Note: This IR Policy is a translation of the Japanese language original for convenience purposes only, and in the event of any discrepancy, the Japanese language original shall prevail.

Dai-ichi Life Holdings, Inc. (the "Company") has established the following fundamental policy regarding its investor relations.

1. Purpose

The Company, through its IR activities, strives to disclose information regarding the Group's management strategies, financial condition, financial results, and other topics to shareholders, investors and securities analysts (collectively the "Investors") in a fair, timely and appropriate manner and enhance dialogue with the Investors. By making efforts to accurately deliver such information, the Company strives to gain the trust of and proper evaluation from the Investors. The Company also seeks to enhance the Group's corporate value by taking into account the useful requests and opinions of the Investors in the meetings of its Executive Management Board and the Board of Directors.

2. Systems for Disclosure of Corporate Information and Enhancement of Dialogue

(1) Basic policies

The Company recognizes that disclosing the Group's corporate information in a fair, timely and appropriate manner and enhancing dialogue with the Investors are essential both from the viewpoint of ensuring effective corporate governance and complying with timely disclosure requirements. Based on this recognition, the Company develops internal systems including through the appointment of IR representatives.

(2) Internal systems for IR activities

The Company promotes IR activities led by its management. The Company (1) appoints an executive officer in charge of all day-to-day IR activities including development of internal systems, and (2) under him/her deploys IR unit, and gathers and appropriately handles the Group's information.

3. Disclosure of Corporate Information

(1) Basic policies

The Company commits itself to conduct fair disclosure in accordance with (1) laws and ordinances including the Financial Instruments and Exchange Act (the "Act") and (2) the Securities Listing Regulations (the "Regulations") of the Tokyo Stock Exchange (the "TSE"). The Company will also make fair, timely and appropriate disclosure of additional information which it believes helps the Investors achieve a better understanding of the Group.

(2) Method of disclosure

Information which is required by the Act will be disclosed through EDINET (Electronic Disclosure for Investors' NETwork), an online disclosure system made available by the Financial Services Agency of Japan.

The Company discloses information that the Regulations require through TDnet (Timely Disclosure network) provided by the TSE.

In addition, the Company proactively discloses relevant information to the Investors in various ways, including news releases, integrated report and others. The Company also strives to enhance dialogue with the Investors by holding meetings and responding to their inquiries.

(3) Fair disclosure

Generally, the information to be disclosed in news releases, integrated report and others will also be available on the Company's website, with the goal of conducting fair disclosure. The Company also makes sure that only disclosed information and well-known facts are provided in response to inquiries.

(4) IR quiet period

In order to prevent unfair disclosure of its financial results, the Company establishes a three-week period before each announcement date for its quarterly financial results as a "Quiet Period", during which it refrains from answering inquiries regarding the Group's financial results and, in principle, dose not hold individual IR meetings. However, even during such periods, the Company will make an announcement as necessary if there is a risk that results could differ materially from previously announced estimates.

4. Feedback to the Company's Management

The Group strives to improve its management quality by reviewing its business activity through communication with all stakeholders and implementing the PDCA cycle. Accordingly, useful requests and opinions from the Investors will be communicated to the Company's management and directors at the meetings of its Executive Management Board and the Board of Directors to be considered and shared within the Group under proper information management.

[Appendix]

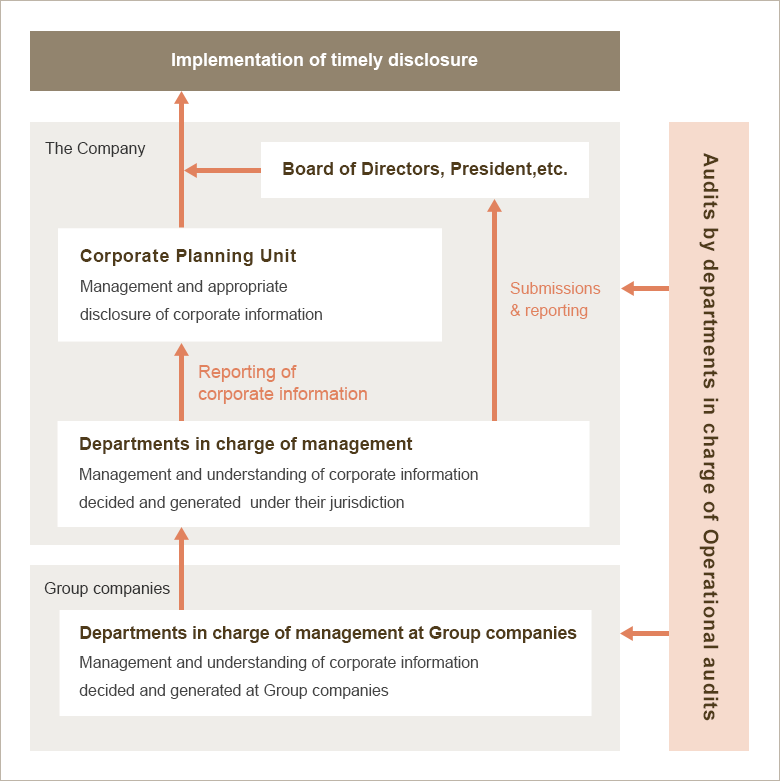

Systems for Timely Disclosure of Corporate Information

(1) Internal systems for timely disclosure

Understanding of information for timely disclosure

The Company adopts a system under which all units involved in gathering the Company's corporate information are designated as "departments in charge of management" and all the Company's corporate information is submitted to the Corporate Planning Unit by departments in charge of management.

Judgments on timely disclosure

Corporate Planning Unit is responsible for judging whether or not the gathered corporate information needs to be disclosed in accordance with the regulations of the stock exchange on which the Company's stock is listed or other relevant laws and regulations.

Implementation of timely disclosure

Based on the Corporate Planning Unit's judgment on the need for disclosure, timely disclosure is made in accordance with the prescribed procedure.

(2) Implementation of operational audits

Internal audit departments verify whether or not the system for timely disclosure of corporate information is functioning effectively across the group and report to the Board of Directors, etc. on a regular basis.

Diagram of system for timely disclosure of corporate information

The purpose of our IR website

This website provides useful information for shareholders, investors, and security analysts, through various ways such as news releases, briefing documents, videos, and audio clips.