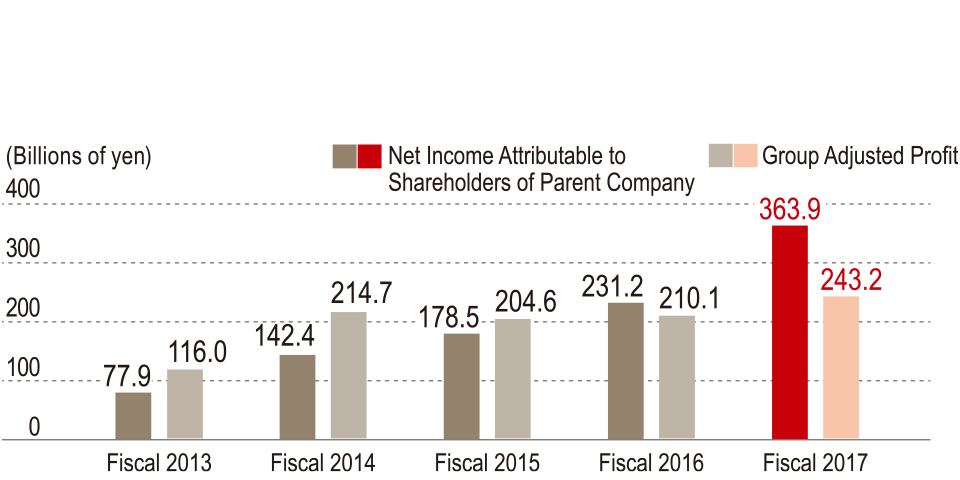

Profit Indicators

Net Income Attributable to Shareholders of Parent Company /

Group Adjusted Profit*1363.9billion yen

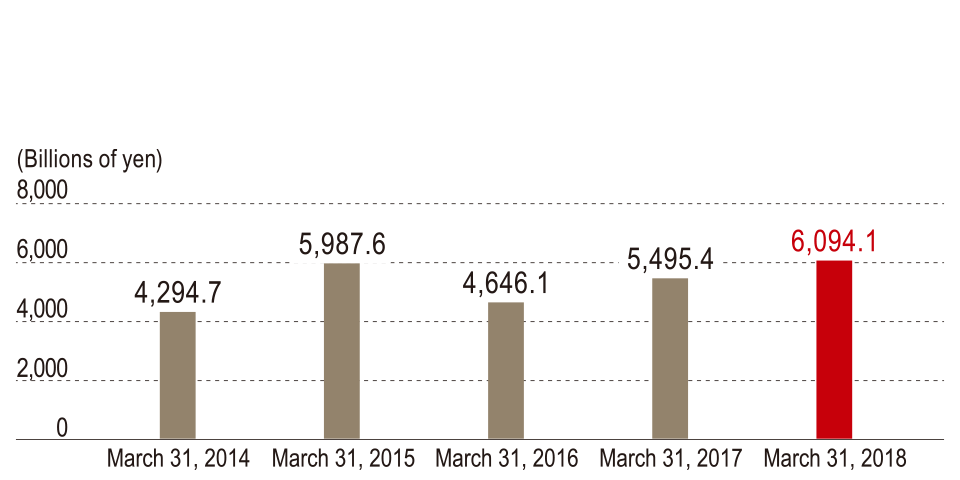

Corporate Value Indicators

-

Group European Embedded Value (EEV)

6,094.1billion yen

-

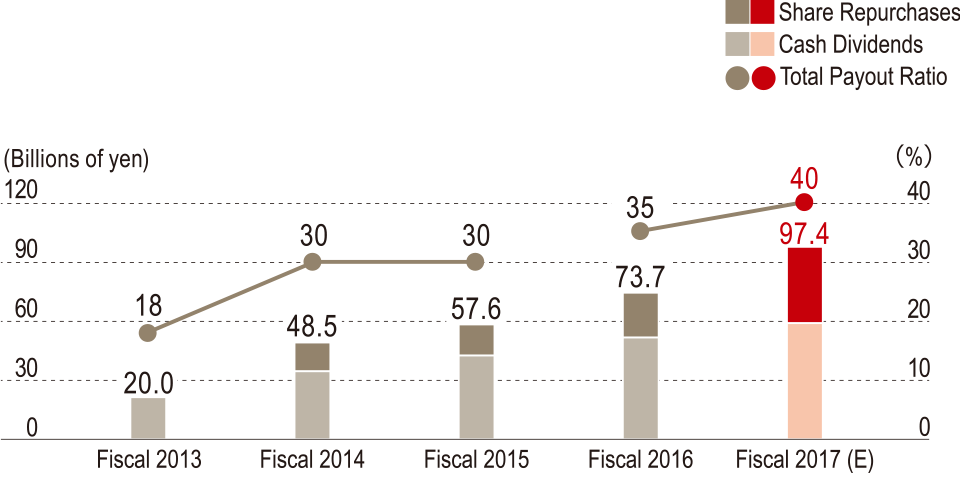

Total Shareholder Payout*2/ Total Payout Ratio*3

97.4billion yen

-

Financial Soundness Indicators

- Economic Solvency Ratio

- 170%

- Consolidated Solvency Margin Ratio

- 838.3%

Capital Efficiency Indicators

- RoEV (Average Since Demutualization)

- 11.5%

-

Rating Information*4

-

Rating and

Investment Information (R&I) Insurance Claims Paying Ability

Insurance Claims Paying Ability -

Japan Credit

Rating Agency (JCR) Ability to Pay Insurance Claims

Ability to Pay Insurance Claims -

Standard & Poor's (S&P)

Insurer Financial Strength Rating

Insurer Financial Strength Rating -

Fitch Ratings (Fitch)

Insurer Financial Strength Rating

Insurer Financial Strength Rating

-

- *1 An indicator of the Company representing the source for shareholder returns. Please see page 77 for further details.

- *2 97.4 billion yen for fiscal 2017 includes the upper limit of the Company's stock repurchase amount of 39.0 billion yen resolved on May 15, 2018.

- *3 Total payout ratio was based on consolidated adjusted net income until fiscal 2015, and Group adjusted profit from fiscal 2016.

- *4 Rating for Dai-ichi Life (as of July 31, 2018). The ratings represent the opinions of the rating agencies, and do not guarantee the payment of insurance benefits, etc. The ratings may change at the discretion of the rating agencies.

Talent and Know-how

Diverse Human Capital, High Expertise,

and Extensive Experience Supporting Transformation and Growth

-

Group Employees

Approx. 70,000

in7countries -

Participants in Global Communication Program

Approx. 2,100* employees

* Cumulative total for the most recent five years -

MDRT* Members

Japan189 persons

Overseas257 persons

* Formed in 1927, Million Dollar Round Table (MDRT) is a global, independent association of more than 66,000 of the world's leading life insurance and financial services professionals from more than 500 companies in 71 nations and territories. MDRT members demonstrate exceptional professional knowledge, strict ethical standards, and outstanding client service. MDRT membership is recognized internationally as the standard of excellence in the life insurance and financial services business.

Advanced Operational and IT Know-how

to Drive Innovation

Strong Brand

Developed into a Well-known Brand

through a Long History of over a Century

Various relationships with customers around the world

Strong Customer Base

-

Japan

No. of policies in force

Approx.

15.1 million -

Corporate customers

Approx.

150 thousand companies -

U.S.A.

No. of policies

in forceApprox.

8.3 million -

Vietnam

No. of policies

in forceApprox.

72 ten thousand -

Australia

No. of

customersAlmost

4 million

-

One of the Largest

Sales Forces in JapanNo. of sales representatives:

44,626

-

Diverse Sales Channels

- Total Life Plan Designers

- Independent Agents

- Individual Insurance Agents

- Independent Insurance Agents

- Wholesale

- Independent Advisors

- Securities Companies and Banks

- Direct Sales